|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

光是週一,美國現貨以太坊 ETF 資金流入就達到 1.308 億美元。相反,比特幣 (BTC) ETF 流出 2.265 億美元

Institutions are showing more interest in Ethereum (ETH) than Bitcoin (BTC), with Ethereum ETFs seeing strong inflows while BTC ETFs experience outflows. Also, Solana (SOL) is outperforming BTC and ETH in terms of capital inflows and price performance.

機構對以太坊(ETH)表現出比比特幣(BTC)更大的興趣,以太坊 ETF 出現強勁流入,而 BTC ETF 出現流出。此外,Solana (SOL) 在資本流入和價格表現方面優於 BTC 和 ETH。

Institutions Opting for Ethereum ETFs Amid Bullish News

機構在看漲消息中選擇以太幣 ETF

According to data from Farside Investors, Ethereum ETFs saw a net inflow of $130.8 million on Monday, while Bitcoin ETFs faced an outflow of $226.5 million on Tuesday.

Farside Investors的數據顯示,週一以太坊ETF淨流入1.308億美元,而週二比特幣ETF淨流出2.265億美元。

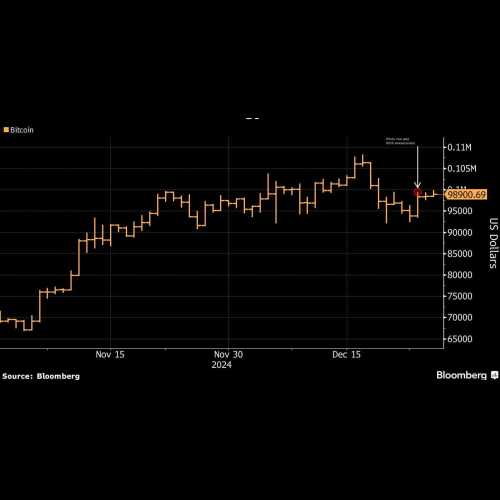

This marks the third consecutive week of outflows for Bitcoin ETFs. Institutions appear to be shifting their focus toward Ethereum, driven by a week of positive news.

這標誌著比特幣 ETF 連續第三週出現資金流出。在一周積極消息的推動下,機構似乎正在將注意力轉向以太坊。

The Securities and Exchange Commission (SEC)’s recent stance on approving Ethereum-based ETFs has played a significant role in boosting institutional interest in ETH.

美國證券交易委員會 (SEC) 最近對批准基於以太坊的 ETF 的立場在提高機構對 ETH 的興趣方面發揮了重要作用。

In contrast, Bitcoin ETFs encountered headwinds during the holiday season. However, the recent performance of Ethereum ETFs is notably remarkable, indicating increasing institutional money participation in the Ether market.

相比之下,比特幣 ETF 在假期期間遇到了阻力。然而,以太坊 ETF 最近的表現尤其引人注目,顯示機構資金對以太坊市場的參與不斷增加。

Solana Outperforms BTC, ETH in Price Performance

Solana 的價格表現優於 BTC、ETH

On-chain data reveals that Solana beats BTC and ETH in terms of capital inflows and price performance earlier this week. Solana inflows reached $776 million, outperforming Bitcoin and Ethereum.

鏈上數據顯示,本週早些時候,Solana 在資金流入和價格表現方面擊敗了 BTC 和 ETH。 Solana 流入量達 7.76 億美元,表現優於比特幣和以太坊。

This showcases a remarkable recovery for 2024, considering that the coin’s price drastically dropped to $9 in 2022 following the FTX collapse.

考慮到 FTX 崩盤後代幣的價格在 2022 年大幅跌至 9 美元,這顯示了 2024 年顯著的復甦。

Since then, SOL’s price surged by over 2000% as increased activity on its blockchain boosts demand for the network, especially within the meme coin space.

從那時起,SOL 的價格飆升了 2000% 以上,因為其區塊鏈上的活動增加增加了對網路的需求,特別是在模因幣領域。

With SOL serving as the base currency for meme coin transactions on its blockchain, its growth trajectory instills strong market confidence.

SOL 作為其區塊鏈上 meme 幣交易的基礎貨幣,其成長軌跡為市場注入了強勁的信心。

The token reached a new all-time high of $263 on November 23. The data also indicates that SOL has maintained a positive net capital inflow since September 2023.

該代幣於11月23日創下263美元的歷史新高。

This signifies that the chain is attracting new investors, and, coupled with increased activity by long-term holders taking profits, it serves as a key driving force for SOL’s price.

這意味著該鏈正在吸引新的投資者,再加上長期持有者獲利了結的活動增加,它成為 SOL 價格的關鍵驅動力。

Justin Sun’s Large Ethereum Transfer to Exchange Stirs Interest

賈斯汀·孫(Justin Sun)向交易所進行的大規模以太坊轉移引起了人們的興趣

In another development, Tron founder Justin Sun transferred about $245 million in Ethereum to a crypto exchange.

另一項進展是,Tron 創辦人孫宇晨將約 2.45 億美元的以太幣轉移到了加密貨幣交易所。

The crypto billionaire moved 70,182 ETH to HTX on Christmas Eve. The transferred amount was unstaked Ethereum from Lido Finance and Etherfi.

這位加密貨幣億萬富翁在聖誕節前夕將 70,182 ETH 轉移到 HTX。轉移的金額是從 Lido Finance 和 Etherfi 解質押的以太坊。

Sun's total HTX exchange deposits now stand at 179,101 ETH, valued at more than $645 million at current market prices.

Sun 的 HTX 交易所存款總額目前為 179,101 ETH,以當前市場價格計算價值超過 6.45 億美元。

The timing of Sun's transfer suggests he might be anticipating a possible ETH rally, which some analysts predict could unfold within the next few weeks.

Sun 轉會的時機表明他可能預計 ETH 可能會上漲,一些分析師預測這可能會在未來幾週內展開。

Such a move by Sun could influence Ether's price, as large holders' movements often impact the price direction of any token.

Sun 的這一舉動可能會影響以太幣的價格,因為大持有者的舉動通常會影響任何代幣的價格方向。

Analyst Predicts ETH to Outperform BTC by Early 2025

分析師預測 2025 年初 ETH 的表現將超過 BTC

A popular analyst is predicting that Ether could be outperforming BTC in terms of price gains by January 2025.

一位受歡迎的分析師預測,到 2025 年 1 月,以太幣的價格漲幅可能會超過 BTC。

According to MN Capital founder Michael van de Poppe, the ETH/BTC ratio is showing signs of breaking above the 0.04 mark (currently at 0.0356).

MN Capital 創辦人 Michael van de Poppe 表示,ETH/BTC 比率有突破 0.04 大關(目前為 0.0356)的跡象。

If this prediction unfolds, it will indicate a shift in dominance for Ethereum over Bitcoin, triggering an “altcoin run.”

如果這項預測成為現實,這將表明以太坊相對於比特幣的主導地位發生轉變,從而引發「山寨幣擠兌」。

The analyst also notes that strong institutional interest is likely to continue boosting Ethereum's outperformance.

該分析師也指出,強烈的機構興趣可能會繼續推動以太坊的優異表現。

Moreover, increasing Ether ETF inflows into leading products like those from BlackRock and Fidelity could positively influence ETH's price.

此外,增加 ETH ETF 流入貝萊德和富達等領先產品可能會對 ETH 的價格產生積極影響。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 本週 DeFi:穩定幣季節和超級鏈敘事提供了對 DeFi 世界的思考

- 2024-12-26 14:35:01

- 過去一周,穩定幣季和超級鏈的故事提供了人們對 DeFi 世界的思考。

-

- 巴西成為加密貨幣創新中心

- 2024-12-26 14:35:01

- Mercado Bitcoin 被認為是巴西最大的加密貨幣交易所,擁有超過 300 萬的客戶群,最近取得了重大進展

-

-

-

- BTFD 幣、Fartcoin 和不可玩幣:最適合長期加入的新 Meme 幣

- 2024-12-26 14:35:01

- 早在 1973 年經濟衰退時,精明的投資者就抓住了逢低買入的機會,化混亂為現金。

-

-

- 這枚稀有的 2 便士硬幣可能就藏在您的零錢中,值得一筆小錢 - 以下是您需要尋找的東西

- 2024-12-26 14:35:01

- 對於收藏家來說非常有價值的硬幣通常分為以下幾類

-

-

- $USUAL 如何達到每單位 10 美元

- 2024-12-26 14:25:01