|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 年第一季度,加密貨幣領域見證了重大發展和變化。以太坊的 Dencun 升級大幅削減了 Layer 2 交易費用,而 Sam Bankman-Fried 對 FTX 醜聞的判決凸顯了監管審查的加強。美國證券交易委員會對現貨比特幣 ETF 的批准標誌著一個里程碑,表明人們對加密貨幣的接受度不斷提高。 Ripple 推出與美元掛鉤的穩定幣,強調了其增強流動性的承諾。在市場波動的情況下,Uniswap 面臨監管挑戰,凸顯了 DeFi 領域需要明確性。

Ethereum Dencun Upgrade Slashes Transaction Fees

以太坊Dencun升級大幅削減交易費用

The Ethereum Network has completed its Dencun upgrade, delivering a significant reduction in transaction fees on Layer 2 chains. Layer 2 solutions, such as Arbitrum, Polygon, and Coinbase Global, utilize these chains to process transactions, providing lower costs and faster settlement times.

以太坊網路已完成 Dencun 升級,第 2 層鏈上的交易費用大幅降低。 Arbitrum、Polygon 和 Coinbase Global 等 Layer 2 解決方案利用這些鏈來處理交易,從而提供更低的成本和更快的結算時間。

With the Dencun upgrade, transactions that previously cost $1 now incur just a cent, while those costing a few cents are now mere fractions of a cent. This dramatic reduction in fees is expected to stimulate further development and adoption of decentralized applications (dApps) and other blockchain-based services on the Ethereum Network.

隨著 Dencun 的升級,以前需要花費 1 美元的交易現在只需花費 1 美分,而那些花費幾美分的交易現在只需花費幾美分。費用的大幅降低預計將刺激以太坊網路上去中心化應用程式(dApp)和其他基於區塊鏈的服務的進一步開發和採用。

Sam Bankman-Fried Receives 25-Year Sentence for FTX Fraud Scandal

Sam Bankman-Fried 因 FTX 詐欺醜聞被判 25 年徒刑

Former FTX CEO Sam Bankman-Fried has been sentenced to 25 years in prison for his role in the FTX cryptocurrency exchange collapse. The verdict concludes a high-profile trial that highlighted the rampant financial misconduct within the company.

FTX 前執行長 Sam Bankman-Fried 因其在 FTX 加密貨幣交易所崩潰中所扮演的角色而被判處 25 年監禁。判決結束了一場備受矚目的審判,凸顯了該公司內部猖獗的財務不當行為。

Bankman-Fried was convicted on multiple counts of fraud, money laundering, and conspiracy. His lawyers have appealed the sentence, arguing for a more lenient punishment. Nonetheless, the verdict sends a clear message regarding the consequences of cryptocurrency-related financial malfeasance.

班克曼-弗里德因多項詐欺、洗錢和共謀罪被定罪。他的律師已對判決提出上訴,主張從輕處罰。儘管如此,該判決還是就與加密貨幣相關的金融不當行為的後果發出了明確的訊息。

SEC Approves Bitcoin ETFs Amid Market Volatility

在市場波動之際,美國證券交易委員會 (SEC) 批准比特幣 ETF

In a historic move, the U.S. Securities and Exchange Commission (SEC) has approved spot Bitcoin Exchange-Traded Funds (ETFs). Spot ETFs track the real-time price of Bitcoin, allowing investors to gain exposure to the cryptocurrency without directly purchasing it.

美國證券交易委員會(SEC)批准了現貨比特幣交易所交易基金(ETF),這是一項歷史性舉措。現貨 ETF 追蹤比特幣的即時價格,使投資者無需直接購買即可獲得加密貨幣的投資。

The approval comes after years of legal battles and regulatory concerns. It marks a major milestone in the integration of cryptocurrencies into mainstream finance and could significantly increase Bitcoin's accessibility for both institutional and retail investors.

經過多年的法律鬥爭和監管擔憂後獲得批准。它標誌著加密貨幣融入主流金融的一個重要里程碑,並可能顯著提高機構和散戶投資者對比特幣的可及性。

Ripple Launches USD-Pegged Stablecoin

Ripple推出與美元掛鉤的穩定幣

Blockchain innovator Ripple has officially entered the stablecoin market with the launch of a USD-backed digital currency. The stablecoin, pegged to the U.S. dollar at a 1:1 ratio, is backed by tangible assets and subject to monthly audits.

區塊鏈創新者 Ripple 推出美元支持的數位貨幣,正式進入穩定幣市場。該穩定幣以 1:1 的比例與美元掛鉤,由有形資產支持,並接受每月審計。

Ripple's stablecoin aims to provide the stability and trust of a fiat currency with the benefits of blockchain technology. It will initially be available on the XRP Ledger (XRPL) and will also support multichain integration in the future.

Ripple 的穩定幣旨在利用區塊鏈技術的優勢提供法定貨幣的穩定性和信任。它最初將在 XRP Ledger (XRPL) 上提供,並且將來還將支援多鏈整合。

Coinbase Partners with Lightspark for Lightning-Fast Bitcoin Transactions

Coinbase 與 Lightspark 合作實現閃電般的比特幣交易

Coinbase has joined forces with Lightspark, a provider of Lightning Network solutions, to integrate Lightning Network capabilities into its platform. This collaboration aims to transform Bitcoin transactions on Coinbase, enabling instant and low-cost settlements.

Coinbase 已與閃電網路解決方案供應商 Lightspark 聯手,將閃電網路功能整合到其平台中。此次合作旨在改變 Coinbase 上的比特幣交易,以實現即時且低成本的結算。

Lightning Network is a Layer 2 payment protocol that operates on top of the Bitcoin blockchain. It allows for faster and cheaper transactions by facilitating off-chain payments between participating nodes. The integration with Lightspark will enhance the user experience on Coinbase, making Bitcoin more accessible and convenient for everyday use.

閃電網路是在比特幣區塊鏈之上運行的第 2 層支付協議。它透過促進參與節點之間的鏈下支付來實現更快、更便宜的交易。與 Lightspark 的整合將增強 Coinbase 上的用戶體驗,使比特幣更易於日常使用。

SEC Investigates Uniswap Amid Market Volatility

SEC 在市場波動之際調查 Uniswap

Uniswap, a decentralized cryptocurrency exchange (DEX), is under scrutiny by the SEC. The SEC has notified Uniswap Labs, the developer of Uniswap, of potential enforcement actions, raising concerns about the DEX's legal status and regulatory compliance.

Uniswap 是一家去中心化加密貨幣交易所 (DEX),正在接受 SEC 的審查。美國證券交易委員會 (SEC) 已向 Uniswap 開發商 Uniswap Labs 通報了可能採取的執法行動,引發了人們對 DEX 法律地位和監管合規性的擔憂。

This development has sparked uncertainty in the market, with the $UNI token experiencing significant volatility. Uniswap has faced regulatory challenges in the past, similar to those encountered by Ripple with its $XRP token. Such challenges can pose short-term risks to the market, but also provide opportunities for recovery and resilience in the long run.

這一發展引發了市場的不確定性,$UNI 代幣經歷了大幅波動。 Uniswap 過去曾面臨監管挑戰,類似於 Ripple 的 $XRP 代幣所遇到的挑戰。這些挑戰可能會給市場帶來短期風險,但長期來看也提供了復甦和恢復的機會。

Conclusion: Cryptocurrency Landscape in Transition

結論:轉型中的加密貨幣格局

The first quarter of 2024 has witnessed significant developments and shifts in the cryptocurrency landscape. Ethereum's Dencun upgrade has dramatically reduced transaction fees, while Sam Bankman-Fried's sentencing has emphasized the importance of regulatory compliance. The SEC's approval of Bitcoin ETFs and Ripple's stablecoin launch indicate growing acceptance and utility of cryptocurrencies.

2024 年第一季見證了加密貨幣格局的重大發展和變化。以太坊的 Dencun 升級大幅降低了交易費用,而 Sam Bankman-Fried 的量刑則強調了監管合規的重要性。美國證券交易委員會批准比特幣 ETF 和 Ripple 推出穩定幣表明加密貨幣的接受度和實用性不斷提高。

However, the SEC's investigation into Uniswap highlights the regulatory challenges facing decentralized finance (DeFi) platforms. As the cryptocurrency industry continues to evolve, the need for regulatory clarity and guidance remains paramount for investors and the broader crypto community.

然而,SEC 對 Uniswap 的調查凸顯了去中心化金融(DeFi)平檯面臨的監管挑戰。隨著加密貨幣產業的不斷發展,對於投資者和更廣泛的加密社群來說,監管清晰度和指導的需求仍然至關重要。

Tags: BTCETF, ETH, FTX, SEC, UNI, XRP

標籤:BTCETF、ETH、FTX、SEC、UNI、XRP

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- W Token (W):您的下一個加密貨幣大機會?

- 2024-12-28 08:25:02

- 加密貨幣正在改寫財富創造規則,W Token(W)正在成為 DeFi 領域的潛在明星。

-

- 在當今市場上提供最佳安全性和便利性的頂級加密錢包

- 2024-12-28 08:25:02

- 到 2024 年,加密安全漏洞將驚人地增加 21%,造成的金融動盪高達 22 億美元,很明顯,威脅情況正在改變。

-

-

-

-

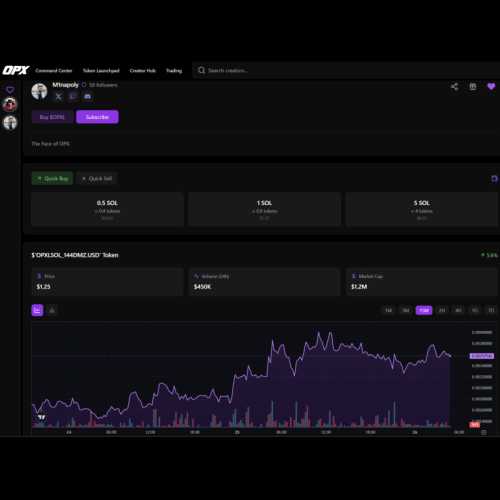

- OPX Live 本週六上線,瞄準創作者經濟 2.0

- 2024-12-28 08:25:02

- OPX Live 計劃於本週六(12 月 28 日)推出,提供整合代幣創建、交易和串流媒體的統一平台

-