|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CRV 加密貨幣在過去 30 天內下跌了 55%,高年度通膨率加劇了下行壓力。 Curve Finance 的治理代幣 Curve DAO 代幣的市值和交易量都出現下降。技術指標顯示價格可能進一步下跌,價格在下降楔形內交易並低於關鍵均線。

Curve DAO Token (CRV): A Comprehensive Analysis of Its Plunging Value and Technical Outlook

Curve DAO Token(CRV):暴跌價值與技術前景綜合分析

In the ever-evolving landscape of the cryptocurrency market, Curve DAO Token (CRV) has emerged as a governance token for Curve Finance, a prominent decentralized exchange. However, the past month has witnessed a precipitous decline in its value, raising concerns among investors and traders. This analysis aims to provide a comprehensive examination of CRV's recent performance, its underlying fundamentals, and its technical outlook, offering valuable insights into its current trajectory.

在不斷發展的加密貨幣市場格局中,Curve DAO 代幣(CRV)已成為著名去中心化交易所 Curve Finance 的治理代幣。然而,過去一個月其價值急劇下跌,引發了投資者和交易員的擔憂。本分析旨在全面審視 CRV 的近期表現、基本面和技術前景,為其當前發展軌跡提供有價值的見解。

Sharp Price Depreciation and High Inflation

物價大幅貶值及高通膨

The price of CRV has experienced a significant downturn in the last 30 days, plummeting by a staggering 55%. This sharp decline has eroded investor confidence and amplified concerns about the token's long-term viability. Compounding this problem is CRV's high annual inflation rate, which further exacerbates the downward pressure on its value.

CRV的價格在過去30天內經歷了大幅下滑,並暴跌了驚人的55%。這種急劇下跌削弱了投資者的信心,並加劇了對該代幣長期生存能力的擔憂。雪上加霜的是CRV較高的年通膨率,進一步加劇了其價值的下行壓力。

Governance Token for Curve Finance

Curve Finance 的治理代幣

CRV serves as the governance token for Curve Finance, a popular automated market maker protocol. It empowers users to participate in governance decisions, vote on proposals, and stake their tokens to earn rewards. This utility has traditionally been a source of value for CRV holders, but the recent price movements have raised questions about its effectiveness as a governance mechanism.

CRV 是 Curve Finance 的治理代幣,Curve Finance 是一種流行的自動化做市商協議。它使用戶能夠參與治理決策、對提案進行投票並抵押其代幣以獲得獎勵。傳統上,這種實用程式一直是 CRV 持有者的價值來源,但最近的價格走勢引發了人們對其作為治理機制的有效性的質疑。

Market Cap and Trading Volume Drop

市值和交易量下降

The decline in CRV's price has also had a negative impact on its market capitalization and trading volume. In the last 24 hours, the market cap of CRV has fallen by 2.04%, while its trading volume has plummeted by 32.7%. This indicates a loss of investor interest and a reduction in the liquidity of the token.

CRV價格的下跌也對其市值和交易量產生了負面影響。過去24小時內,CRV市值下跌2.04%,成交量暴跌32.7%。這顯示投資者興趣喪失,代幣流動性減少。

Circulating Supply and Tokenomics

流通供應與通證經濟學

The circulating supply of CRV currently stands at 1.189 billion tokens, representing 36.01% of the token's maximum supply of 3.303 billion. The total supply of CRV is set at 2.105 billion tokens. The fully diluted market cap, which considers all tokens in circulation, is estimated at $1.426 billion.

目前CRV的流通量為11.89億枚,佔其最大發行量33.03億枚的36.01%。 CRV的總供應量設定為21.05億個代幣。考慮到所有流通代幣,完全稀釋後的市值估計為 14.26 億美元。

Total Value Locked and Annualized Revenue

總鎖定價值與年化收入

Curve Finance has a significant amount of assets locked in its decentralized exchange, with the total value locked (TVL) currently at $1.941 billion. The staked value of CRV accounts for $331.43 million, indicating that a substantial portion of the circulating supply is being held for long-term rewards. The token also generates substantial annualized fees of $104.31 million, resulting in an annualized revenue of $13.63 million.

Curve Finance 在其去中心化交易所中鎖定了大量資產,目前鎖定的總價值(TVL)為 19.41 億美元。 CRV 的質押價值為 3.3143 億美元,這表明流通供應量的很大一部分是為了長期獎勵而持有的。該代幣還產生高達 1.0431 億美元的年化費用,從而帶來 1,363 萬美元的年化收入。

Derivatives Analysis

衍生性商品分析

Coinglass data reveals that the open interest in CRV derivatives has been consistently declining over the past few weeks. In the last 24 hours alone, the open interest has decreased by 8.85%. This suggests that traders are reducing their exposure to CRV futures and options, indicating a lack of confidence in its short-term price movements.

Coinglass 數據顯示,CRV 衍生性商品的未平倉合約在過去幾週持續下降。僅在過去24小時內,持倉量就減少了8.85%。這表明交易者正在減少 CRV 期貨和選擇權的曝險,顯示對其短期價格走勢缺乏信心。

Trading Volume and Price Correlation

交易量和價格相關性

The trading volume of CRV derivatives has also declined by 48.5% in the last 24 hours. This drop in volume suggests that there is less activity in the derivatives market for CRV, which further supports the notion of reduced trader interest. Additionally, the correlation between CRV's price and total open interest has weakened, indicating that the momentum cycle of the token is becoming less predictable.

CRV衍生性商品的交易量在過去24小時內也下降了48.5%。成交量的下降表明 CRV 衍生性商品市場的活動減少,這進一步支持了交易者興趣下降的觀點。此外,CRV 價格與未平倉總量之間的相關性已經減弱,顯示代幣的動量週期變得越來越難以預測。

Technical Analysis: Descending Wedge Pattern

技術分析:下降楔形形態

A technical analysis of CRV's price chart reveals that the token is trading within a descending wedge pattern. This pattern is characterized by two converging trendlines, with the upper trendline acting as resistance and the lower trendline providing support. The price of CRV has declined to the lower band of the wedge pattern, suggesting that a breakout to the downside is likely.

對 CRV 價格圖表的技術分析表明,該代幣正以下降楔形模式進行交易。此形態的特徵是兩條趨勢線匯聚,上方趨勢線充當阻力,下方趨勢線提供支撐。 CRV 的價格已跌至楔形形態的下限,顯示可能會向下突破。

Death Cross and Bearish Candlesticks

死亡十字和看跌燭台

On the daily chart, the 50-day and 200-day exponential moving averages (EMAs) have formed a death cross, where the 50-day EMA has fallen below the 200-day EMA. This technical indicator is often interpreted as a bearish signal, suggesting further downward pressure on CRV's price. Additionally, the recent candlestick patterns on the chart have formed strong bearish candlesticks, reinforcing the likelihood of continued declines.

日線圖上,50日和200日指數移動平均線(EMA)形成死亡交叉,其中50日EMA已跌破200日EMA。此技術指標通常被解讀為看跌訊號,表明 CRV 價格面臨進一步下行壓力。此外,圖表上最近的燭台模式已形成強勁的看跌燭台,增強了持續下跌的可能性。

MACD and RSI Indicators

MACD 和 RSI 指標

The MACD indicator, which measures the relationship between two moving averages, has also turned negative, with the MACD line and the signal line both falling below the zero level. This indicates that the momentum cycle of CRV is firmly in bearish territory. The RSI indicator, which measures the strength of price movements, has dropped to the oversold zones from the overbought zone, suggesting a shift in sentiment and a potential reversal of the bullish momentum.

衡量兩條均線之間關係的MACD指標也轉為負值,MACD線和訊號線都跌破零線。這顯示CRV的動量週期牢牢處於看跌區域。衡量價格走勢強度的 RSI 指標已從超買區域跌至超賣區域,顯示市場情緒轉變,看漲動能可能出現逆轉。

Conclusion: Bearish Outlook and Potential Declines

結論:看跌前景和潛在下跌

The technical analysis of CRV's price chart and derivatives data paint a bleak picture for the token in the short term. Indicators such as the death cross, bearish candlesticks, and negative MACD and RSI values all suggest that further declines are likely. The high annual inflation rate and declining open interest and trading volume further corroborate this bearish outlook. Investors and traders should exercise caution and consider their risk tolerance before investing in CRV, as the current market conditions indicate a high probability of further value depreciation.

CRV 價格圖表和衍生性商品數據的技術分析為該代幣在短期內描繪了一幅黯淡的圖景。死亡交叉、看跌燭台、MACD 和 RSI 負值等指標都表明可能會進一步下跌。高年度通膨率以及未平倉合約和交易量的下降進一步證實了這種看跌前景。投資者和交易者在投資CRV之前應謹慎行事並考慮自己的風險承受能力,因為當前的市場狀況表明其價值進一步貶值的可能性很高。

Disclaimer: This analysis is provided for informational purposes only and should not be construed as financial advice. The author and any parties mentioned in this article bear no responsibility for any financial losses incurred as a result of investment or trading decisions based on the information provided. It is crucial to conduct thorough research and understand the risks involved before making any financial decisions.

免責聲明:本分析僅供參考,不應視為財務建議。作者及本文提及的任何各方對根據所提供的資訊進行投資或交易決策而造成的任何經濟損失不承擔任何責任。在做出任何財務決策之前,進行徹底的研究並了解所涉及的風險至關重要。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

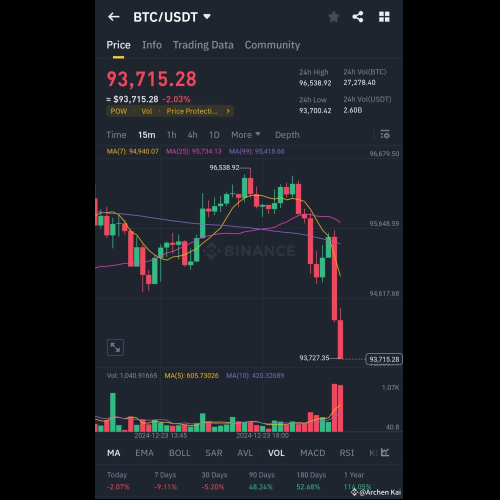

- 比特幣($BTC)短期分析

- 2024-12-24 03:20:01

- 目前價格:$93,715

-

-

-

-

-

-

-

-