|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Curve DAO Token (CRV) Plunges 55% Amidst High Inflation and Technical Bearishness

Apr 22, 2024 at 10:35 pm

The CRV crypto has experienced a 55% decline in the last 30 days, with a high annual inflation rate contributing to the downward pressure. The Curve DAO Token, the governance token for Curve Finance, has seen a decline in market cap and trading volume. Technical indicators suggest potential further declines, with the price trading inside a declining wedge pattern and below key EMAs.

Curve DAO Token (CRV): A Comprehensive Analysis of Its Plunging Value and Technical Outlook

In the ever-evolving landscape of the cryptocurrency market, Curve DAO Token (CRV) has emerged as a governance token for Curve Finance, a prominent decentralized exchange. However, the past month has witnessed a precipitous decline in its value, raising concerns among investors and traders. This analysis aims to provide a comprehensive examination of CRV's recent performance, its underlying fundamentals, and its technical outlook, offering valuable insights into its current trajectory.

Sharp Price Depreciation and High Inflation

The price of CRV has experienced a significant downturn in the last 30 days, plummeting by a staggering 55%. This sharp decline has eroded investor confidence and amplified concerns about the token's long-term viability. Compounding this problem is CRV's high annual inflation rate, which further exacerbates the downward pressure on its value.

Governance Token for Curve Finance

CRV serves as the governance token for Curve Finance, a popular automated market maker protocol. It empowers users to participate in governance decisions, vote on proposals, and stake their tokens to earn rewards. This utility has traditionally been a source of value for CRV holders, but the recent price movements have raised questions about its effectiveness as a governance mechanism.

Market Cap and Trading Volume Drop

The decline in CRV's price has also had a negative impact on its market capitalization and trading volume. In the last 24 hours, the market cap of CRV has fallen by 2.04%, while its trading volume has plummeted by 32.7%. This indicates a loss of investor interest and a reduction in the liquidity of the token.

Circulating Supply and Tokenomics

The circulating supply of CRV currently stands at 1.189 billion tokens, representing 36.01% of the token's maximum supply of 3.303 billion. The total supply of CRV is set at 2.105 billion tokens. The fully diluted market cap, which considers all tokens in circulation, is estimated at $1.426 billion.

Total Value Locked and Annualized Revenue

Curve Finance has a significant amount of assets locked in its decentralized exchange, with the total value locked (TVL) currently at $1.941 billion. The staked value of CRV accounts for $331.43 million, indicating that a substantial portion of the circulating supply is being held for long-term rewards. The token also generates substantial annualized fees of $104.31 million, resulting in an annualized revenue of $13.63 million.

Derivatives Analysis

Coinglass data reveals that the open interest in CRV derivatives has been consistently declining over the past few weeks. In the last 24 hours alone, the open interest has decreased by 8.85%. This suggests that traders are reducing their exposure to CRV futures and options, indicating a lack of confidence in its short-term price movements.

Trading Volume and Price Correlation

The trading volume of CRV derivatives has also declined by 48.5% in the last 24 hours. This drop in volume suggests that there is less activity in the derivatives market for CRV, which further supports the notion of reduced trader interest. Additionally, the correlation between CRV's price and total open interest has weakened, indicating that the momentum cycle of the token is becoming less predictable.

Technical Analysis: Descending Wedge Pattern

A technical analysis of CRV's price chart reveals that the token is trading within a descending wedge pattern. This pattern is characterized by two converging trendlines, with the upper trendline acting as resistance and the lower trendline providing support. The price of CRV has declined to the lower band of the wedge pattern, suggesting that a breakout to the downside is likely.

Death Cross and Bearish Candlesticks

On the daily chart, the 50-day and 200-day exponential moving averages (EMAs) have formed a death cross, where the 50-day EMA has fallen below the 200-day EMA. This technical indicator is often interpreted as a bearish signal, suggesting further downward pressure on CRV's price. Additionally, the recent candlestick patterns on the chart have formed strong bearish candlesticks, reinforcing the likelihood of continued declines.

MACD and RSI Indicators

The MACD indicator, which measures the relationship between two moving averages, has also turned negative, with the MACD line and the signal line both falling below the zero level. This indicates that the momentum cycle of CRV is firmly in bearish territory. The RSI indicator, which measures the strength of price movements, has dropped to the oversold zones from the overbought zone, suggesting a shift in sentiment and a potential reversal of the bullish momentum.

Conclusion: Bearish Outlook and Potential Declines

The technical analysis of CRV's price chart and derivatives data paint a bleak picture for the token in the short term. Indicators such as the death cross, bearish candlesticks, and negative MACD and RSI values all suggest that further declines are likely. The high annual inflation rate and declining open interest and trading volume further corroborate this bearish outlook. Investors and traders should exercise caution and consider their risk tolerance before investing in CRV, as the current market conditions indicate a high probability of further value depreciation.

Disclaimer: This analysis is provided for informational purposes only and should not be construed as financial advice. The author and any parties mentioned in this article bear no responsibility for any financial losses incurred as a result of investment or trading decisions based on the information provided. It is crucial to conduct thorough research and understand the risks involved before making any financial decisions.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

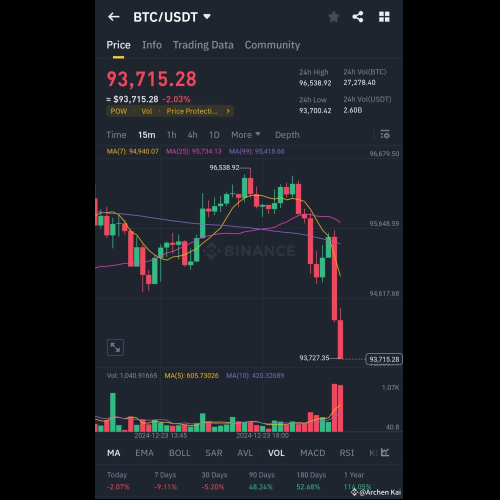

- Bitcoin ($BTC) Short-Term Analysis

- Dec 24, 2024 at 03:20 am

- Current Price: $93,715

-

- SonicX, the First TikTok App Layer Developed by Sonic SVM, Will Airdrop $SONIC Tokens to All Eligible TikTok Users

- Dec 24, 2024 at 03:05 am

- Sonic SVM, the team behind SonicX, the TikTok App Layer and the hit tap-to-earn game, has announced that they will airdrop their $SONIC token to all users onboarded through TikTok.

-

- Lunex Network Emerges as Investors' Top Crypto Investment Choice

- Dec 24, 2024 at 03:05 am

- Lunex Network is establishing itself as a frontrunner in the DeFi and crypto investment space. What started as a DeFi revolution and innovative dream has now turned into a presale star and an absolute reality that is offering aid to the long-standing issues of DeFi.

-

- TON Blockchain Daily Active Users Surpass 5 Million by Mid-2024, Data Shows

- Dec 24, 2024 at 03:05 am

- The TON blockchain has seen remarkable growth in 2024, driven by the increasing adoption of Telegram mini-apps. This surge in usage helped the network surpass 5 million daily active users by mid-year, solidifying its position as one of the most active blockchain ecosystems.

-

- The Best Cryptos to Buy and Hold for Long Term Success in 2024 and Beyond

- Dec 24, 2024 at 03:05 am

- One crypto project turning heads is Qubetics ($TICS), which brings real-world solutions to asset tokenisation and addresses critical gaps that older platforms have struggled with. Alongside Qubetics, there are other noteworthy altcoins offering solid long-term potential. Here are the best cryptos to buy and hold for long term success in 2024 and beyond.

-