|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣巨頭 Sam Bankman-Fried 的定罪凸顯了新興加密貨幣產業金融腐敗的持久性。儘管加密貨幣據稱具有合法性,但弗里德曼案表明欺詐和投機行為的普遍存在,讓人想起歷史上的金融騙局。隨著加密貨幣價格大幅波動,監管機構面臨缺乏有效監督的問題,導致投資者容易受到掠奪性計畫的影響。

The Fall of the Crypto King: Sam Bankman-Fried and the Perils of Fictitious Capital

加密貨幣之王的衰落:薩姆·班克曼-弗里德與虛擬資本的危險

The United States Attorney's Office for the Southern District of New York has dealt a major blow to the cryptocurrency industry with the conviction of Samuel Bankman-Fried (SBF), the former CEO of FTX, on charges of fraud and conspiracy. The indictment alleges that SBF masterminded a years-long scheme to defraud investors of billions of dollars, marking it as one of the largest financial frauds in American history.

紐約南區美國檢察官辦公室對 FTX 前首席執行官塞繆爾·班克曼·弗里德 (SBF) 因欺詐和共謀罪被定罪,對加密貨幣行業造成了重大打擊。起訴書稱,SBF 策劃了一項長達數年的計劃,詐騙投資者數十億美元,使其成為美國歷史上最大的金融詐欺案之一。

According to Damian Williams, the Manhattan US Attorney, "Sam Bankman-Fried perpetrated one of the biggest financial frauds in American history – a multibillion-dollar scheme designed to make him the king of crypto. This case has always been about lying, cheating and stealing and we have no patience for it."

曼哈頓美國檢察官達米安威廉斯(Damian Williams) 表示,「山姆班克曼弗里德(Sam Bankman-Fried) 犯下了美國歷史上最大的金融詐欺案之一,這是一項價值數十億美元的計劃,旨在讓他成為加密貨幣之王。

The SBF case has sent shockwaves through the burgeoning cryptocurrency market, once hailed as a legitimate alternative to traditional fiat currencies. However, as Williams notes, "this kind of corruption is as old as time."

SBF 案對蓬勃發展的加密貨幣市場造成了衝擊,加密貨幣市場一度被譽為傳統法定貨幣的合法替代品。然而,正如威廉斯指出的那樣,“這種腐敗現象由來已久。”

The Rise and Fall of Bitcoin and Cryptocurrencies

比特幣和加密貨幣的興衰

Bitcoin, the world's first cryptocurrency, was introduced just over a decade ago by an anonymous programmer known as Satoshi Nakamoto. Its decentralized nature, free from the control of governments and central banks, sparked excitement among tech enthusiasts and libertarian proponents of a post-capitalist society.

比特幣是世界上第一種加密貨幣,十多年前由一位名叫中本聰的匿名程式設計師推出。它的去中心化性質,不受政府和央行的控制,激發了科技愛好者和後資本主義社會的自由主義支持者的興奮。

However, as the crypto craze escalated, a sobering truth emerged. Bitcoin and other cryptocurrencies lacked the intrinsic value of fiat currencies, backed by government guarantees and subject to regulation. Instead, their value rested solely on the trust of users and the consensus of key miners and holders.

然而,隨著加密貨幣熱潮的升級,一個發人深省的事實出現了。比特幣和其他加密貨幣缺乏法定貨幣的內在價值,有政府擔保並受到監管。相反,它們的價值完全取決於用戶的信任以及關鍵礦工和持有者的共識。

As a result, the price of Bitcoin has experienced wild fluctuations, soaring to stratospheric heights only to plummet down again. This volatility has hindered its acceptance as an everyday means of exchange, relegating it primarily to the realm of speculation and fictitious capital.

結果,比特幣的價格經歷了劇烈的波動,飆升至平流層的高度,然後又暴跌。這種波動性阻礙了它作為日常交易手段的接受,使其主要進入投機和虛擬資本領域。

Fictitious Capital and the Finance Casino

虛擬資本與金融賭場

Karl Marx's analysis of fictitious capital remains eerily relevant in the context of cryptocurrencies. Marx described it as a financial fiction that represents real value, where the movement and transfer of property take place through gambling on the stock exchange. In the case of cryptocurrencies, this stock exchange is the digital realm, where fortunes are made and shattered within the blink of an eye.

卡爾馬克思對虛擬資本的分析在加密貨幣的背景下仍然具有驚人的相關性。馬克思將其描述為代表真實價值的金融虛構,其中財產的流動和轉移是透過在證券交易所賭博進行的。就加密貨幣而言,這個證券交易所就是數位領域,財富的創造和毀滅都在眨眼之間。

The cryptocurrency industry has become a playground for swindlers and sharks, feasting upon unwitting investors drawn in by promises of quick riches and financial freedom. The proliferation of financial fictions in recent years, such as SPACs (special purpose acquisition companies) and NFTs (non-fungible tokens), has further fueled speculation and fraud within the financial casino.

加密貨幣產業已成為騙子和鯊魚的遊樂場,不知情的投資者被快速致富和財務自由的承諾所吸引。近年來,SPAC(特殊目的收購公司)和 NFT(不可替代代幣)等金融虛構行為的激增,進一步助長了金融賭場內的投機和欺詐行為。

Regulatory Failure

監管失敗

Despite the glaring risks posed by cryptocurrencies, financial regulators have largely failed to protect investors from predatory schemes. They have been slow to respond to the rapidly evolving digital financial landscape, leaving a vacuum that has allowed criminals and swindlers to thrive.

儘管加密貨幣帶來了明顯的風險,但金融監管機構在很大程度上未能保護投資者免受掠奪性計畫的侵害。他們對快速發展的數位金融格局反應遲緩,留下了讓犯罪者和詐騙者猖獗的真空。

Politicians, influenced by the campaign contributions of crypto companies, have also hindered regulation. The US Congress has been deadlocked on bills aimed at codifying lax regulations, granting loopholes and carve-outs to the industry.

政客們受到加密貨幣公司競選捐款的影響,也阻礙了監管。美國國會在旨在製定寬鬆法規、為該行業提供漏洞和例外的法案上陷入僵局。

The Answer: Banning Fictitious Capital Investment

答案:禁止虛擬資本投資

The litany of financial crises and swindles throughout history demonstrates the inadequacy of regulation as a solution to the dangers of speculative finance. True protection for investors requires more than retrospective oversight; it demands a fundamental shift away from fictitious capital investment.

歷史上一連串的金融危機和詐騙事件表明,監管不足以解決投機金融的危險。對投資者的真正保護需要的不僅僅是回顧性監督;它要求從根本上改變虛擬資本投資。

Hedge funds, bitcoin exchanges, and exchange trade funding should be abolished. The banking system should be transformed into a public service, focused on providing deposits and loans to households and small businesses, rather than facilitating the financial machinations of criminals and swindlers.

對沖基金、比特幣交易所和交易所交易融資應該被廢除。銀行體系應轉變為公共服務,重點是向家庭和小型企業提供存款和貸款,而不是為犯罪分子和詐騙者的金融陰謀提供便利。

Conclusion

結論

The conviction of SBF serves as a stark reminder of the risks inherent in the unregulated world of cryptocurrencies. It is a testament to the enduring allure of fictitious capital and the failure of regulators to protect the public from predatory schemes.

SBF 的判決清楚地提醒人們,不受監管的加密貨幣世界所固有的風險。這證明了虛擬資本的持久吸引力以及監管機構未能保護公眾免受掠奪性計劃的侵害。

As the crypto industry reels from the fallout of this scandal, it is imperative to re-examine the role of finance in society. By banning fictitious capital investment and redirecting the banking system towards its true purpose, we can create a more equitable and sustainable financial system that safeguards the livelihoods of citizens, not the fortunes of criminals and swindlers.

隨著加密貨幣產業受到這一醜聞的影響,必須重新審視金融在社會中扮演的角色。透過禁止虛擬資本投資並調整銀行體系的真實目標,我們可以創造一個更公平和永續的金融體系,保護公民的生計,而不是保護犯罪者和詐騙者的財富。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 安東尼龐普里亞諾解釋為什麼美國需要比特幣儲備

- 2024-12-28 12:35:02

- Pomp Investments 創辦人兼執行長 Anthony Pompliano 強調了比特幣在地緣政治背景下的重要性。

-

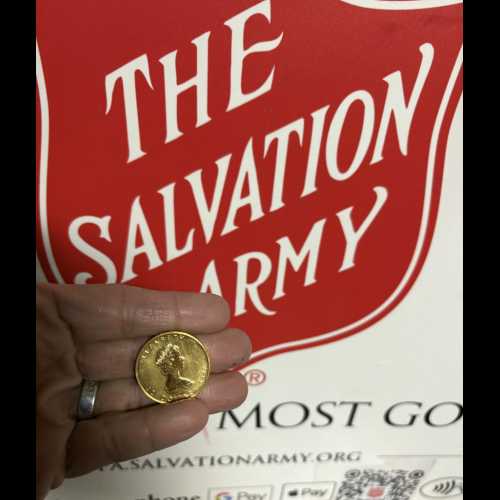

- 匿名捐贈者將稀有金幣投入救世軍水壺中

- 2024-12-28 12:35:02

- 這是聖誕節期間常見的景象和聲音——作為救世軍年度活動的一部分,路人將鈔票和硬幣投入紅色水壺中,志工敲響了鈴聲。

-

-

-

-

- Pudgy Penguins [PENGU] 的市值翻轉 Dogwifhat [WIF]

- 2024-12-28 12:35:02

- 過去一周山寨幣的價格表現表明,模因幣現在將繼續存在。

-

-

- Galaxy Digital 預計美國政府將在 2025 年停止購買比特幣

- 2024-12-28 12:35:02

- Galaxy Digital 研究部門預測美國政府將在 2025 年停止購買比特幣

-