|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Clearpool launches Credit Vaults on Avalanche, offering flexible borrowing terms for DeFi users.

- Banxa partners with Clearpool to inaugurate the first Credit Vault, enabling access to up to USDT 5 million in borrowing capacity.

Clearpool, a prominent decentralized finance (DeFi) player, has moved significantly by expanding its operations to Avalanche and introducing its latest product, Credit Vaults. This innovative offering aims to transform the landscape of on-chain credit markets by providing liquidity and flexibility to borrowers while offering attractive yields to lenders.

Clearpool 在Avalanche 上推出Credit Vaults,為DeFi 用戶提供靈活的借貸條款。Banxa 與Clearpool 合作推出第一個Credit Vault,可提供高達500 萬USDT 的借貸能力。Clearpool 是著名的去中心化金融(DeFi) 參與者,透過將業務擴展到 Avalanche 並推出最新產品 Credit Vaults,取得了重大進展。這項創新產品旨在透過為借款人提供流動性和靈活性,同時為貸方提供有吸引力的收益率,來改變鏈上信貸市場的格局。

By giving borrowers control over the terms, such as interest rates and repayment schedules, Credit Vaults deviate from conventional lending methods. This flexibility creates opportunities for various on-chain borrowers, including fintech and payment companies, as they search for stable rates and increased liquidity. With Credit Vaults, Clearpool hopes to meet the changing needs of the DeFi community and achieve 100% usage of efficient lending APYs.

透過讓借款人控制利率和還款計畫等條款,信用庫不同於傳統的貸款方法。這種靈活性為包括金融科技和支付公司在內的各種鏈上借款人創造了機會,因為他們尋求穩定的利率和增加的流動性。 Clearpool 希望透過 Credit Vaults 滿足 DeFi 社群不斷變化的需求,並實現高效借貸 APY 的 100% 使用。

The partnership between Clearpool and Avalanche demonstrates a common dedication to promoting innovation in digital financial solutions. Avalanche is the perfect platform to facilitate the launch of Credit Vaults, according to Morgan Krupetsky, Senior Director of BD for Institutions and Capital Markets at Ava Labs. He highlights Avalanche’s role in promoting more utility within the Avalanche ecosystem.

Clearpool 和 Avalanche 之間的合作夥伴關係體現了對促進數位金融解決方案創新的共同承諾。 Ava Labs 代理商和資本市場 BD 高級總監 Morgan Krupetsky 表示,Avalanche 是促進 Credit Vault 推出的完美平台。他強調了 Avalanche 在促進 Avalanche 生態系統內更多實用性方面的作用。

Banxa Partners with Clearpool for Inaugural Credit Vault

The inaugural Credit Vault has been launched by Banxa and Clearpool, two well-known infrastructure providers that enable embedding crypto in the payments industry. Banxa will be able to borrow up to USDT 5 million thanks to this agreement, while lenders will benefit from further incentives in the form of AVAX tokens and a seven-day payback window. In order to satisfy its liquidity needs and draw in a larger lender base, Banxa plans to utilize Credit Vaults.

Banxa 與 Clearpool 合作推出首個 Credit Vault 首個 Credit Vault 是由 Banxa 和 Clearpool 推出的,這兩家知名的基礎設施提供商能夠在支付行業中嵌入加密貨幣。透過該協議,Banxa 將能夠借入高達 500 萬美元的資金,而貸方將受益於 AVAX 代幣和 7 天還款窗口形式的進一步激勵措施。為了滿足其流動性需求並吸引更大的貸方基礎,Banxa 計劃利用 Credit Vaults。

Credit Vaults’ debut in RWA-backed lending represents a major turning point because it provides the most liquid and short-term fintech pools. The use of cryptocurrency and DeFi by institutions is growing; Clearpool has seen a growth in demand from more than 20 organizations, including the massive Wall Street firm Jane Street. The fact that Banxa has entered the on-chain borrowing space indicates the increasing interest institutions are showing in Clearpool’s product line, as more are expected to follow.

Credit Vaults 在 RWA 支持的貸款領域的首次亮相代表著一個重大轉折點,因為它提供了最具流動性和短期的金融科技池。機構對加密貨幣和 DeFi 的使用正在增長; Clearpool 發現 20 多家組織的需求不斷增長,其中包括大型華爾街公司 Jane Street。 Banxa 進入鏈上借貸領域的事實表明,機構對 Clearpool 產品線的興趣日益濃厚,預計還會有更多機構跟進。

Holger Arians, Chairman & CEO of Banxa, expresses enthusiasm for Clearpool’s Credit Vaults, citing their flexibility in meeting liquidity requirements. He emphasizes the seamless and efficient on-chain credit solution offered by Clearpool, underscoring Banxa’s commitment to developing its relationship with Clearpool amidst rising transaction volumes.

Banxa 董事長兼首席執行官 Holger Arians 對 Clearpool 的 Credit Vaults 表達了熱情,稱其在滿足流動性要求方面具有靈活性。他強調了 Clearpool 提供的無縫且高效的鏈上信貸解決方案,強調了 Banxa 在交易量不斷增長的情況下發展與 Clearpool 關係的承諾。

Cauris, an investment firm specializing in private credit for fintech companies, has been instrumental in structuring and managing the Credit Vault. With a focus on implementing robust security measures, including direct control over designated bank accounts and critical covenants, Cauris ensures the system’s integrity, safeguarding the interests of all stakeholders involved.

Cauris 是一家專門為金融科技公司提供私人信貸的投資公司,在 Credit Vault 的建置和管理方面發揮了重要作用。 Cauris 專注於實施強有力的安全措施,包括對指定銀行帳戶和關鍵契約的直接控制,確保系統的完整性,維護所有相關利害關係人的利益。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 標題:儘管假新聞

- 2025-04-08 18:50:12

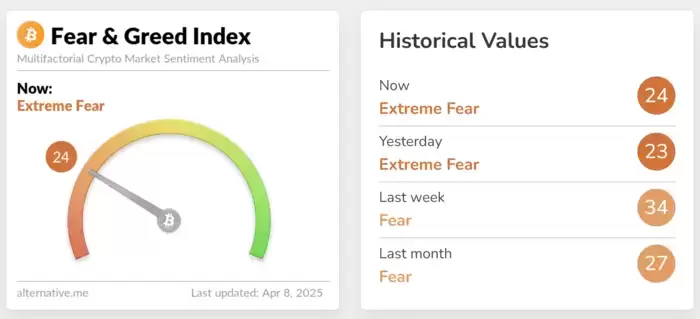

- 儘管有假新聞,但比特幣一直在暴跌,達到了80,000美元。

-

-

-

-

-

![比特幣[BTC]進入了合併階段,顯示了冷卻的跡象,而無需觸發廣泛的銷售 比特幣[BTC]進入了合併階段,顯示了冷卻的跡象,而無需觸發廣泛的銷售](/assets/pc/images/moren/280_160.png)

- 比特幣[BTC]進入了合併階段,顯示了冷卻的跡象,而無需觸發廣泛的銷售

- 2025-04-08 18:40:12

- 比特幣[BTC]進入了合併階段,顯示了冷卻的跡象,而不會觸發廣泛的銷售。

-

![比特幣[BTC]進入了合併階段,顯示了冷卻的跡象,而無需觸發廣泛的銷售 比特幣[BTC]進入了合併階段,顯示了冷卻的跡象,而無需觸發廣泛的銷售](/uploads/2025/03/27/cryptocurrencies-news/articles/bitcoin-btc-entered-consolidation-phase-signs-cooling-triggering-widespread-selling/img-1_800_480.jpg)