|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

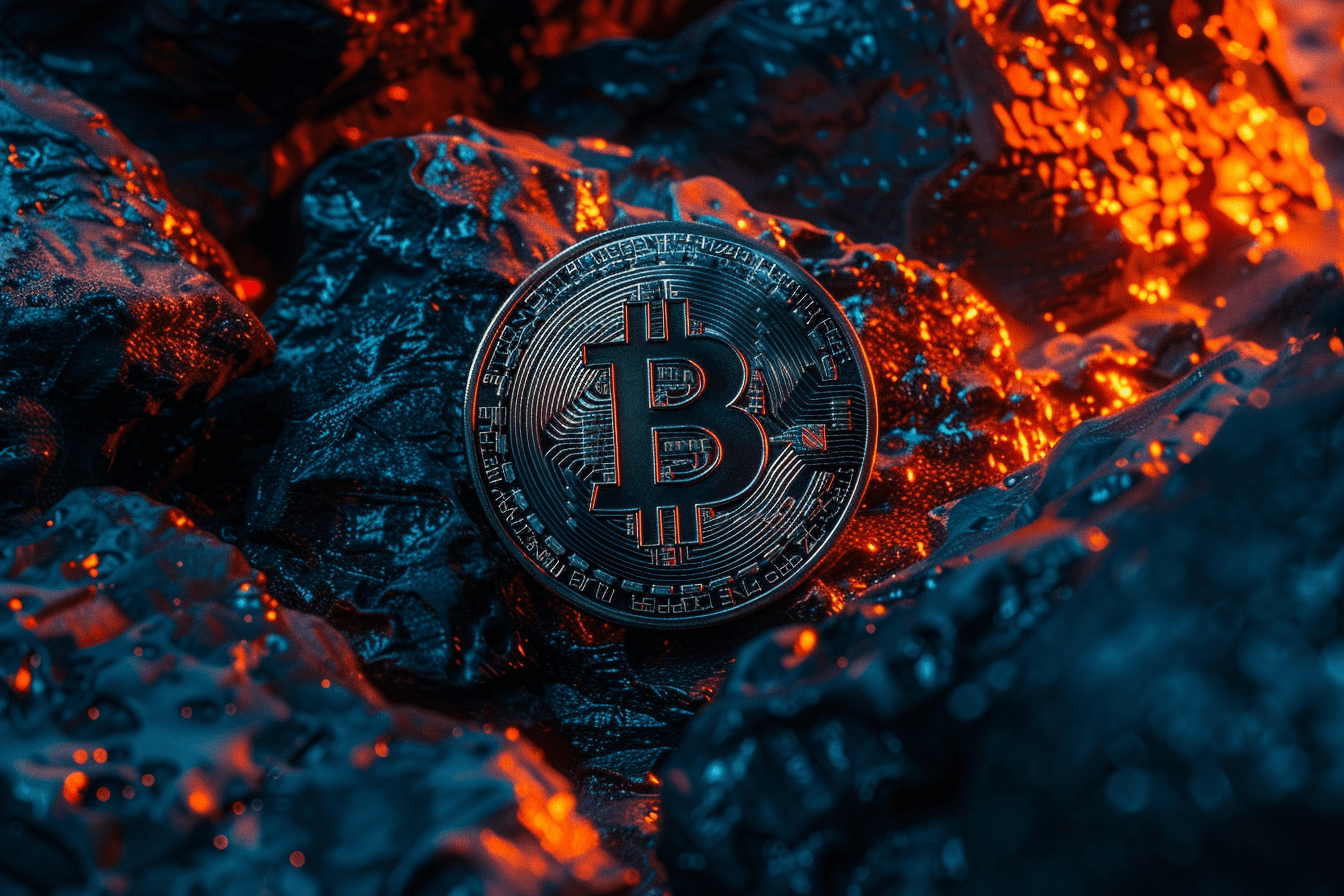

著名資產管理公司貝萊德表示,其對比特幣(BTC)和以太幣(ETH)以外的加密貨幣興趣有限。貝萊德首席數位資產長羅伯特·米奇尼克表示,比特幣仍然是他們客戶的主要關注點,其次是以太坊。該公司對其他加密貨幣缺乏熱情,這一點在其專注於基於 BTC 和 ETH 的交易所交易基金 (ETF) 上可見一斑,這表明該公司偏愛成熟且知名的資產。

BlackRock's Focus on Bitcoin and Ethereum

貝萊德專注於比特幣和以太坊

BlackRock, the world's largest asset manager, has expressed its preference for Bitcoin (BTC) and Ethereum (ETH) over other cryptocurrencies. Robert Mitchnick, BlackRock's Chief Digital Asset Officer, stated that Bitcoin remains the "overwhelmingly the number one priority" for the firm's client base.

全球最大的資產管理公司貝萊德表示,相較於其他加密貨幣,它更青睞比特幣(BTC)和以太幣(ETH)。貝萊德首席數位資產長羅伯特·米奇尼克表示,比特幣仍然是該公司客戶群「壓倒性的第一要務」。

BTC and ETH Dominate BlackRock's Cryptocurrency Strategy

BTC和ETH主導貝萊德的加密貨幣策略

BlackRock's decision to prioritize Bitcoin and Ethereum is evident in its recent product launches. In early 2024, the firm introduced the BTC ETF, which has become the most successful Bitcoin ETF in the market. Additionally, BlackRock is exploring the possibility of establishing an Ethereum fund.

貝萊德優先考慮比特幣和以太坊的決定在其最近的產品發布中顯而易見。 2024年初,該公司推出了BTC ETF,該公司已成為市場上最成功的比特幣ETF。此外,貝萊德正在探索建立以太坊基金的可能性。

Limited Appetite for Other Cryptocurrencies

對其他加密貨幣的興趣有限

Despite the growing popularity of alternative cryptocurrencies, Mitchnick indicated that BlackRock is unlikely to pursue ETFs for assets beyond BTC and ETH. "It's just not what we focus on," he remarked.

儘管替代加密貨幣越來越受歡迎,但米奇尼克表示,貝萊德不太可能為 BTC 和 ETH 以外的資產尋求 ETF。 「這不是我們關注的重點,」他說。

Market Dynamics and Investor Preferences

市場動態和投資者偏好

BlackRock's focus on Bitcoin and Ethereum aligns with market trends and investor preferences. A survey conducted by Bitwise in January revealed that 71% of investment advisors favored Bitcoin over Ethereum, suggesting limited demand for other cryptocurrencies among institutional investors.

貝萊德對比特幣和以太坊的關注符合市場趨勢和投資者偏好。 Bitwise 一月份進行的一項調查顯示,71% 的投資顧問更喜歡比特幣而不是以太坊,這表明機構投資者對其他加密貨幣的需求有限。

Bitcoin's Role in the Future of Finance

比特幣在未來金融中的作用

Mitchnick also provided insights into Bitcoin's potential role in the future of Wall Street. He anticipates a convergence between traditional finance and blockchain technology, leading to the emergence of a new financial infrastructure system.

米奇尼克也深入探討了比特幣在華爾街未來的潛在角色。他預計傳統金融和區塊鏈技術之間的整合將導致新的金融基礎設施系統的出現。

Implications for ETH ETFs

對 ETH ETF 的影響

While BlackRock's decision to focus on Bitcoin and Ethereum may not preclude the approval of ETH ETFs, experts believe these funds are unlikely to achieve the same level of popularity as their Bitcoin counterparts.

儘管貝萊德決定專注於比特幣和以太坊,可能不會妨礙 ETH ETF 獲得批准,但專家認為,這些基金不太可能達到與比特幣同類基金相同的受歡迎程度。

Conclusion

結論

BlackRock's preference for Bitcoin and Ethereum underscores the importance of these two cryptocurrencies in the institutional investment landscape. The firm's focus on these assets aligns with market dynamics and investor preferences, and it is expected to continue shaping the development of the cryptocurrency industry in the years to come.

貝萊德對比特幣和以太幣的偏好凸顯了這兩種加密貨幣在機構投資領域的重要性。該公司對這些資產的關注符合市場動態和投資者偏好,預計在未來幾年繼續影響加密貨幣產業的發展。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 2025 年阿聯酋最值得購買的期刊

- 2025-01-09 11:40:23

- 閨蜜,如果你在 2024 年沒有提升你的生活組織能力,那麼你最好相信 2025 年將是你糾正問題的一年。

-

- 推出必要的山寨幣來增強您的投資組合

- 2025-01-09 11:05:23

- 在動盪的加密貨幣市場中,做出正確的投資選擇至關重要。頂級分析師已經確定了可以提供穩定性的傑出替代硬幣

-

- 以太坊(ETH)價格因其看漲軌跡而受到關注

- 2025-01-09 11:05:23

- 分析師預計短期潛在價格目標為 4,755 美元,中期前景目標為 6,000 美元。

-

-

-

- 加密貨幣巨頭幣安交易量突破 100 兆美元

- 2025-01-09 11:00:22

- 幣安是全球交易量最大的加密貨幣交易所,週三發布了年終報告,顯示其所有產品的累積歷史交易量達到驚人的 100 兆美元。

-

-

-

- 隨著投資者的樂觀情緒和信心迅速上升,比特幣長期持有者紛紛增持

- 2025-01-09 10:50:22

- 在旗艦資產最新價格飆升至先前阻力位後,投資者對比特幣的樂觀和信心正在迅速上升。