|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bitcoin is poised for transformative changes driven by new technologies and evolving global landscapes. Here's a look at how key factors will shape Bitcoin's journey in 2025.

As we approach 2025, Bitcoin stands at a crossroads, influenced by technological advancements and evolving financial frameworks. Investors eager to navigate this dynamic landscape must keep abreast of emerging trends and potential challenges. Here’s a look at key factors shaping Bitcoin's future, complete with insightful investment advice and a balanced view of risks and rewards.

1. Quantum Computing’s Impact on Bitcoin

With quantum computing on the brink of reality, its potential to alter the mechanisms behind Bitcoin should not be underestimated. Currently, Bitcoin transactions are secured by public-private key cryptography, which has remained largely unbreachable due to the immense computational power required to crack the encryption. However, quantum computers, once fully realized, could perform these complex calculations at lightning speeds, rendering conventional encryption methods vulnerable.

To counter this threat and ensure the continued integrity of the Bitcoin network, innovations in cryptography are underway. One possibility is the integration of quantum-resistant algorithms into the Bitcoin protocol, rendering the blockchain immune to advanced computing techniques.

Another potential outcome is the emergence of quantum-enhanced blockchains, offering unprecedented levels of safety and efficiency. By combining the strengths of quantum computing with blockchain technology, new possibilities for secure and scalable decentralized networks could arise.

2. Regulatory Evolutions Shaping Bitcoin's Future

As nations increasingly dive into digital currencies, ranging from central bank digital currencies (CBDCs) to non-fungible tokens (NFTs), the regulatory terrain will likely become more intricate. Future governments might adopt centralized digital currencies, which could influence Bitcoin's market position.

In the United States, the Biden administration is expected to release its framework for regulating digital assets in 2023. This guidance will outline the roles of different agencies, such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), in overseeing the cryptocurrency industry.

The upcoming regulatory landscape will present both threats and opportunities for Bitcoin investors. On the one hand, excessive regulation could stifle innovation and hamper the growth of the cryptocurrency market. On the other hand, clear and supportive guidelines could attract institutional investors and drive the integration of Bitcoin into mainstream financial systems.

3. Green Energy Innovations Revolutionizing Bitcoin Mining

Bitcoin's energy consumption has been a hot topic in recent years, sparking debates over its environmental impact. Currently, Bitcoin mining is largely powered by fossil fuels, which has drawn criticism from regulators and climate activists alike.

However, innovations in sustainable energy could revolutionize mining processes, potentially transforming Bitcoin into an environmentally friendly asset. By harnessing green technology, such as solar or wind power, Bitcoin mining could become more energy-efficient and sustainable.

This shift would not only pave the way for wider adoption of Bitcoin but also align with the Biden administration's goal of achieving net-zero emissions by 2050.

4. Decentralized Finance (DeFi) Expansion: Bitcoin as a Cornerstone

The DeFi space, rapidly maturing and expanding, offers a glimpse into Bitcoin's potential beyond a store of value. Currently, DeFi protocols are primarily built on Ethereum or other smart contract platforms, enabling users to trade, lend, and borrow cryptocurrencies without intermediaries.

However, Bitcoin's unique characteristics, such as its decentralized nature, scarcity, and strong brand recognition, make it an ideal candidate for integration into DeFi systems. By 2025, Bitcoin could play a pivotal role in decentralized finance, serving as a cornerstone for new financial innovations.

5. Bitcoin Investment Risks and Opportunities for 2025

Investing in Bitcoin remains a high-stakes endeavor, especially for those seeking quick profits. The volatility of cryptocurrency can lead to significant gains but also substantial losses. However, as Bitcoin becomes more established and integrated into mainstream financial systems, its value could stabilize, potentially reducing volatility.

Investors should prepare for a future where regulatory decisions dramatically influence market conditions, impacting value trajectories. Closely monitoring government announcements and policies will be crucial for navigating the investment landscape.

6. Predictions for Bitcoin Rates by 2025

Forecasting Bitcoin's price by 2025 involves a lot of speculation. Some analysts predict that the flagship cryptocurrency will continue to soar, reaching astronomical figures, while others anticipate a price correction or potential slumps.

The increasing integration of blockchain technology in diverse sectors, such as supply chain management or digital identity, might drive Bitcoin's price upward. However, factors such as regulatory developments and technological breakthroughs will play crucial roles in determining its market value.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

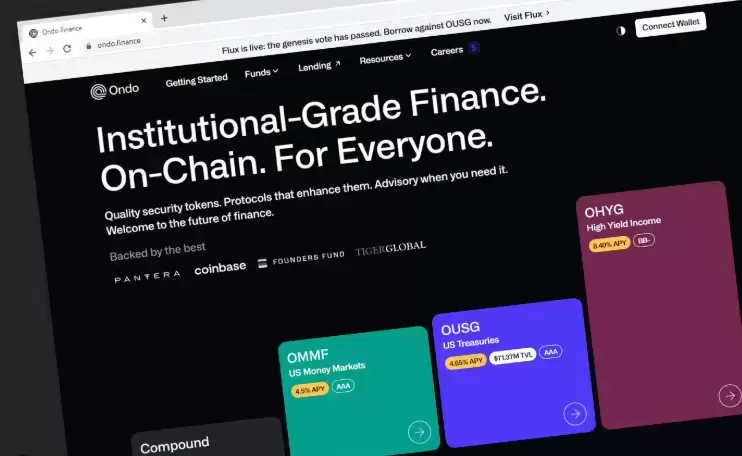

- RWA:Ondo Finance將用萬事達卡征服美國國庫債券市場

- 2025-04-17 18:40:12

- Onda Finance將以萬事達卡征服美國國庫債券市場。

-

-

-

-

- 卡巴(KAS)可以100倍嗎?新的指標和漸強升級信號巨大潛力

- 2025-04-17 18:30:12

- 卡巴(Kas)(KAS)迅速成為市場上最受關注的加密貨幣之一。它因其快速技術,低費用和強大的社區而引起關注。

-

- 由於市場週期通常會贏得恐慌的耐心,精明的投資者已經鎖定了職位

- 2025-04-17 18:25:12

- 隨著市場週期通常會贏得恐慌的耐心,精明的投資者已經鎖定了具有強大基本原理的項目的位置

-

-

- ZA Miner推出了一個免費的雲挖掘平台,使用戶可以不用硬件或前期成本開採比特幣和狗狗,從而使加密貨幣採礦可訪問

- 2025-04-17 18:20:15

- 通過Zaminer的雲採礦服務產生被動收入。