|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

不到48小時,比特幣將發生第四次減半,標誌著挖礦區塊獎勵大幅減少。從歷史上看,這一事件會引發市場波動和牛市,但它也挑戰了比特幣礦商的獲利能力。由於礦商面臨收入減少,他們必須調整策略以維持營運。

The Impending Bitcoin Halving: A Catalyst for Market Upturn and a Reshaping of the Mining Landscape

即將到來的比特幣減半:市場好轉和礦業格局重塑的催化劑

With less than two days remaining before the fourth Bitcoin halving, the cryptocurrency industry eagerly anticipates this pivotal event. As one of the most significant narratives within the sector, the halving is widely viewed as a catalyst for propelling the market into a new bull run, while also signaling a major shift in the Bitcoin mining landscape.

距離第四次比特幣減半還有不到兩天的時間,加密貨幣產業熱切期待這一關鍵事件。作為該產業內最重要的敘事之一,減半被廣泛視為推動市場進入新一輪牛市的催化劑,同時也標誌著比特幣挖礦格局的重大轉變。

Understanding the Bitcoin Halving Mechanism

了解比特幣減半機制

Central to the halving's impact is its foundational principle of scarcity. Codified by Bitcoin's creator, Satoshi Nakamoto, the halving occurs every 210,000 blocks mined, resulting in a 50% reduction in miner rewards. This mechanism, akin to the natural depletion of gold mining rates, endows Bitcoin with a scarcity value comparable to gold.

減半影響的核心是其稀缺性的基本原則。比特幣創始人中本聰制定的規則是,每開採 21 萬個區塊就會減半,導致礦工獎勵減少 50%。這種機制類似黃金開採率的自然消耗,賦予比特幣與黃金相當的稀缺價值。

Simultaneously, the halving mechanism underscores the crucial role of miners as the cornerstone of Bitcoin's network operation. Miners receive block rewards for successfully mining new blocks through competitive processes, which represents the sole means of generating new BTC.

同時,減半機制凸顯了礦工作為比特幣網路運作基石的關鍵作用。礦工透過競爭性流程成功開採新區塊而獲得區塊獎勵,這是產生新 BTC 的唯一手段。

Consequences for the Bitcoin Mining Landscape

對比特幣挖礦格局的影響

As the halving directly affects miner earnings, participants in the industry face the challenge of navigating income reductions while operating costs remain largely fixed. This necessitates a reassessment and adjustment of operational strategies.

由於減半直接影響礦工收入,該行業參與者面臨收入減少的挑戰,而營運成本基本上保持不變。這就需要重新評估和調整營運策略。

Industry reports indicate the widespread use of inefficient miners among mining participants. To maintain profitability post-halving, these miners must keep operating costs below $0.05 per kilowatt-hour. Consequently, some miners have already begun to relocate their operations to regions offering cheaper electricity, such as Africa and South America.

產業報告表明,採礦參與者普遍使用低效礦工。為了在減半後保持獲利能力,這些礦商必須將營運成本保持在每千瓦時 0.05 美元以下。因此,一些礦商已經開始將業務轉移到電力較便宜的地區,例如非洲和南美洲。

Furthermore, the current global distribution of Bitcoin hashrate reveals a high level of centralization, with the United States leading in terms of hashrate dominance. However, the pursuit of cost efficiency, particularly lower electricity costs, may gradually lead to a more globally dispersed mining landscape.

此外,從目前比特幣算力的全球分佈來看,中心化程度較高,其中美國算力佔據主導地位。然而,對成本效率的追求,特別是降低電力成本,可能會逐漸導致採礦業在全球範圍內更加分散。

Survival Strategies for Mining Participants

採礦參與者的生存策略

To remain competitive, larger mining companies have invested in acquiring more efficient mining rigs like the Antminer S21. These newer miners not only offer higher hashrate but also consume less energy, effectively reducing mining costs. However, the introduction of these advanced miners, coupled with the ever-increasing hashrate, poses challenges for small-scale miners.

為了保持競爭力,較大的礦業公司已投資購買更有效率的礦機,例如 Antminer S21。這些新型礦機不僅提供更高的算力,而且消耗更少的能源,有效降低挖礦成本。然而,這些先進礦機的引入,加上算力的不斷增加,為小規模礦機帶來了挑戰。

As of the recent Bitcoin mining difficulty adjustment, the network difficulty has reached a historic high of 86.39T, nearly doubling from a year ago. With the halving approaching, the number of minable Bitcoins will soon decrease by 50%, compelling miners to increase their hashrate to maintain sufficient earnings.

截至近期比特幣挖礦難度調整,網路難度已達86.39T的歷史高位,較一年前成長近一倍。隨著減半的臨近,可開採的比特幣數量很快就會減少50%,迫使礦工提高算力以維持足夠的收入。

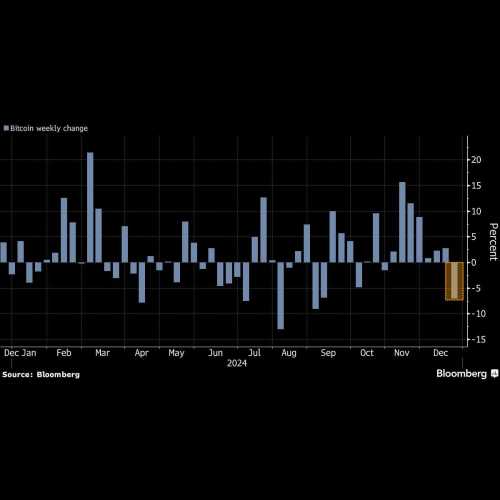

In the face of declining mining profits, miners with higher operating costs may consider temporarily shutting down their rigs until Bitcoin prices experience a significant increase. Current market conditions are unfavorable for miners, with the price of Bitcoin hovering around $62,000 and having dropped over 10% in the past week.

面對挖礦利潤下降,營運成本較高的礦商可能會考慮暫時關閉礦機,直到比特幣價格大幅上漲。目前的市場狀況對礦工不利,比特幣價格徘徊在 62,000 美元左右,過去一周下跌超過 10%。

Preparatory Measures for Miners

礦工準備措施

Miners with ample cash flow can endure the current unprofitable mining conditions, anticipating a future rise in Bitcoin prices. However, miners with limited cash flow may need to sell a portion of their daily mined Bitcoin to cover operational costs. Failure of Bitcoin prices to rebound post-halving will exert severe financial pressure on these miners.

擁有充足現金流的礦工可以忍受當前無利可圖的採礦條件,並預計比特幣價格未來會上漲。然而,現金流有限的礦工可能需要出售部分日常開採的比特幣來支付營運成本。比特幣價格在減半後未能反彈將對這些礦商造成嚴重的財務壓力。

For miners facing cash flow constraints, financial instruments offered by platforms like ViaBTC provide risk management tools to mitigate the impact of price fluctuations caused by the halving. ViaBTC's "Crypto Loans" and "Hedging Service" offer asset management solutions for such miners.

對於面臨現金流限制的礦工來說,ViaBTC等平台提供的金融工具提供了風險管理工具,以減輕減半造成的價格波動的影響。 ViaBTC的「加密借貸」和「對沖服務」為此類礦工提供資產管理解決方案。

ViaBTC's Hedging and Lending Services

ViaBTC 的對沖和借貸服務

ViaBTC's "Hedging Service" allows miners to lock in profits by borrowing coins and selling them in advance. Repayment is made with the Bitcoins they continue to mine. Conversely, if miners are optimistic about the future price of Bitcoin but require cash flow for operating expenses, they can pledge assets and borrow from ViaBTC through the "Crypto Loans" service. Repayment and asset redemption occur later.

ViaBTC的「對沖服務」允許礦工透過借幣並提前出售來鎖定利潤。償還是用他們繼續開採的比特幣進行的。相反,如果礦工看好比特幣未來價格,但又需要現金流來支付營運費用,則可以質押資產,透過「加密貸款」服務向ViaBTC借款。償還和資產贖回稍後發生。

Historical Significance and Outlook

歷史意義與展望

Historically, each Bitcoin halving has proven to be a major test for the mining industry, yet historical data also indicates a significant appreciation in Bitcoin's value following each halving. However, only miners who manage to "survive" can reap the rewards of the market's post-halving recovery. While it remains uncertain whether this halving will follow historical patterns, the immediate priority for miners is to find ways to prolong their operations as much as possible.

從歷史上看,每次比特幣減半都被證明是對採礦業的重大考驗,但歷史數據也表明,每次減半後比特幣的價值都會大幅升值。然而,只有設法「生存」的礦工才能獲得減半後市場復甦的回報。雖然目前還不確定這次減半是否會遵循歷史模式,但礦工的當務之急是找到盡可能延長營運時間的方法。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.