|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

Bitcoin (BTC) Price Prediction: Stargling New Estimates Target $200K as Institutional FOMO Builds

2024/11/28 16:00

Only 0.01% of publicly traded companies worldwide currently own Bitcoin, a surprisingly low figure that highlights the untapped potential for institutional adoption of the coin, according to OKG Research.

Conservative estimates from OKG Research suggest that nearly $2.28 trillion could flow into Bitcoin over the next year. Such a massive influx of capital could drive up Bitcoin’s price to a projected $200,000, according to separate estimates from Standard Chartered Bank, Bernstein, and BCA Research.

Institutional interest, particularly in the upcoming launch of Bitcoin spot ETFs, is gaining momentum, according to Bernstein's analysis. These financial instruments are designed to make Bitcoin more accessible to mainstream investors, increasing the demand for the asset.

Standard Chartered Bank also predicts that if the regulatory environment supports crypto innovation and ETF approvals, Bitcoin could reach $200,000 by the end of 2024. These bullish projections indicate a shared belief that institutional adoption will serve as a powerful catalyst for Bitcoin's price appreciation.

While these projections are compelling, it's crucial to note the volatility inherent in the crypto market. The $2.28 trillion estimate assumes a scenario where institutional uptake and favorable regulatory conditions converge seamlessly.

This trajectory could be impacted by factors such as macroeconomic shifts, market sentiment, and potential regulatory setbacks. Nevertheless, the growing recognition of Bitcoin as a legitimate store of value and inflation hedge underscores its enduring significance in the global financial landscape.

In a broader narrative, Bitcoin's story is intertwined with geopolitical dynamics. As CNF previously reported, major industry player MARA has highlighted the strategic importance of Bitcoin to U.S. national security.

MARA's recommendations include domestic ASIC manufacturing, building up Bitcoin reserves, and incentivizing investment in U.S.-based mining operations as the global mining dominance shifts toward countries like China and Russia.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

- 10月美國核心PCE物價指數年增2.8%,BTC價格突破97,000美元

- 2024-11-28 18:25:02

- 週三,美國10月核心PCE物價指數年增2.8%,符合預期,但仍高於聯準會2%的目標。

-

- Kraken NFT 市場將於 11 月 27 日關閉,理由是策略轉變

- 2024-11-28 18:25:02

- Kraken 在給客戶的電子郵件中確認,該平台將於 11 月 27 日進入僅限提款階段。

-

-

![LCX [LCX] 恢復看漲市場結構,但能否突破 0.33 美元阻力? LCX [LCX] 恢復看漲市場結構,但能否突破 0.33 美元阻力?](/uploads/2024/11/28/cryptocurrencies-news/articles/lcx-lcx-regains-bullish-market-structure-beat-resistance/image-1.jpg)

- LCX [LCX] 恢復看漲市場結構,但能否突破 0.33 美元阻力?

- 2024-11-28 18:25:02

- LCX [LCX]近兩個月來首次在一日時間框架內恢復看漲市場結構。

-

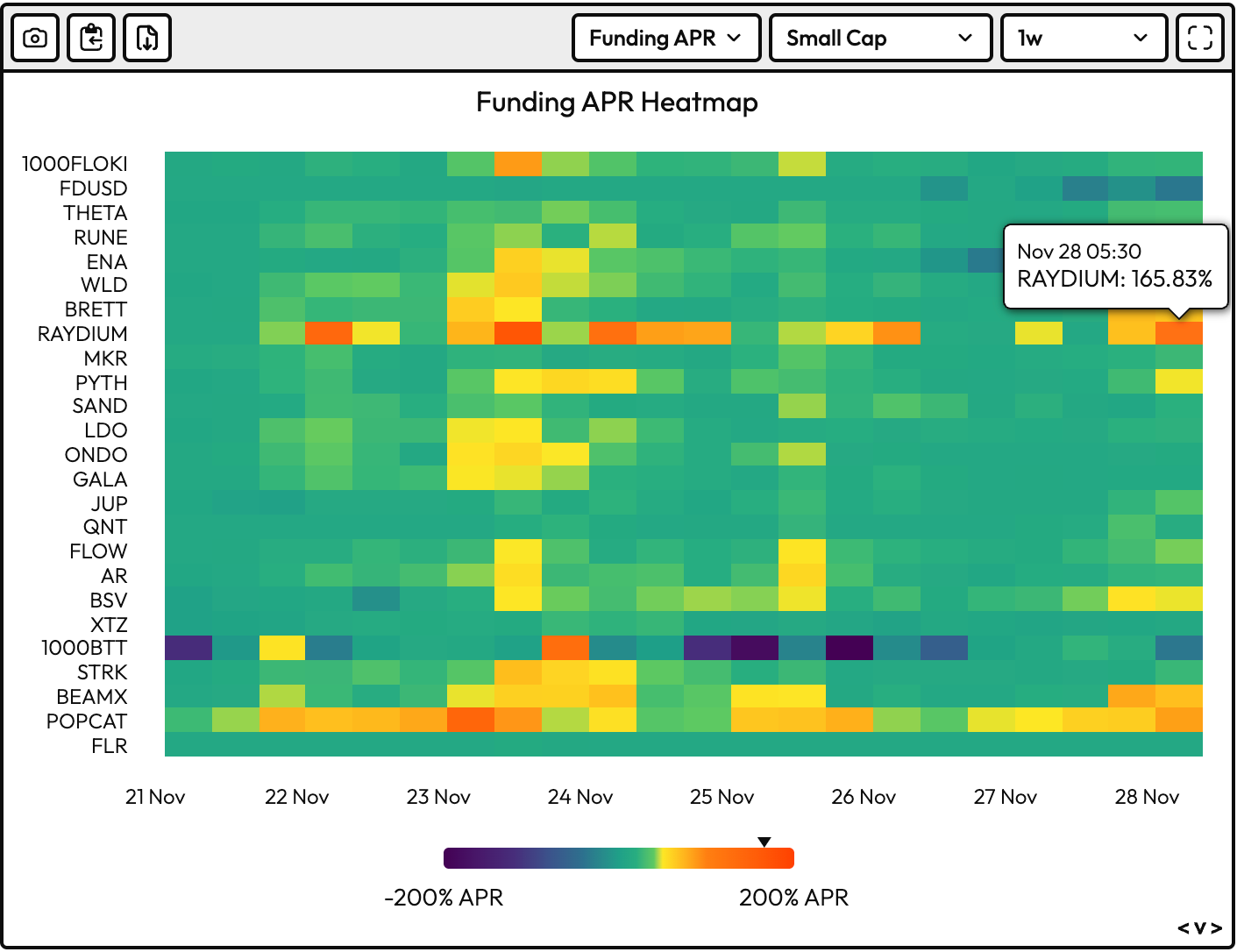

- 數據顯示,Raydium 的 RAY 代幣是最過熱的加密貨幣

- 2024-11-28 18:20:01

- 比特幣(BTC)最近的看漲停頓後,小盤代幣的年化永久融資利率已經冷卻了更廣泛的市場

-