|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣的價值飆升,在 2024 年第二次突破 70,000 美元。11 個比特幣 ETF 申請獲得批准推動的高需求,以及儘管拋售壓力仍然持續流入 ETF,都是比特幣價格飆升的原因。加密貨幣社群對其他加密貨幣 ETF 的推出持樂觀態度,大量投資加密貨幣的公司的股價也出現了上漲。比特幣減半預計將推動進一步上漲,價格預測預計到今年年底潛在價值將達到 10 萬美元甚至 15 萬美元。儘管存在潛在的波動性,但最近的上漲凸顯了比特幣和其他加密貨幣不斷增長的需求和價值。

Bitcoin Soars Past $70,000, Fueled by Growing Demand and ETF Inflows

在需求成長和 ETF 流入的推動下,比特幣飆升至 70,000 美元以上

In a remarkable resurgence, Bitcoin (BTC) has eclipsed the $70,000 milestone for the second time in 2024, marking a significant surge in its value. On Monday, the cryptocurrency experienced a substantial 7.1% increase, propelling it to $70,816 at market close. Since then, BTC has maintained its elevated position, hovering around $70,806.91 and exhibiting a 5.22% jump over the past 24 hours.

比特幣 (BTC) 顯著復甦,在 2024 年第二次突破 70,000 美元大關,標誌著其價值大幅飆升。週一,該加密貨幣大幅上漲 7.1%,收盤價升至 70,816 美元。此後,BTC 一直保持高位,徘徊在 70,806.91 美元附近,過去 24 小時內上漲 5.22%。

Analysts attribute Bitcoin's remarkable ascent to a confluence of factors, primarily driven by burgeoning demand and consistent inflows. The approval of 11 Bitcoin ETF applications by the United States Securities & Exchange Commission (SEC) has ignited a wave of enthusiasm among traders, enabling them to invest in the cryptocurrency without incurring direct exposure.

分析師將比特幣的顯著上漲歸因於多種因素的綜合作用,主要是由需求成長和持續資金流入所推動的。美國證券交易委員會 (SEC) 批准了 11 隻比特幣 ETF 申請,點燃了交易者的熱情,使他們能夠在不產生直接風險的情況下投資加密貨幣。

Notably, ETF inflows have remained robust despite selling pressure from Grayscale. While the inflow experienced a slight deceleration over the past week, its overall trajectory has been largely unaffected. Nathanaël Cohen, Co-Founder of INDIGO Fund, believes that the downward trend in inflows does not deter traders from accumulating BTC. He astutely observes that traders are eager to "buy the dip," seeking opportunities to add Bitcoin to their portfolios when prices decline.

值得注意的是,儘管來自灰階的拋售壓力,ETF 流入仍然強勁。儘管過去一周資金流入略有放緩,但整體軌跡基本上不受影響。 INDIGO Fund 共同創辦人 Nathanaël Cohen 認為,資金流入的下降趨勢並不能阻止交易者累積 BTC。他敏銳地觀察到,交易者渴望“逢低買入”,尋找機會在價格下跌時將比特幣添加到他們的投資組合中。

The substantial inflows into Bitcoin ETFs have instilled a sense of optimism within the crypto community. Speculation abounds regarding the imminent launch of additional crypto-related ETFs, with the Ether ETF emerging as the frontrunner. Expectations are high that this product will enter the market by the end of 2024.

比特幣 ETF 的大量資金流入給加密社群注入了樂觀情緒。關於即將推出更多加密貨幣相關 ETF 的猜測比比皆是,其中以太坊 ETF 成為領跑者。人們對該產品將於 2024 年底進入市場抱有很高的期望。

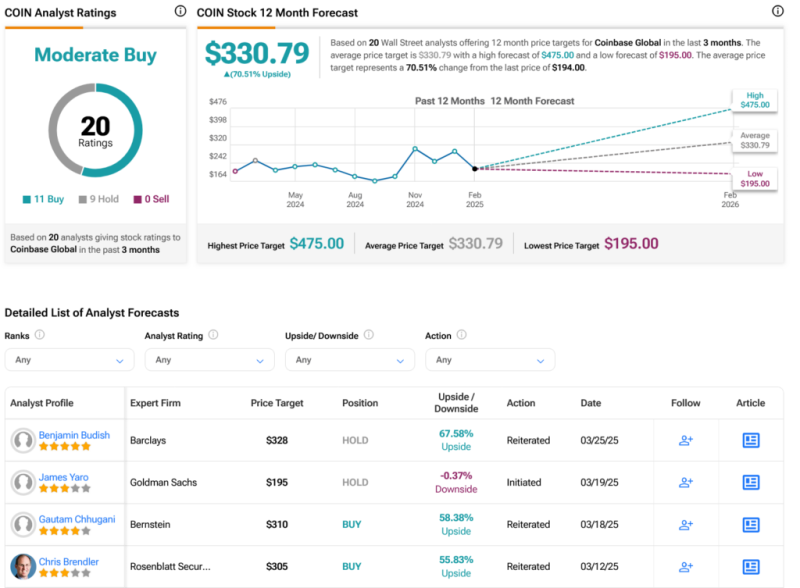

Companies heavily invested in the cryptocurrency sector have witnessed a commensurate rise in their stock values. MicroStrategy, an ardent proponent of Bitcoin, has experienced a 20% surge in its share price. Coinbase Global and Marathon Digital have also enjoyed notable gains, increasing by 9% and 5%, respectively.

大量投資加密貨幣領域的公司的股價也隨之上漲。 MicroStrategy 是比特幣的熱情支持者,其股價已飆升 20%。 Coinbase Global 和 Marathon Digital 也取得了顯著的成長,分別成長了 9% 和 5%。

The positive sentiment has extended to other cryptocurrencies as well. Ethereum (ETH) has registered a 5.26% gain, trading at $3,653.91 at the time of writing. Solana (SOL) and Dogecoin (DOGE) have also exhibited upward momentum, climbing by 3.15% and 5.05%, respectively. The rise in their values is particularly noteworthy given the recent pullout of $900 million from ETFs over the past week.

這種正面情緒也延伸到了其他加密貨幣。截至撰寫本文時,以太幣 (ETH) 上漲 5.26%,交易價格為 3,653.91 美元。 Solana (SOL) 和 Dogecoin (DOGE) 也表現出上漲勢頭,分別上漲 3.15% 和 5.05%。鑑於過去一周從 ETF 撤資 9 億美元,其價值的上漲尤其值得注意。

In the wake of Bitcoin's recent rally, analysts anticipate further gains in the coming months, particularly in the run-up to the highly anticipated Bitcoin Halving event. BTC price forecasts suggest that the cryptocurrency could potentially reach $100,000 by the end of the year. While some analysts remain cautiously optimistic, others believe that Bitcoin could rally even higher, potentially surpassing the $120,000 or even $150,000 mark.

在比特幣最近上漲之後,分析師預計未來幾個月將進一步上漲,特別是在備受期待的比特幣減半事件之前。 BTC 價格預測表明,到今年年底,這種加密貨幣可能會達到 10 萬美元。儘管一些分析師仍持謹慎樂觀態度,但另一些分析師認為,比特幣可能會上漲得更高,有可能突破 12 萬美元甚至 15 萬美元大關。

Amidst the bullish sentiment, caution remains paramount. The cryptocurrency market is inherently volatile, and investors are advised to exercise due diligence and conduct a thorough risk assessment before making any investment decisions.

在看漲情緒中,謹慎仍然至關重要。加密貨幣市場本質上具有波動性,建議投資者在做出任何投資決定之前進行盡職調查並進行徹底的風險評估。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

-

-

- 7個最佳加密貨幣預售:爆炸性

- 2025-04-08 13:55:12

- 2025年的加密貨幣預售市場正在加熱,有幾個高潛力的項目有助於爆炸性增長。

-

-

- 5個可以節省快速收益的加密項目

- 2025-04-08 13:50:12

- 加密世界以其快節奏的性質而聞名,為投資者提供了無數的機會,可以在短時間內取得回報。

-