|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

암호화폐 뉴스 기사

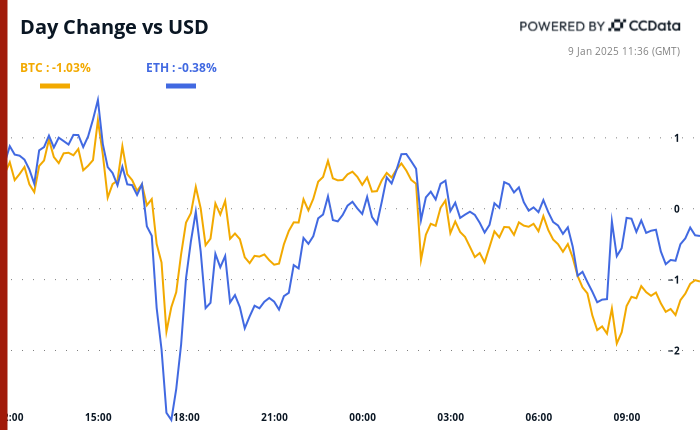

Market Wrap: Bitcoin (BTC) Hovers Above $93K as Crypto Industry Market Cap Drops Under $3.2T

2025/01/09 20:04

All times ET unless indicated otherwise

The total cryptocurrency industry is now under $3.2 trillion in market capitalization, as over $300 billion has been wiped out since Jan. 6, taking away all early gains for the year, according to the TradingView metric TOTAL. As a whole, the market is digesting the unconfirmed reports from DB News, which suggest that the U.S. government has been given the green light to liquidate as much as 69,370 BTC ($6.5B) from the Silk Road seizure.

Adding to the bearish sentiment, market is now digesting the unconfirmed reports from DB News which suggest that the U.S. government has been given the green light to liquidate as much as 69,370 BTC ($6.5B) from the Silk Road seizure. This makes the political theatre between the outgoing and incoming U.S. administrations even more intriguing, as president-elect Donald Trump, who is just few days away from being sworn in on Jan. 20, vowed not to sell any of the bitcoin held by U.S. authorities, which, according to Glassnode data, amounts to 187,236 BTC.

The onslaught in the crypto industry also stems from an extremely high DXY index, above 109, which measures the value of the U.S. Dollar relative to a weighted basket of major foreign currencies. In addition, for a brief moment, the U.S. treasury yields were rising before retreating slightly yesterday. The benchmark for 10-year yield was as high as 4.73%.

The inflation concerns that paddled the selloff in the broader market are picking up alongside growth expectations, LondonCryptoClub told CoinDesk. "The combination of rising growth and inflation expectations alongside rising term premia as the market struggles to digest huge treasury supply to fund these deficits is pushing U.S. yields higher, which is dragging global yields higher, excluding China."

However, turmoil is occurring across the pond in the U.K., with gilt yields continuing to march higher this morning. Records were set today, as the 30-year U.K. jumped to almost 5.45%, the highest level since 1998. While the benchmark U.K. 10-year challenged 4.95%, the highest since 2008, the treasury was forced to intervene in the market to calm investors, according to reports from The Telegraph.

LondonCryptoClub mentioned the key reasons for the turmoil, "the U.K. is under pressure after a disastrous budget which has increased borrowing needs with little to no positive growth impact, exacerbating the negative debt/GDP dynamics and driving a larger fiscal deficit."

As a result, the not-so-Great British pound, falling yet again, is now 1.22 against the dollar, the lowest level since November 2023, and has fallen almost 4% in the past month.

Today, Jan. 9, is declared a mourning day in the U.S. to remember the death of former President Jimmy Carter. Therefore, the stock market will be closed. So, all eyes will be turning to the jobs report on Friday. The market is in a good news is bad news scenario as rate cuts for 2025 get pushed back with only one rate cut expected for 2025.

A strong jobs report could remove this rate cut, with unemployment expected to come in at 4.2%, while nonfarm payroll is estimated at 154,000. A hot jobs print could send the dollar to 110, putting further pressure on risk-assets. Stay alert!

부인 성명:info@kdj.com

제공된 정보는 거래 조언이 아닙니다. kdj.com은 이 기사에 제공된 정보를 기반으로 이루어진 투자에 대해 어떠한 책임도 지지 않습니다. 암호화폐는 변동성이 매우 높으므로 철저한 조사 후 신중하게 투자하는 것이 좋습니다!

본 웹사이트에 사용된 내용이 귀하의 저작권을 침해한다고 판단되는 경우, 즉시 당사(info@kdj.com)로 연락주시면 즉시 삭제하도록 하겠습니다.