|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Unstoppable Bitcoin Rally Continues, with Saylor Doubling Down

Mar 26, 2024 at 11:09 pm

Is Bitcoin's Ascent Unstoppable, and Is Saylor Still a Believer?

In the wake of Bitcoin's (BTCUSD) resurgence, hitting the $71,000 mark again, MicroStrategy's Chairman, Michael Saylor, remains steadfast in his conviction in the digital asset.

Saylor, an ardent advocate for Bitcoin, recently reaffirmed his unwavering belief with a succinct tweet: "Still betting on #Bitcoin..."

Is Bitcoin's Rally Sustainable Despite ETF Outflows?

Despite significant outflows from U.S. exchange-traded funds (ETFs) last week, Bitcoin has regained its momentum, soaring past the $71,000 threshold. The outflows, totaling nearly $900 million, reflect diminishing subscription growth for offerings from BlackRock and Fidelity Investment, as well as ongoing redemptions from Grayscale Bitcoin Trust.

Are Other Crypto Assets Benefiting from Bitcoin's Gains?

The broader digital asset market has also experienced a surge, with most assets posting gains. Bitcoin's rise of 5.41% over the past 24 hours to $70,689 has been particularly impressive, with an intraday high of $71,583.

Are Companies Riding the Cryptocurrency Wave?

Cryptocurrency-related stocks have also been on a bullish run, with Bitcoin proxy MicroStrategy witnessing a 20% gain, crypto exchange Coinbase Global rising by 9%, and miner Marathon Digital climbing by 5%.

Is Saylor's Bitcoin Hoarding Strategy a Winning Bet?

Saylor, renowned for his bullish stance on Bitcoin, believes it is a store of value and an inflation hedge. His company, MicroStrategy, has invested heavily in Bitcoin, amassing roughly 1% of the total supply. Despite market volatility, Saylor has maintained his optimistic outlook.

Since 2020, MicroStrategy has acquired an impressive 214,246 Bitcoin at an average cost of $35,160 per coin. This bold strategy has not only made MicroStrategy a prominent corporate Bitcoin investor but has also attracted the attention of other institutional players exploring cryptocurrencies as an asset class.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Nasdaq ISE Proposes Increasing Position and Exercise Limits for iShares Bitcoin Trust ETF (IBIT) Options

- Jan 09, 2025 at 05:25 pm

- The Nasdaq ISE is an options exchange owned by Nasdaq. This has filed a proposed rule change with the U.S. The Securities and Exchange Commission increased the position and exercise limits for options of the iShares Bitcoin Trust ETF (IBIT) from 25,000 contracts to 250,000.

-

-

- Forget Bitcoin (BTC) and Ethereum (ETH) – Lightchain AI Could Skyrocket Your Crypto Portfolio!

- Jan 09, 2025 at 05:25 pm

- Bitcoin and Ethereum are the heavyweights known for their widespread adoption and market influence. However, emerging projects like Lightchain AI are proving to be lucrative opportunities for investors looking beyond traditional assets.

-

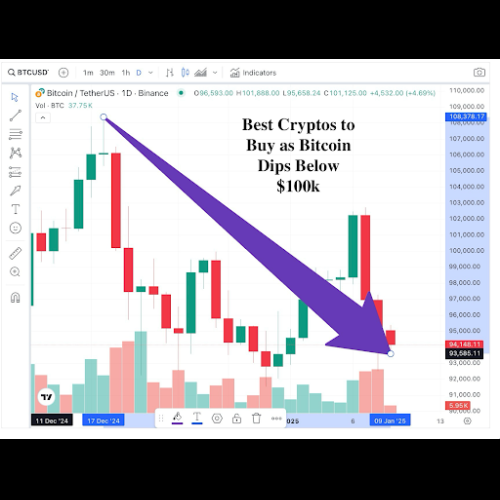

- Bitcoin and Ethereum Consolidate as Altcoins Outperform with Strong Gains

- Jan 09, 2025 at 05:25 pm

- Bitcoin is holding just below $97,000, while Ethereum has dipped back under $3,400. Despite these minor pullbacks, the first week of January has been largely bullish for the cryptocurrency market, recovering from the fade seen at the end of 2024.

-

- XRP Poised to Surge 40% as Shifting Regulatory Tides in the U.S. and Favorable Price Action Set the Stage

- Jan 09, 2025 at 05:25 pm

- Since hitting highs near $2.9 in early December, payments-focused cryptocurrency XRP has lost steam to carve out what is known as a "descending triangle" pattern in technical analysis.