|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

US President Donald Trump launches $Trump meme coin, promising "digital collectibles"

Mar 21, 2025 at 08:06 pm

In January, US President Donald Trump launched $Trump, so fans could show their support, “celebrate our win and have fun”. People have collectively paid more than $350 million for these tokens

In January, US President Donald Trump launched $Trump, so fans could show their support, “celebrate our win and have fun”. People have collectively paid more than $350 million for these tokens, since mid-January.

For Trump, the move was a way to thank his supporters for helping him win the 2024 election.

"I hope you enjoy this special token that is a tribute to the incredible MAGA movement that we've built over the past eight years," he said in a statement.

The tokens are not "the subject of, an investment opportunity, investment contract, or security of any type".

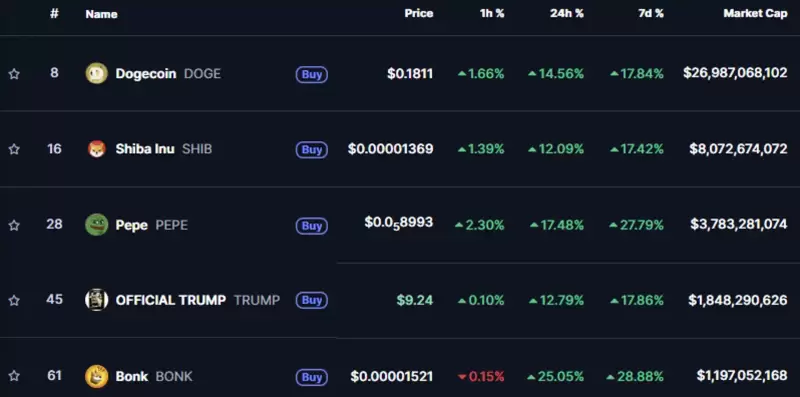

And yet, the industry has ballooned to a market capitalisation (the total value of all the meme coins in circulation) of nearly $49 billion, according to cryptocurrency tracker CoinMarketCap.

And, in February, Faustin-Archange Touadéra, President of Central African Republic launched $CAR, in an "experiment" to draw investors and boost its economy. (The coin has had a rocky start, but still currently represents $15.56 million.)

How did we get here?

It all began, of course, with Doge, which was launched as a joke.

In 2013, software engineers Billy Markus and Jackson Palmer created the world's first such token, named for the meme about the confused-looking Shiba Inu dog.

If Bitcoin (launched in 2009) could be considered real money, they demanded, why not this crypto coin based on a meme?

It too had to be developed using coding and blockchain.

If enough people bought in, could it be considered legitimate currency as well?

The joke backfired almost immediately. Doge became trendy, as "a community-driven digital currency, particularly for tipping and charitable donations," says David S Krause, a blockchain researcher and emeritus associate professor of finance at Marquette University in Milwaukee.

By the end of that year, Doge was worth nearly $8 billion. Then Elon Musk invested in it, and began to accept it as payment for Tesla accessories. More recently, the US government helpfully named the cost-cutting squad Musk heads the Department of Government Efficiency. All this has helped raise Doge valuations to about $25.5 billion.

Meanwhile, millions of other meme coins now sit around, uselessly, across the ethosphere.

There's one named for Pepe the Frog of the Boy's Club comics (Pepe). Another named after a favourite condiment (GRLC). Even nicher ones play on interests in scatological humour, pornography, and sheer silliness (PINEOWL, for a wished-for hybrid of a pineapple and an owl).

There has been a boom since January 2024, when the cryptocurrency launchpad Pump.Fun made it possible to create a meme coin with a few clicks (in exchange for a 1% fee on each trade, and further charges as a coin gets more popular).

Mint condition

Meme coins currently account for about 1.79% of the total cryptocurrency market (which is worth an estimated $2.74 trillion, according to CoinMarketCap).

They exist in a dense regulatory grey area.

The US Securities and Exchange Commission (SEC) in February stated that, in its view, they are collectibles rather than securities, and as such cannot really be monitored or governed.

They "typically are purchased for entertainment, social interaction, and cultural purposes... have limited or no use or functionality... do not generate a yield or convey rights to future income, profits, or assets of a business. In other words, a meme coin is not itself a security," the SEC website states.

It's like Monopoly money, if Monopoly money were to suddenly become tradeable.

Rates are determined, incidentally, by trading volumes on crypto exchanges such as Binance, Coinbase and Kraken.

These trading volumes are driven purely on speculation, hype cycles and the actions of whatever community "buys in on the joke", says Kashyap Kompella, who researches and consults on artificial intelligence, blockchain, automation and emerging technologies.

This makes them uniquely risk-laden.

The $Trump coin, for instance, has seen valuations rise from less than $10 to $70 and then drop to $11.40 since January. Mother is down from $0.21 last July to $0.004659 (and still has a market cap of $4.7 million).

In 2021, Squid Coin revealed another aspect of the dangers. Created anonymously (as many meme coins are), the makers led buyers to believe it was official

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.