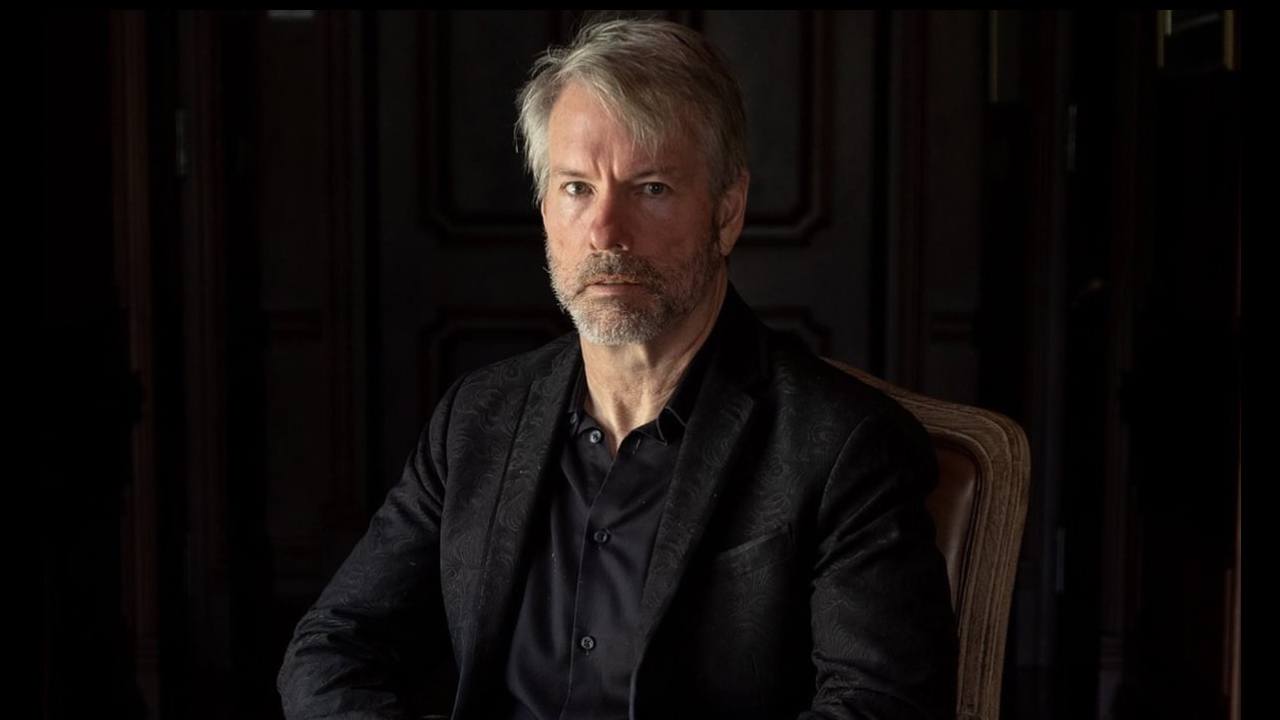

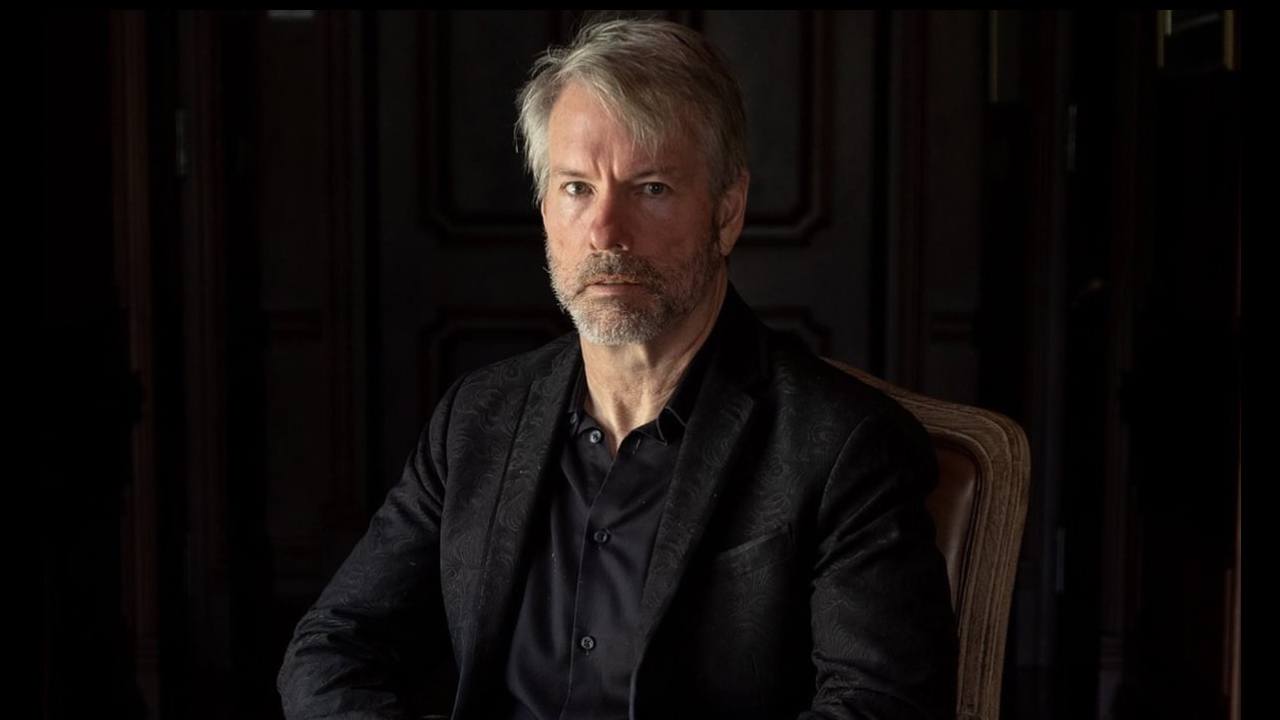

Microstrategy Incorporated (Nasdaq: MSTR), known for its significant bitcoin (BTC) investments, has completed a $3 billion offering of convertible senior notes due in 2029

Microstrategy has finalized a $3 billion convertible note offering, further bolstering its position as a leading bitcoin (BTC) holder with 331,200 BTC now valued at $32.519 billion.

Microstrategy Finalizes Convertible Notes Sale Worth $3 Billion

Microstrategy Incorporated (Nasdaq: MSTR), known for its significant bitcoin (BTC) investments, has completed a $3 billion offering of convertible senior notes due in 2029, according to a company announcement on Nov. 21, 2 بسرعة فائقة2024. The Virginia-based firm plans to use the proceeds to acquire additional bitcoin and for general corporate purposes.

The debt sale included an option for initial buyers to purchase an extra $400 million, which was exercised in full. The press statement says that these notes, sold privately to qualified institutional buyers, do not bear regular interest and are convertible into cash, Microstrategy stock, or a combination of both. Conversion rates are set at 1.4872 shares per $1,000 principal, reflecting a 55% premium over the company’s recent stock price.

This latest offering is part of Microstrategy’s ongoing strategy to increase its bitcoin reserves. The company first adopted BTC as its primary treasury reserve asset in 2020, citing its potential as digital capital and a store of value (SoV). Today, Microstrategy’s total bitcoin holdings stand at 331,200 BTC, valued at approximately $32.519 billion at current market rates.

The company’s bitcoin-focused strategy has been financed through a combination of equity and debt offerings, alongside cash flows from operations. While its approach has drawn both praise and scrutiny, Microstrategy has maintained its stance on bitcoin as a hedge against inflation and a cornerstone of its corporate strategy.

The convertible notes, maturing in December 2029, allow Microstrategy to redeem them under certain conditions beginning in December 2026. The company reported $2.97 billion in net proceeds after deducting fees and expenses from the offering.

Microstrategy’s aggressive bitcoin acquisition strategy highlights its role as a major player in the cryptocurrency sector, blending its enterprise analytics business with a growing digital asset portfolio. Shares of Microstrategy (MSTR) slid 16% as the trading day wrapped up on Nov. 21, reflecting a sharp turn in investor sentiment.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.