|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Incoming Treasury Secretary Scott Bessent Discloses $500k in Bitcoin ETF, Which He Will Divest

Jan 13, 2025 at 06:30 pm

Bessent's portfolio features ETFs such as the SPDR S&P 500 Trust (SPY) and the Invesco QQQ Trust (QQQ). However, his BlackRock Bitcoin ETF investment has drawn significant attention.

President-elect Donald Trump’s nominee for Treasury Secretary, Scott Bessent, has disclosed owning up to $500,000 in BlackRock’s Bitcoin ETF (NYSE:IBIT) among other ETF assets.Bessent’s financial disclosures show a total portfolio valued at around $521 million, including both traditional and crypto investments. As his Senate approval hearing approaches on January 16, 2025, his diverse portfolio has raised questions about potential conflicts of interest.

The portfolio includes ETFs like the SPDR S&P 500 Trust (NYSE:SPY) and the Invesco QQQ Trust (Nasdaq:QQQ). However, Bessent’s BlackRock Bitcoin ETF investment has drawn attention.

Mathew Sigel, head of research at VanEck, has commented on Bloomberg’s suggestion that Bessent may need to liquidate his Bitcoin ETF holdings upon confirmation.

Sigel expressed confusion over the Bloomberg report, stating that there has been no official announcement regarding a requirement for Bessent to sell his IBIT holdings. The situation has sparked discussions about regulatory scrutiny and conflicts of interest if Bessent assumes the office.

When announcing Bessent’s appointment, President Trump spoke about his role in advancing U.S. growth and addressing economic challenges. He highlighted Bessent’s expertise in both traditional markets and emerging sectors like cryptocurrency.

If confirmed, Bessent’s ability to navigate the intersection of crypto and traditional finance could define his tenure as Treasury Secretary.

Bitcoin ETFs have seen a massive influx of資金自2024年起,據Farside Investors透露,現貨比特幣 ETF 錄得淨流入約 362 億美元。

BlackRock’s IBIT alone brought in around $38 billion, which was countered by losses of over $21 billion from the Grayscale Bitcoin Trust (GBTC) during the same period.

This article is provided for informational and educational purposes only. It does not constitute financial advice or an offer to buy or sell any cryptocurrency or other digital asset. Coin Edition does not provide investment advice and will not be held liable for any losses incurred as a result of the utilization of content, products, or services mentioned.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Pudgy Penguins (PENGU) Suffers Sharp Downturn as New Memecoin Project PEPETO Presale Crosses $4 Million

- Feb 01, 2025 at 02:35 am

- Pudgy Penguins (PENGU) has suffered a sharp downturn, with its value declining by over 10% in the past 24 hours alone. The past week has been even more brutal, with the token experiencing a staggering 35.18% drop.

-

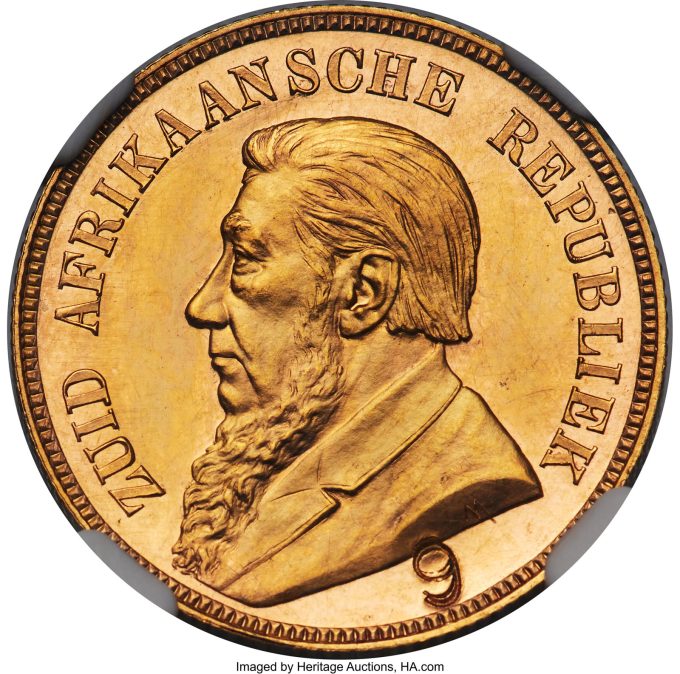

- Heritage Auctions NYINC Platinum Session World & Ancient Coins Signature® Auction Realizes $18,466,337, Part of a Remarkable Start to 2025 for Numismatics

- Feb 01, 2025 at 02:35 am

- By the time the auction hammer fell for the final time in Heritage's January 13 NYINC Platinum Session World & Ancient Coins Signature® Auction, demand drove the so-called "unicorn coin" of the entire series of South African coins to $2.16 million to lead the auction to $18,466,337.

-

-

- Top Trending Cryptos on Tron Chain: Zapo AI, TheKingdom, and Puss

- Feb 01, 2025 at 02:35 am

- Cryptocurrency is constantly buzzing with innovations, but which projects are making the biggest waves right now? If you’ve been following trends, you’ve probably come across Zapo AI, TheKingdom, and Puss, three fast-rising tokens grabbing attention on the TRON blockchain. But what makes them stand out? Are they just hype, or do they offer real value?

-

- Wintermute Co-Founder Evgeny Gaevoy on Asian Crypto Markets, AI in Trading and Liquidity Fragmentation

- Feb 01, 2025 at 02:35 am

- Evgeny Gaevoy began his career in traditional finance, specializing in market making and prop trading. But by 2016, seeing the inefficiencies of legacy financial systems and the potential for disintermediation, Gaevoy realized there was an opportunity to create something entirely new and better.