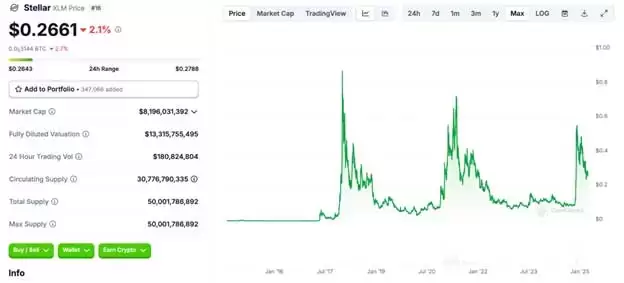

Current data shows that the ratio of Bitcoin's price to gold's per ounce price has dropped to 34. This figure, while attempting to reclaim previous highs

Bitcoin's price is currently about 34 times that of gold per ounce. This is down 15.4% from last December’s peak, which was above 40, as the crypto faces further volatility.

What Impacts Cryptocurrency And Gold Prices Today?

Gold has risen by about 10% since the year’s start and now trades at $2,877 per ounce.

The precious metal is largely up due to investor worries over U.S.-China trade tensions, which are pushing traders into a more risk-offish mood for today’s market.

But the increased demand for gold is also highlighted by the pressures of tariffs and world market uncertainty. For example, JPMorgan is delivering $4 billion of gold bullion to New York.

The build-up of the metal is part of a wider selloff in the markets today, as traders become more pessimistic on a trade deal being reached soon.

The implication of this is that traders are putting more money into safe-haven assets like gold, while pulling it out of riskier ones like Bitcoin.

Those trends are continuing today, with Bitcoin's price remaining flat and still lagging behind previous highs.

The crypto’s volatility has also decreased compared to gold, highlighting how quickly the digital currency market is shifting.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.