Following the successful launch of the first gold ETF in 2004, gold prices surged, fueling optimism that Bitcoin ETFs launched in January could have a similar impact. However, while gold ETFs have performed well, gold miners' ETFs have struggled, indicating a divergence between the underlying asset and companies involved in its extraction. This pattern appears to be repeating in the digital asset space, with Bitcoin ETFs outperforming miners' ETFs.

Gold ETFs Soar While Miners Languish: A Cautionary Tale for Bitcoin Investors

The recent launch of Bitcoin exchange-traded funds (ETFs) has sparked a wave of optimism among cryptocurrency enthusiasts, evoking comparisons to the remarkable surge experienced by gold ETFs after their debut in 2004. However, a closer examination reveals a sobering contrast: while gold ETFs have flourished, gold miners' ETFs have faced significant headwinds.

After the launch of the first Gold ETF, SPDR Gold Shares (GLD), in 2004, the precious metal embarked on a meteoric ascent, climbing from around $430 to a peak of $1,800 per ounce by August 2011. This surge has fueled speculation that Bitcoin could potentially experience a similar, if not more impressive, rise following the launch of Bitcoin ETFs in January.

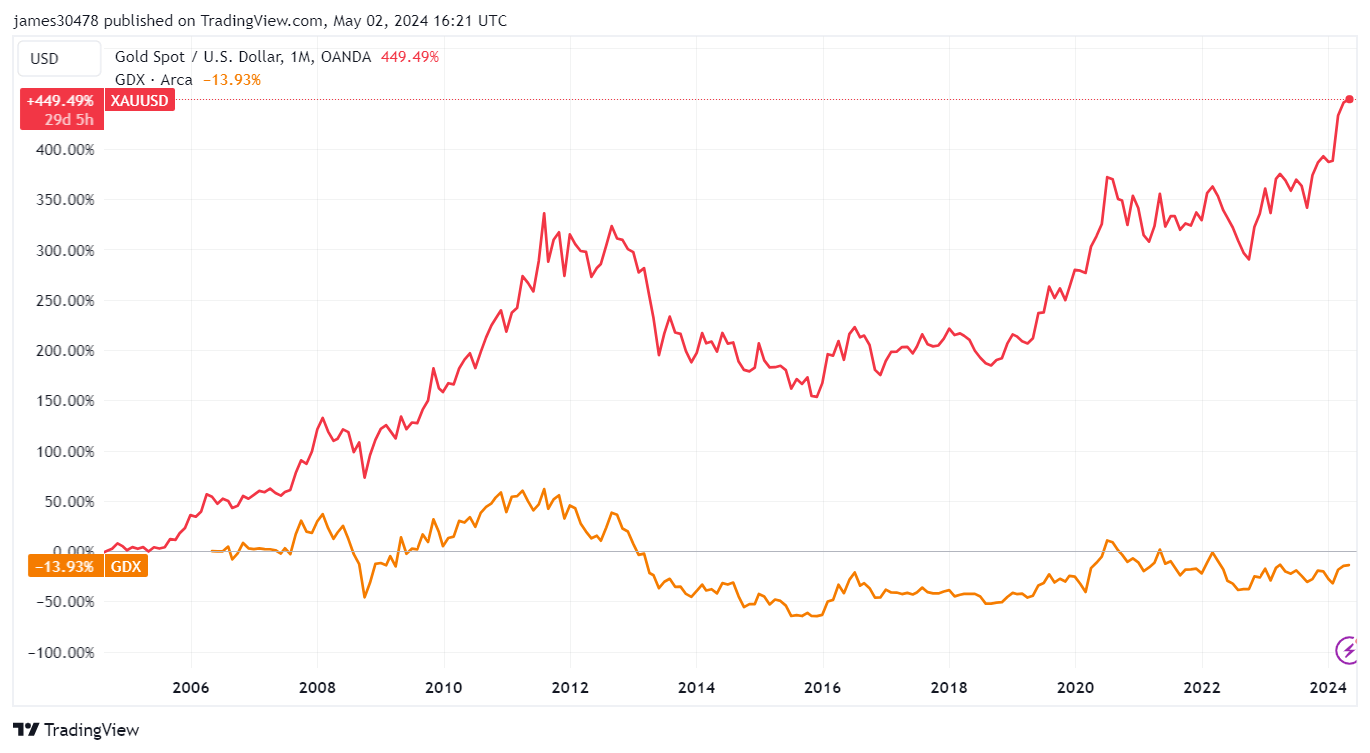

However, a closer look at the performance of gold miners' ETFs paints a very different picture. The VanEck Gold Miners ETF (GDX), one of the largest gold miners' ETFs with assets under management exceeding $13 billion, has declined by a staggering 14% since its inception in 2006, while GLD has appreciated by an impressive 449%.

This stark divergence suggests that the performance of miners' ETFs may not always mirror that of the underlying asset. While GLD tracks the spot price of gold, GDX tracks the performance of gold mining companies, which are subject to a range of factors that can impact their profitability. These factors include operating costs, geopolitical risks, and fluctuations in the value of gold.

A similar trend is emerging in the digital assets space. Since the launch of IBIT by BlackRock on January 11, Bitcoin itself and the ETF have risen 27%. However, the Valkyrie Bitcoin Miners ETF (WGMI), which tracks Bitcoin mining companies, has lost 10% of its value during the same period.

The performance divergence between digital asset ETFs and miners' ETFs highlights the importance of understanding the underlying dynamics of each market. While ETFs can provide investors with exposure to an asset class without the complexities of direct ownership, the performance of miners' ETFs is influenced by a wider range of factors that may not directly correlate with the underlying asset.

For investors considering investing in Bitcoin ETFs, the historical performance of gold miners' ETFs serves as a cautionary tale. While it is possible that Bitcoin ETFs could experience significant gains, it is crucial to recognize that the performance of miners' ETFs may not be a reliable indicator of the future trajectory of the underlying asset.