|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Forget Meme Coins, Crypto Utility Is Already Here

Sep 18, 2024 at 03:08 am

Meme Coin Mania has many wondering if crypto will stop the nonsense and deliver real use-cases, but crypto utility is already here if we simply look, says David Zimmerman

Despite the recent surge in memecoin mania, leaving many to wonder if crypto will ever move past the absurdity and deliver on its promise of real use-cases, a closer examination reveals that crypto utility is already here.

Election 2024 coverage presented by

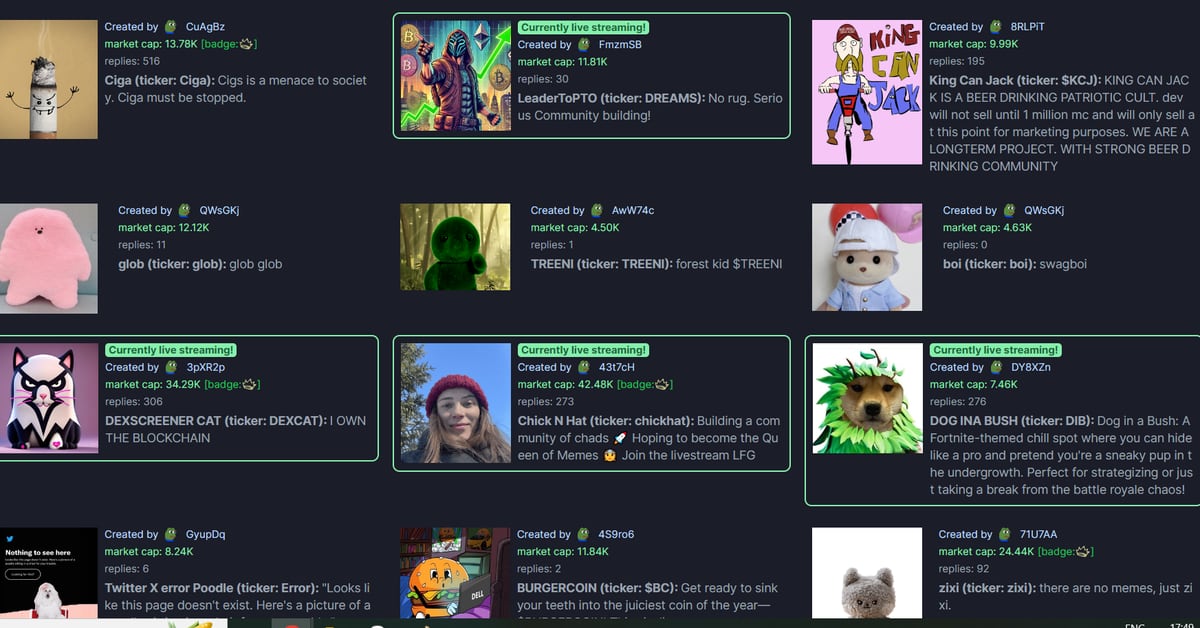

Memecoins have long been a part of the crypto landscape, but only recently has the phenomenon risen to become a dominant narrative within the ecosystem. Memecoin launchpad “Pump.fun” achieved a record in the crypto industry by generating over $100 million in revenue after just 217 days of operation. Following Pump.fun's milestone, the sector has experienced a cooling period.

As the dust settles, a spirited debate has emerged, with crypto natives expressing concerns over the impact of memecoins on the industry's image.

Paul Dylan-Ennis, a lecturer at University College Dublin, stated to The Block: “It's all the worst elements of our industry condensed into one epilepsy-inducing website.”

Of the memecoins launched on Pump.fun, over 99% fail within the first week. Despite this, users have gone on to launch around 2 million coins. Collectively, memecoins listed on CoinGecko boast a total market cap of $40 billion. This figure dwarfs the combined market cap of tokens (excluding tokenized assets) categorized in the Real World Asset (RWA) sector, which currently stands at $6.6 billion and includes the tokenization of U.S. Treasuries and insurance.

Pay No Mind to the Silliness, Crypto Utility Is Right In front of You

Such statistics leave many crypto natives feeling disheartened, leading to a noticeable rise in the cohort of self-described “crypto nihilists” within the industry – individuals who believe that all we do here is sling memes. However, while the wacky fringes of crypto continue to rage on, the serious side of the industry continues to make great strides.

Stablecoin market cap recently hit $175 billion, as demand continues to grow for crypto's greatest product. The utility and importance of USD-pegged stablecoins is often lost on crypto natives in Western countries. However, stablecoins have proven to be a crucial product for people in emerging markets, whether they are seeking to avoid the hyperinflation of their native currency or predatory remittance fees.

Meanwhile, infrastructure for crypto payments continues to expand. Mastercard recently partnered with Mercuryo, enabling users to spend their self-custodied crypto at over 100 million merchants. PayPal and Venmo recently integrated Ethereum Naming Service, allowing their users to transfer crypto using readable names instead of traditional wallet addresses.

The Helium Network, a decentralized physical infrastructure (DePIN) project taking on big telcos, has seen 113,000 people sign up to its mobile service. That is 113,000 people who have ditched the likes of Verizon for a crypto alternative.

Crypto is also integrating itself into our lives through messaging apps. Telegram, with nearly 1 billion monthly active users, integrated The Open Network (TON), allowing users to transfer crypto as easily as sending a text. LINE, an Asian messaging app with over 230 million monthly active users, is following a similar plan with Kaia.

Both TON and Kaia are focused on building out mini apps that will enable crypto usage within Telegram and LINE. TADA, a major ride-hailing app in Southeast-Asian, recently launched “TADA Mini” which enables users to book rides through Telegram and pay using TON or USDT. Kaia Wave, an incentive program starting in Q4, is offering up to $1.2 million in support for developers building out mini apps on LINE.

If that were not enough, there is every indication that the $12 billion in tokenized assets on-chain is only the beginning for the RWA sector. BlackRock's BUIDL fund, a tokenized investment fund focused on U.S. Treasuries and repo agreements, reached over $500 million in capital deployed this summer. BlackRock CEO Larry Fink frequently reiterates the vision to “tokenize all assets”, with BUIDL's launch in March being just the start.

Memecoins Seldom Capture Headlines

Memecoins have stirred a lively debate within crypto circles, but “Dogwifhat” does not capture wider attention and make crypto look bad to outsiders. FTX defrauding customers and collapsing makes crypto look bad. $6 billion in DeFi exploits and hacks makes crypto look bad. VC-backed projects extracting millions and then exiting makes crypto look bad. Memecoins can make crypto look silly, but there are greater issues that damage the crypto’s image.

Fortunately, such issues are balanced out by positive fundamental developments in the space. It is easy to fall into the trap of crypto nihilism, especially when the silliest sectors of the industry steal our attention away from real progress. Memecoin madness will likely continue to be a feature of crypto

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

- Faruqi & Faruqi, LLP Investigating Potential Claims Against Zeta Global Holdings Corp. Following Release of Culper Research Report

- Nov 14, 2024 at 01:55 pm

- NEW YORK--(BUSINESS WIRE)--Faruqi & Faruqi, LLP, a leading national securities law firm, is investigating potential claims against Zeta Global Holdings Corp. (“Zeta” or the “Company”) (NYSE: ZETA).

-

-