|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Financial Mix: US Stocks Dip, Non-US Surge Amidst Crypto Miners' Loss

Apr 06, 2024 at 10:28 pm

Financial stocks commenced the second quarter with losses, driven by the decline in bitcoin prices. Bitcoin miners CleanSpark, Marathon Digital, and Riot Platforms suffered the most significant losses, while Coinbase, a cryptocurrency exchange, also faced a downturn. In contrast, non-U.S. banks outperformed, benefiting from the weaker U.S. dollar, with Grupo Financiero Galicia, Bancolombia, Banco Macro, HDFC Bank, and NatWest Group posting notable gains.

Financial Stocks Post Mixed Performance in First Week of Q2

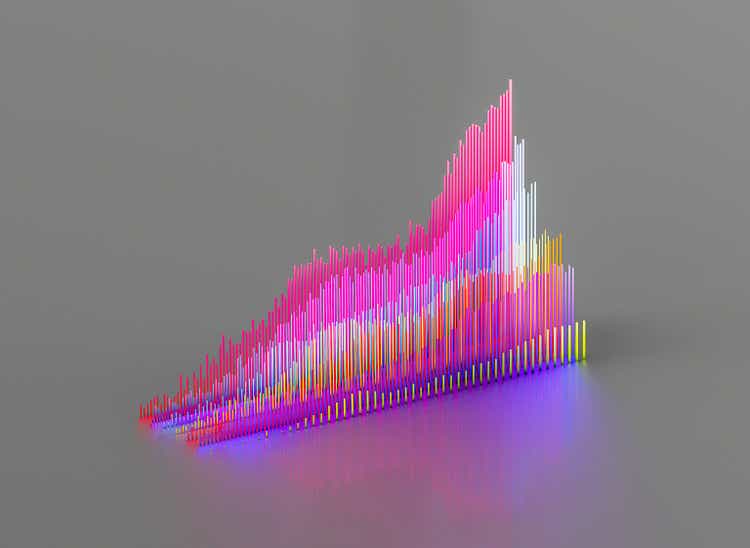

Financial stocks experienced a lackluster start to the second quarter of 2023, with the Financial Select Sector SPDR ETF (XLF) declining 1.3%, slightly underperforming the broader S&P 500's 1% dip.

Cryptocurrency Miners Tumble with Bitcoin Price

Bitcoin (BTC) miners faced significant losses as the cryptocurrency's price suffered a decline this week. CleanSpark (CLSK) plummeted 26.5%, Marathon Digital Holdings (MARA) retreated 18.4%, and Riot Platforms (RIOT) lost 16.7%, marking the steepest declines among financial stocks.

Crypto Exchange and Insurance Company Join Financial Losers

Alongside BTC miners, Coinbase Global (COIN), the largest cryptocurrency exchange in the United States, witnessed a 9.1% decline. The company's acquisition of a restricted dealer license in Canada came amidst ongoing regulatory scrutiny in the US.

Specialty insurance company Kinsale Capital Group (KNSL) also posted a substantial loss of 14.6%.

Non-U.S. Banks Surge on Weaker Dollar

In contrast to the downward trend in US-based financial institutions, non-U.S. banks benefited from the ослабление доллара. Argentina's Grupo Financiero Galicia (GGAL) emerged as the top gainer, advancing 7.7%.

Other notable performers included Colombian lender Bancolombia (CIB), which climbed 6.3%, Argentina-based Banco Macro (BMA) with a 6.1% jump, India's HDFC Bank (HDB) rising 5.4%, and NatWest Group (NWG) from the UK gaining 5.2%.

Analysts' Insights

Analysts have weighed in on the recent performance of financial stocks. Some speculate that CleanSpark may benefit from the upcoming Bitcoin halving event, while others caution that the risk-reward proposition for HDFC Bank remains uncertain.

Citi's research team has identified several highly rated stocks and undervalued stocks within the financial sector, providing investors with valuable insights for portfolio management.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Memecoins Capitalize on the Bullish Sentiment Sparked by Donald Trump's Crypto-Friendly Stance

- Nov 20, 2024 at 06:30 pm

- The recent U.S. elections that saw Donald Trump's victory has sparked optimism for a potentially crypto-friendly regulatory environment. Memecoins, in particular, are capitalizing on the bullish sentiment, with Dogecoin and Pepe Coin, Yeti Ouro seeming to enjoy the win.

-

-

-

- Xclusive Yachts Unveils Encore, a 40-Meter Tri-Deck Sunseeker Super Yacht, Setting a New Standard for Luxury on Dubai's Waters

- Nov 20, 2024 at 06:25 pm

- Joining the fleet alongside the flagship Stardom, Encore becomes part of Xclusive Yachts' elite super yacht trio, which will soon include the 43-meter CRN model Behike.

-

- Egypt Seeks to Complete 1st Stage of El-Dabaa Nuclear Power Plant on Schedule: PM

- Nov 20, 2024 at 06:25 pm

- Cairo, Nov 20 (IANS) Egyptian Prime Minister Mostafa Madbouly said that Egypt seeks to complete the first stage of the construction of El-Dabaa Nuclear Power Plant, built by Russia's State Atomic Energy Corporation Rosatom, as scheduled due to the project's strategic importance.

-

-

-

-

- KuCoin Exchange Lists Blast Royale (NOOB), Introduces Series of Campaigns to Distribute 1.8M NOOB Tokens

- Nov 20, 2024 at 06:25 pm

- KuCoin exchange has introduced Blast Royale (NOOB) to its trading platform, marking the event with a series of promotional campaigns that will distribute a total of 1.8 million NOOB tokens to active users.