Currently priced at $6.592 with a 5.51% decline, Polkadot (DOT) offers an intriguing historical case for market analysts.

The DOT chart history provides some interesting hints about TIA's potential path.

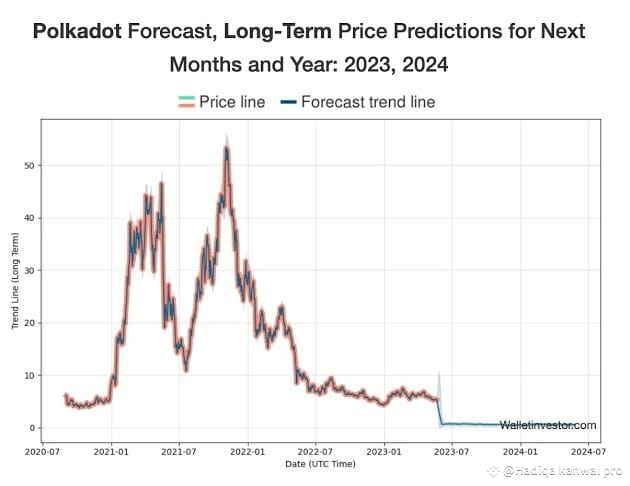

In 2021, DOT surged 15x, forming a double-top reversal pattern before a massive 90% retracement from its peak. Over the last three years, DOT has been in a prolonged accumulation phase with minimal price volatility or significant upward momentum.

Now, striking similarities are emerging with TIA's price action. After a 10x漲幅, TIA formed a classic Head and Shoulders (H&S) reversal pattern, followed by an 80% retracement from its highs. Currently trading in a sideways trend, the price movement suggests a scenario where sustained sideways trading dominates.

There is a possibility that TIA could revisit the $2.5 support zone - where the rally initially began - implying a nearly 90% decline from its all-time high.

If history repeats, we could see TIA's trajectory mirror that of DOT - an extended consolidation period marked by subdued movements within a narrow range. For long-term observers, these trends underscore the cyclical nature of the cryptocurrency market and highlight the importance of strategic patience.

As with DOT, further developments in TIA will likely depend on broader market conditions and investor sentiment.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.