|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

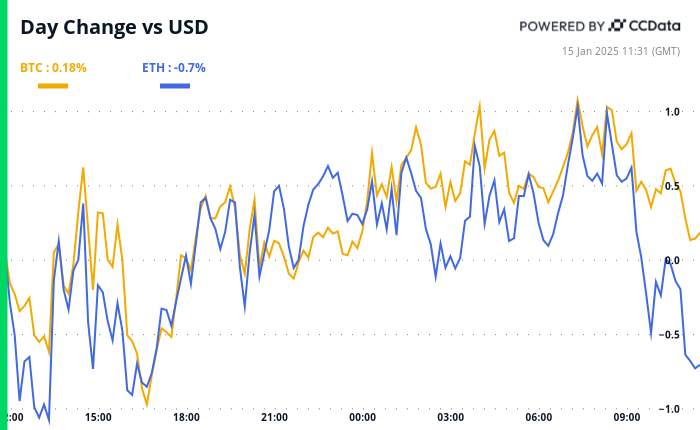

December CPI Data Looms, BTC Options Flows Show Cautious Sentiment as Puts Roll Below the Key $90k Support

Jan 15, 2025 at 08:00 pm

Markets are bracing for the first major U.S. economic event of 2023: December CPI data. The print will be closely watched by traders for clues on the Federal Reserve's monetary policy path, especially amid persistent hawkish concerns.

Bitcoin's strengthening correlation with tech stocks has also made Wednesday's report more significant for the digital assets market. The stalled liquidity inflows via stablecoins have also raised questions on the sustainability of price recovery from sub-$90K levels. Hence, traders are bracing for potential downside volatility by adding short-dated puts.

Here’s what experts are saying about the upcoming event:

* QCP Capital: "In crypto, cautious sentiment is evident in BTC options flows, with puts rolled below the key $90k support. Front-end vols and flies remain elevated, while the VIX stays high at 18.68 – suggesting volatility to persist through January."

* Geoffrey Chen, author of the Fidenza Macro blog: "The rising markets in November and the lifting of election uncertainty pushed business confidence higher, resulting in stronger data. The frontloading of goods imports and the raising of prices to get ahead of tariffs may have also contributed to higher PMIs. On top of that, oil has woken up and rallied over 10% from its December levels, reinforcing the stagflation regime. None of this bodes well for CPI tomorrow [Jan. 15] and the FOMC later this month. These risk events may surprise towards hawkish and stagflationary outcomes, putting more pressure on risk assets.”

* Markus Thielen, founder of 10x Research: "Bitcoin continues to trade within a narrowing wedge, with several critical catalysts on the horizon. Expectations for a higher CPI number have risen, creating a scenario where a softer-than-expected inflation reading could trigger a bitcoin rally."

Focus on XRP and AI

XRP surged to $2.90 early today, matching the December high with technical analysis suggesting a continued run higher.

Meanwhile, dip buyers have been active in AI coins, namely FAI, GRASS, VIRTUAL, Ai16z and TAO, according to Wintermute. These coins, therefore, could chalk out bigger gains in case the CPI spurs renewed risk-taking in financial markets.

What to Watch

Token Events

Conferences:

Token Talk

By Oliver Knight

Derivatives Positioning

Market Movements:

Bitcoin Stats:

Technical Analysis

Crypto Equities

ETF Flows

Spot BTC ETFs:

Spot ETH ETFs

Source: Farside Investors, as of Jan. 14

Overnight Flows

Chart of the Day

While You Were Sleeping

In the Ether

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- As we enter Q2 of 2025, the global crypto market finds itself steering a complex intersection of macroeconomic and geopolitical pressures.

- Apr 07, 2025 at 10:10 am

- Bitcoin's Future: Bullish or Bearish? The two analysts share a bullish outlook on Bitcoin, albeit with differing views on its short-term fluctuations.

-

-

- Intercontinental Exchange Inc. Has Announced That It Signed a Memorandum of Understanding with Circle Internet Group, Inc.

- Apr 07, 2025 at 10:05 am

- The agreement outlines plans to evaluate applications for USDC and USYC within ICE's core markets, including its derivatives exchanges, clearinghouses, and data services.

-

-

- NEAR Protocol Introduces Blockchain Operating System (BOS), Unifying Web3 Development

- Apr 07, 2025 at 10:00 am

- NEAR Protocol has introduced the Blockchain Operating System (BOS), a pioneering initiative designed to redefine Web3 development and enhance user experiences within decentralized environments.

-

- The stock market endures a new shock. Wall Street wobbles, Asia slips, Europe hesitates. The reason? The return of Donald Trump, armed with his favorite weapon: tariffs.

- Apr 07, 2025 at 09:55 am

- Donald Trump plays an old tune again: that of provocative protectionism. His idea? To apply reciprocal tariffs to all countries that tax the United States.