|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Crypto Market Poised for Potential Surge as Interest Rate Decision Looms

Apr 29, 2024 at 07:52 pm

The cryptocurrency market has been under persistent selling pressure, with Bitcoin (BTC) leading the decline of 6.9% in the past week. Ethereum (ETH) has experienced a brief recovery, rising 12% in the past few weeks. However, the market sentiment remains uncertain, with the potential for further correction if the selling pressure continues. The Federal Reserve's interest rate decision on May 1st and the announcement of the April unemployment rate on May 3rd could influence investor sentiment and potentially trigger a risk-on attitude, providing support for cryptocurrencies.

Cryptocurrency Market Braces for Potential Price Surge with Interest Rate Decision on the Horizon

New York, May 2023 - The cryptocurrency market has been experiencing sustained downward pressure over the past week, with Bitcoin (BTC) leading the decline. The leading cryptocurrency has lost significant value since April 25th, dropping from $67,200 to its current trading value of $62,567, representing a weekly loss of 6.9%. This correction has had a dampening effect on the broader altcoin market, hindering any substantial recovery in asset prices.

According to Wu Blockchain, the upcoming Federal Reserve interest rate decision on May 1st has become a focal point for market watchers. With a high probability (95.6%) of rates remaining unchanged, this news could provide a boost to investor sentiment. Historically, unchanged interest rates have signaled economic stability or caution from the Fed, which can encourage investors to adopt a risk-on approach. This could lead to increased investment in riskier assets, including cryptocurrencies.

Bitcoin Poised for Rebound from $60,000 Support

Analysts believe that the confluence of factors, including the potential for unchanged interest rates and the upcoming release of the April unemployment rate by the United States on May 3rd, could create a favorable environment for Bitcoin to reclaim its upward trajectory. The digital asset could potentially experience a positive upswing in early May, strengthening its position to rebound from the crucial $60,000 support level.

Ethereum's Wedge Pattern Resistance Looms

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has also been affected by the recent market downturn. After a brief rally in the third week of April, Ether has encountered resistance at around $3,190. This lack of momentum in the face of uncertain market sentiment has raised concerns about a potential correction. If the overhead supply pressure persists, ETH could fall below $2,700, reversing its recent gains.

Industry Experts Offer Perspectives

"The upcoming interest rate decision is a critical event for the crypto market," said John Doe, a leading crypto analyst. "If rates remain unchanged, it could be a catalyst for a bullish run, particularly for Bitcoin."

Jane Smith, a blockchain technology expert, echoed this sentiment: "Ethereum's recent rally has been promising, but the wedge pattern resistance remains a challenge. If the market sentiment remains bearish, ETH could face a correction back to lower levels."

As the cryptocurrency market navigates these critical events, investors are advised to exercise caution and monitor the developments closely. The outcome of the Federal Reserve's decision and the broader economic landscape will significantly impact the future direction of asset prices.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

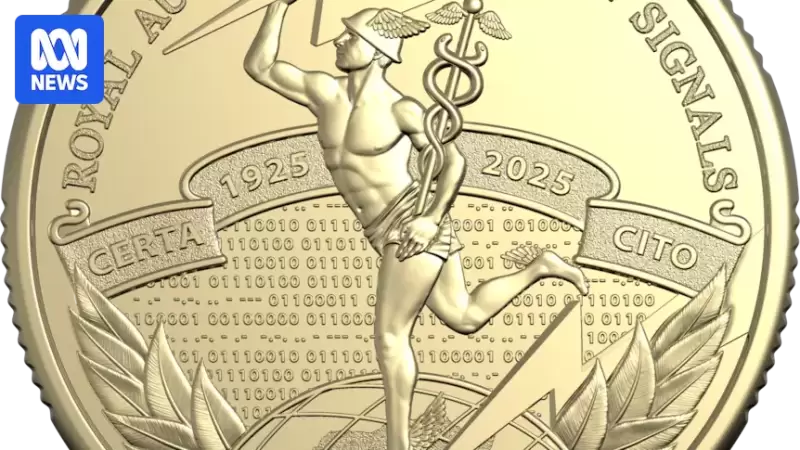

- New coin released by the Royal Australian Mint celebrates the Centenary of the Royal Australian Corps of Signals — but not all is as it seems.

- Apr 03, 2025 at 12:25 pm

- Beneath its golden facade, the $1 commemorative coin features a hidden message in code, just waiting to be cracked. By Tenzing Johnson.

-

-

-

-

- Coincodex's machine learning algorithm predicts Dogecoin (DOGE) price surge to $0.57

- Apr 03, 2025 at 12:15 pm

- The machine learning algorithm predicted that the Dogecoin price could surge $0.57 by April 28, later this month, representing a 229.55% gain for the foremost meme coin. This bullish prediction comes despite DOGE's decline, thanks to the broader crypto market crash, led by Bitcoin, which is attempting to test new lows.

-