|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

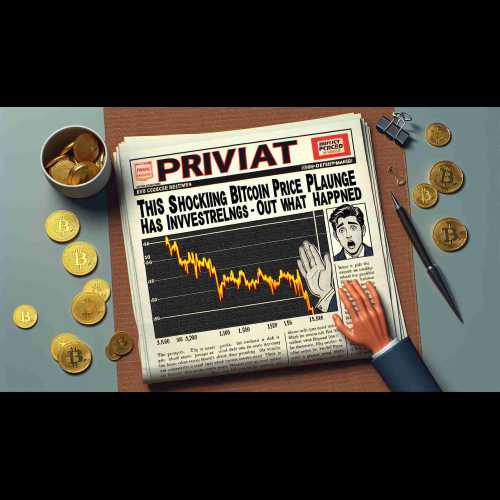

Bitcoin Spot-Perpetual Gap Falls To -$59 – What Next?

Dec 22, 2024 at 07:00 pm

The US Federal Reserve's public consideration of reduced interest rate cuts in 2025 resulted in numerous negative effects on financial markets.

The US Federal Reserve’s public consideration of reduced interest rate cuts in 2025 had several negative effects on financial markets.

In addition to a 17% price loss for Bitcoin, data from Binance exchange shows the BTC market has now developed its largest spot-perpetual price gap.

Bitcoin Spot-Perpetual Gap Falls To -$59 – What Next?

Last week, the Fed announced the potential reductions of its originally planned four rate cuts in 2025 to two triggered a wide-scale selloff in the global financial markets.

As the total crypto market cap dipped by 17.4%, over $1.8 trillion was lost in the stock market on a single day as investors looked to offload the risky assets in their portfolio, representing the worst daily decline since March 2020.

For the Bitcoin market, CryptoQuant analyst Darkfost reports a notable increase in selling pressure from the derivatives market, resulting in a spot-perpetual price gap of -$59.14, the largest ever in BTC history.

For context, the spot-perpetual price gap represents the difference between the price of a cryptocurrency on the spot market (where an asset is traded directly) and its perpetual futures price (contracts that speculate on an asset’s future value without expiry).

A negative gap means perpetual futures are trading at a lower price than the spot market indicating bearish sentiment in the derivatives market.

Therefore, the current highly negative spot-perpetual price gap of -$59.14 suggests derivatives traders expect a short-term decline in Bitcoin’s price.

However, Darkfost notes that spot-perpetual price gaps are historically likely to reverse as markets stabilize.

Therefore, extremely negative gaps such as that currently presented are often good buying opportunities as markets tend to overreact during periods of heightened uncertainty before recovery occurs.

BTC Investors Record Over $5.72 Billion Profit Amid Price Decline

In other news, crypto analyst Ali Martinez reports that the Bitcoin market witnessed over $5.72 billion in realized profit during the recent market crash.

This indicates that a significant portion of Bitcoin holders were in profit ahead of the price correction, which triggered profit-taking.

While large realized profits can signal a cautious or bearish short-term sentiment, they also suggest that bitcoin’s earlier price rally was substantial enough to benefit many investors who believe in a strong bullish structure that is sustainable in the long term.

At the time of writing, Bitcoin is valued at $97,182 with a 0.83% gain in the past day. However, the asset’s trading volume is down by $50.28% and valued at $54.23 billion.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Bitcoin's 21 Million Supply Cap Is a Boomer Myth

- Dec 23, 2024 at 02:55 am

- In the world of Bitcoin, some things are meant to be immutable. Yet a seemingly innocuous disclaimer in BlackRock's recent three-minute Bitcoin explainer video has sparked an existential debate about one of crypto's most sacred tenets: the 21 million supply cap.

-

-

-

-

- Chainlink (LINK) Could Become One of the Big Winners in 2025, With an Anticipated Increase of 160%

- Dec 23, 2024 at 02:55 am

- The last two weeks of December have been tumultuous for the crypto market, marked by a significant drop in prices. However, Chainlink (LINK) could become one of the big winners in 2025, with an anticipated increase of 160%.

-

-

-

- Dogecoin (DOGE) and Pepe (PEPE) Struggle as Investors Turn to a New $0.04 DeFi Coin with Massive ROI Potential by 2025

- Dec 23, 2024 at 02:45 am

- Dogecoin (DOGE) and Pepe (PEPE), major players in the meme coin scene, have gained significant traction among crypto investors due to their potential for huge surges. However, they have experienced recent slow performance. Due to this slump, Dogecoin and PEPE holders have shifted their focus to this new $0.04 coin.