|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Retreats to $97K, MVRV Score Hints BTC Price Is Still Cheap

Dec 23, 2024 at 12:27 am

Bitcoin (BTC) has retreated to $97,000 from the all-time high of $108,427 after the Federal Reserve pointed to just two interest rate cuts in 2025.

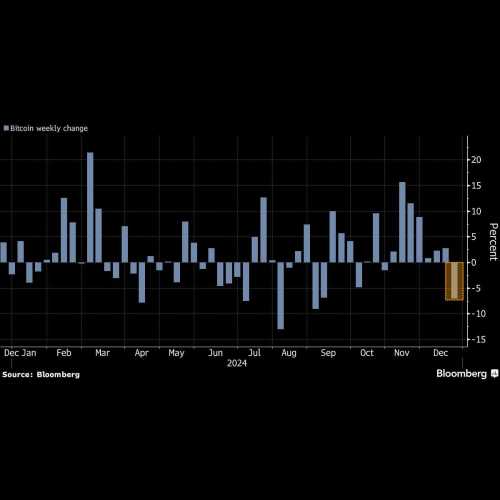

Bitcoin (BTC) price has had a strong performance this year as it jumped by 120%, beating popular assets like the Nasdaq 100 and the S&P 500 indices.

However, the coin took a beating this week after the Federal Reserve pointed to just two interest rate cuts in 2025.

As a result, BTC price dropped to $97,000 from the all-time high of $108,427. At the same time, spot ETF flows showed that some investors believe that Bitcoin may have topped.

According to SoSoValue, these funds had net outflows of $276 million on Friday, a day after they shed $680 million in assets.

This happened as the MVRV score showed that Bitcoin price is still cheap even after moving to a record high last week.

According to CoinGlass, the MVRV-Z score has dropped to 2.84 from last week’s high of 3.3. Historically, an MVRV-Z score figure below 3.7 is a sign that an asset is undervalued.

The MVRV-Z score is an important indicator that looks at the market value and the relative value of a coin. It is calculated by subtracting the realized market capitalization from the circulation market value and then dividing the figure by the standard deviation.

Bitcoin had an MVRV score of 3.03 in the last big correction in March this year, and 7 in the previous major correction in January 2021.

Therefore, this score is a sign that the coin could recover strongly in the next few weeks. As we wrote in a recent BTC forecast, the cup and handle pattern points to a rally to $122,000 in this bullish cycle.

BTC has other strong fundamentals

The coin also has some strong fundamentals. As shown below, the number of Bitcoins in circulation has dropped to a multi-year low of 2.24 million. There were over 2.72 million coins in exchanges in September this year.

That indicates that more investors are buying and storing Bitcoins in self-custody wallets. Some of these investors are those accumulating ETFs, which now have over $109 billion in assets. Companies like Marathon Digital and MicroStrategy have also continued to accumulate Bitcoins this year.

MicroStrategy now holds over 439,000 coins.

The other potential catalyst for Bitcoin is that the stablecoin market cap has jumped to almost $210 billion, up from $122 billion a year earlier.

A rise in stablecoin value is usually a positive indication, underscoring how more investors are showing interest in cryptocurrencies.

Meanwhile, Bitcoin’s annual inflation rate has continued falling, moving to 1.12% from the 2015 high of almost 12%. This inflation rate has fallen because of the halving events and the rising mining difficulty rate.

Therefore, while more Bitcoin pullback is possible, there are signs that its favorable MVRV score and strong fundamentals will help to push it higher in the longer term.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- XRP Soars Past $2.5, Signaling Renewed Enthusiasm Among Investors; Minotaurus (MTAUR) Presale Contributions Surpass $931K

- Dec 23, 2024 at 06:55 am

- Recent market developments have sent the cryptocurrency XRP soaring past 2.5 USDT, signaling a robust rally and renewed enthusiasm among investors. The impressive performance has propelled XRP's market capitalization beyond 145 billion USDT, solidifying its position as the third-largest digital currency.

-

-

- Rollblock ($RBLK) Continues Its Steady Ascent to Crypto Gaming Dominance as Ripple and Cardano Holders Seek a Piece of the GambleFi Action

- Dec 23, 2024 at 06:55 am

- With the introduction of Rollblock sports betting, all bets are in for this hugely promising community-backed casino with unbelievable 50x potential.

-

-

- Move over XRP: XYZ targets 7,400% gains to steal the spotlight

- Dec 23, 2024 at 06:55 am

- XRP has been making headlines with ambitious price targets, capturing the interest of crypto enthusiasts. Yet, an emerging altcoin boasting an astounding potential return of 7,400% is poised to steal the limelight.