|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Spot ETF Experiences Inflow Surge After Outflow Woes

Mar 27, 2024 at 05:36 am

The approval of the Bitcoin spot ETF sparked initial hype, attracting new users and investments. However, Grayscale's ETF recently experienced significant outflows. Now, Fidelity and BlackRock's ETFs are gaining traction, with BlackRock's IBIT ETF witnessing a substantial intraday volume of $2.62 billion in the past 24 hours.

Bitcoin Spot ETF Draws Inflows After Outflow Surge

The Bitcoin spot exchange-traded fund (ETF) has witnessed a recent inflow of $15.4 million, reversing a significant outflow trend experienced in the past several weeks. The inflows have been driven predominantly by Fidelity's and BlackRock's ETFs.

Over the past 24 hours, BlackRock's iShares Bitcoin Trust (IBIT) registered an intraday volume of $2.62 billion, while Grayscale's Bitcoin Trust (GBTC) and Fidelity's Wise Origin Bitcoin Trust (FBTC) recorded $1.34 billion and $1.26 billion, respectively. Notably, GBTC remains the largest Bitcoin ETF with $27.68 billion in assets under management, followed by IBIT with $15.58 billion.

The total intraday volume for the Bitcoin ETF market currently stands at $6.44 billion, translating to a market capitalization of $76.46 billion. Earlier this week, the ETF category experienced a cumulative outflow of $887.6 million, primarily attributable to GBTC.

The Bitcoin spot ETF has garnered significant attention since its inception in January 2024, with approximately 11 institutions vying for approval. The eventual green light by regulators was a watershed moment in the cryptocurrency market, initially attracting billions of dollars and new users.

Hype Buoys Ether Spot ETF Prospects

While the Bitcoin spot ETF has faced challenges, speculation persists about the potential approval of an Ether spot ETF by May 2024. Market observers anticipate that the ongoing rise in Bitcoin prices may drive inflows into this new ETF category.

Pre-Approval and Post-Approval Price Dynamics

Before the approval of the Bitcoin spot ETF, the Securities and Exchange Commission (SEC) had consistently rejected such applications, including those submitted by Grayscale and Fidelity. However, upon its launch, the ETF spurred a surge in Bitcoin prices, pushing them above $60,000 and eventually reaching an all-time high of over $73,000.

As of the time of writing, Bitcoin trades at $70,760, having gained 5.65% intraday. Market analysts widely attribute this price surge to the introduction of ETFs.

Broader Market Trends

The overall cryptocurrency market capitalization has surged over 5% in the past 24 hours, reaching $2.62 trillion. Ethereum, the second-largest cryptocurrency by market capitalization, has also witnessed an increase of 5.69% over the same period.

Amongst the top gainers over the past seven days, Ondo (ONDO) leads with a surge of 119%. Other notable performers include Internet Computers (ICP) at 72.52%, eCash at 49.70%, Floki (FLOKI) at 45.46%, and Dogecoin (DOGE) at 42.58%.

Disclaimer:

The views and opinions expressed herein are solely for informational purposes and do not constitute financial, investment, or other advice.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Nasdaq ISE Proposes Increasing Position and Exercise Limits for iShares Bitcoin Trust ETF (IBIT) Options

- Jan 09, 2025 at 05:25 pm

- The Nasdaq ISE is an options exchange owned by Nasdaq. This has filed a proposed rule change with the U.S. The Securities and Exchange Commission increased the position and exercise limits for options of the iShares Bitcoin Trust ETF (IBIT) from 25,000 contracts to 250,000.

-

-

- Forget Bitcoin (BTC) and Ethereum (ETH) – Lightchain AI Could Skyrocket Your Crypto Portfolio!

- Jan 09, 2025 at 05:25 pm

- Bitcoin and Ethereum are the heavyweights known for their widespread adoption and market influence. However, emerging projects like Lightchain AI are proving to be lucrative opportunities for investors looking beyond traditional assets.

-

- Bitcoin and Ethereum Consolidate as Altcoins Outperform with Strong Gains

- Jan 09, 2025 at 05:25 pm

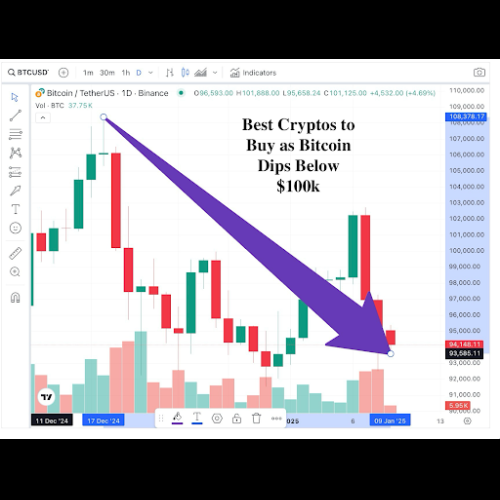

- Bitcoin is holding just below $97,000, while Ethereum has dipped back under $3,400. Despite these minor pullbacks, the first week of January has been largely bullish for the cryptocurrency market, recovering from the fade seen at the end of 2024.

-

- XRP Poised to Surge 40% as Shifting Regulatory Tides in the U.S. and Favorable Price Action Set the Stage

- Jan 09, 2025 at 05:25 pm

- Since hitting highs near $2.9 in early December, payments-focused cryptocurrency XRP has lost steam to carve out what is known as a "descending triangle" pattern in technical analysis.