|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Soars Past $99,000 as Industry Welcomes Incoming Trump Administration's 'Crypto-Friendly' Approach

Nov 22, 2024 at 11:43 pm

Cryptocurrency has been around for a while now. But, chances are, you've heard about it more and more over the last few years.

Bitcoin price today: Cryptocurrency inches closer to $100,000 after record highs, but experts warn of investment risks

Bitcoin price today: Cryptocurrency inches closer to $100,000 after record highs, but experts warn of investment risks

Bitcoin price today, January 13: The cryptocurrency continued its record-breaking streak after inching closer to the $100,000 mark for the first time ever. As of early Friday, BTC was trading at $98,882, according to CoinDesk. The recent surge in interest around bitcoin comes as industry players pin their hopes on the incoming Trump administration to bring a more “crypto-friendly” approach toward regulating the digital currency. Here's a closer look at what's driving the price and what experts are saying about the risks.

Bitcoin price today: A quick recap

After dropping below $17,000 following the collapse of crypto exchange FTX, Bitcoin has now recovered to stand at the doorstep of $100,000 — a remarkable turnaround in just two years. The cryptocurrency has rocketed more than 40 per cent in just two weeks.

What’s driving Bitcoin price?

A lot of the recent action has to do with the outcome of the US presidential election. Crypto industry players have welcomed Trump's victory, in hopes that he would be able to push through legislative and regulatory changes that they've long lobbied for — which, generally speaking, aim for an increased sense of legitimacy without too much red tape. Trump, who was once a crypto sceptic, recently pledged to make the US “the crypto capital of the planet” and create a “strategic reserve” of bitcoin. His campaign accepted donations in cryptocurrency and he courted fans at a bitcoin conference in July. He also launched World Liberty Financial, a new venture with family members to trade cryptocurrencies.

How of this will actually pan out — and whether or not Trump will successfully act quickly on these promises — has yet to be seen. “This is not necessarily a short-term story, it's likely a much longer-term story," Citi macro strategist David Glass told The Associated Press last week. "And there is the question of how quickly can US crypto policy make a serious impact on (wider adoption).”

Adam Morgan McCarthy, a research analyst at Kaiko, thinks the industry is craving “just some sort of clarity”. Much of the approach to regulating crypto in the past has been “enforcement based”, he notes, which has been helpful in weeding out some bad actors — but legislation might fill in other key gaps.

Gary Gensler, who as head of the Securities and Exchange Commission under President Joe Biden has led a US government's crackdown on the crypto industry, penalised a number of crypto companies for violating securities laws. Gensler announced on Thursday that he would step down as SEC chair on January 20, Inauguration Day. Despite crypto's recent excitement around Trump, McCarthy said that 2024 has already been a “hugely consequential year for regulation in the US” — pointing to January's approval of spot bitcoin ETFs, for example, which mark a new way to invest in the asset.

Spot ETFs have been the dominant driver of bitcoin for some time now — but, like much of the crypto's recent momentum, saw record inflows postelection.

According to Kaiko, bitcoin ETFs recorded $6 billion in trade volume for the week of the election alone. In April, bitcoin also saw its fourth “halving” — a preprogrammed event that impacts production by cutting the reward for mining, or the creation of new bitcoin, in half. In theory, if demand remains strong, some analysts say this “supply shock” can also help propel the price long term. Others note it may be too early to tell.

What are the risks?

History shows you can lose money in crypto as quickly as you've made it. Long-term price behaviour relies on larger market conditions. Trading continues at all hours, every day. At the start of the COVID-19 pandemic, bitcoin stood at just over $5,000. Its price climbed to nearly $69,000 by November 2021, during high demand for technology assets, but later crashed during an aggressive series of Federal Reserve rate hikes. And in late 2022 collapse of FTX significantly undermined confidence in crypto overall, with bitcoin falling below $17,000. Investors began returning in large numbers as inflation started to cool — and gains skyrocketed on the anticipation and then early success of spot ETFs. But experts still stress caution, especially for small-pocketed investors. And lighter regulation from the coming Trump administration could mean less guardrails. While its been a big month for crypto — and particularly bitcoin, which McCarthy notes has set record highs for ten of the last 21 days — there's always risk for “

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

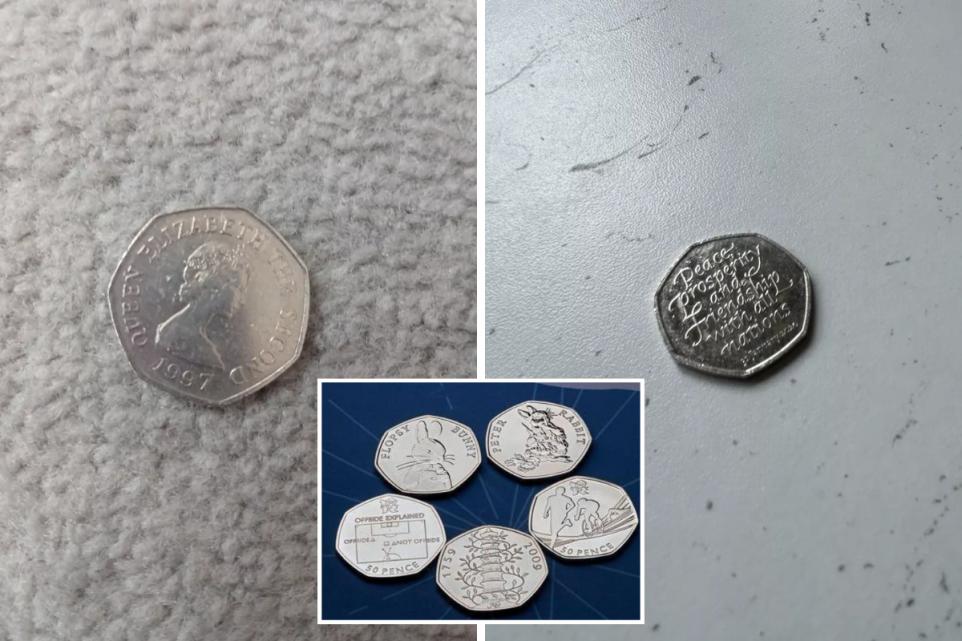

- The Fascinating World of Rare British 50p Coins: From Benjamin Bunny to Kew Gardens

- Nov 23, 2024 at 04:25 am

- The world of coin collecting has seen a surge in interest over the years, with certain rare coins fetching eye-watering prices at auctions and on marketplaces like eBay. Among the most sought-after coins in the UK are 50p pieces, particularly those that feature unique designs or commemorate significant national events.

-

- The King Charles III 50p Coin: A New Era of Collectibles

- Nov 23, 2024 at 04:25 am

- The Royal Mint has released a series of 50p coins featuring the portrait of King Charles III, but one particular coin has quickly surpassed even the iconic Kew Gardens 50p coin in terms of desirability. With the growing interest in coin collecting, it’s now more important than ever to check your change — you may be holding onto a hidden treasure that could be worth much more than its face value.

-

-

-

- XRP (XRP) Keeps Attracting Interest With Its Increasing Price Trajectory as Rexas Finance (RXS) Emerges a Possible Rival

- Nov 23, 2024 at 04:25 am

- XRP has increased 4.34% over the previous 24 hours, raising its market capitalization above $65 billion. With analysts speculating about the likelihood of a major price breakout, this little movement has driven forecasts that XRP might shortly break $1.50. But another growing star in the crypto scene while the globe observes XRP’s every action is Rexas Finance (RXS). A Ripple millionaire sees this coin as a major rival to XRP’s supremacy since he believes it might soar by an amazing 19,900% to $16 in the next 70 days or less.