|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amid the market volatility, Bitcoin (BTC) has been unable to reclaim the $85,000-$86,000 zone despite its weekly performance.

Bitcoin has been unable to rise above the $85,000-$86,000 zone despite its weekly performance, but some analysts suggest that a breakout from the key resistance level might be around the corner.

Bitcoin has been juggling between the $83,000-$86,000 price range as it recovers from the sub-$80,000 correction at the start of the month. The flagship crypto has faced significant volatility due to the ongoing trade tariff war between the US and dozens of countries.

However, the past week saw a recovery as US President Donald Trump paused the tariff on over 75 countries for 90 days, sending BTC’s price back above the $80,000 mark.

This follows a period of testing the key $78,500 as support and its four-month downtrend resistance, compressing Bitcoin between these two levels.

According to market watcher Daan Crypto Trades, Bitcoin has been moving within a significant area, as it was retesting its downtrend line as well as the Daily 200 Exponential Moving Average (EMA) and Moving Average (MA), which “has been a tough price region to crack in recent weeks.”

BTC is finally breaking out of its downtrend, which could lead to a surge toward the “ultimate level to break for the bulls,” the $90,000-$91,000 barrier, as he suggested that the sideways move in the mid-$80,000 region won’t continue for much longer.

Nonetheless, the trader considers that the coming days might not have significant swings due to the Easter weekend, with low volumes and liquidity expected. “Likely going to be quite boring absent any major new headlines,” he asserted, adding that “we’ll see where this wants to go next week.”

The analyst explained that Bitcoin is trapped below the 50-day EMA, which is “what separated us from a bull run resumption.”

Cryptocurrency has been juggling between $78,000-$95,000 since March, with the 50 EMA coinciding with the price range’s mid-zone and seemingly acting as resistance for the past week.

Breaking out of the mid-range, between $85,000-$86,000 levels, could send BTC’s price above the $90,000 mark and toward the range’s high. According to the post, Bitcoin’s current price action resembles May 2021’s performance, before the bull run resumed.

At the time, BTC reclaimed the 50 EMA on the daily chart, which “right now, just as back then, (…) has been the line in the sand between the bull and bear markets.”

The analyst explained that strong spot buying pressure is necessary to break this resistance and resume BTC’s rally. “Should we finally have this spot buying pressure, and should we finally see the EMA 50 Daily being flipped, all you want next is for that liquidity wall at $87K to be properly broken,” he concluded.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Fetch.ai (FET) Token Rallies 30% as the Company Unveils ASI-1 Extended, Its Most Advanced Web3-native LLM to Date

- Apr 22, 2025 at 12:25 am

- Fetch.ai (FET) is making headlines this week with a sharp 30% rally over the past seven days, supported by strong market momentum and the highly anticipated launch of ASI-1 Extended, its most advanced Web3-native large language model (LLM) to date. The token climbed nearly 8% in the last 24 hours alone, with the price now sitting around $0.6511.

-

-

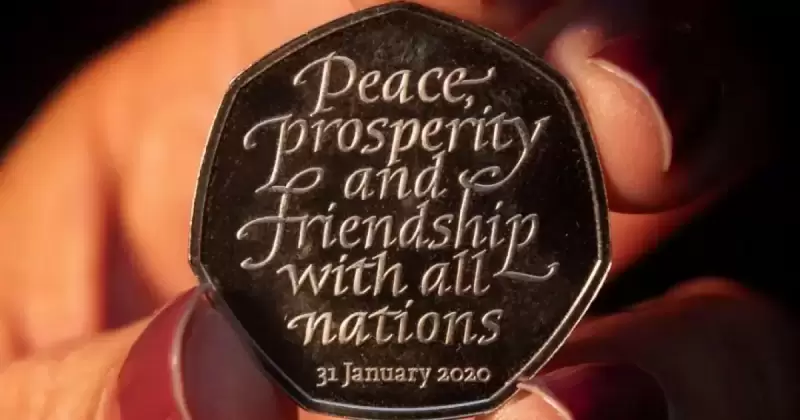

- 2020 Brexit 50p coin sells for £9900 on eBay

- Apr 22, 2025 at 12:20 am

- The silver 50p coin, which was part of a collection first introduced by Sajid Javid in 2020, to mark Britain's departure from the EU, bears the inscription “Peace, prosperity and friendship with all nations” and the date of January 31.

-

- China keeps benchmark loans unchanged in order to block the one-year set to 3.1% and the five-year sentence to 3.6%

- Apr 22, 2025 at 12:15 am

- Input: China kept his benchmark credit rates unchanged on Monday for the sixth month in a row and blocked the one-year loan rate by 3.1% and the five-year sentence at 3.6%.

-

-

-

-