|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Price Shows Slight Uptick of 0.75% to Reach Its Current Trading Value of $87776

Mar 26, 2025 at 01:07 am

On Tuesday, March 25th, the Bitcoin price showed a slight uptick of 0.75% to reach its current trading value of $87,776.

The price of Bitcoin (BTC) showed a slight uptick of 0.75% in the past 24 hours to reach $87,776 at the time of writing. The renewed recovery is now on the verge of testing the resistance trend of the current correction, which could spark a rally to a new all-time high.

The latest on-chain data from Spot On Chain shows that large-scale holders are returning to the BTC market, putting strength behind the recovery.

One billionaire whale was observed to be accumulating BTC at a rapid pace, having already withdrawn 3,238 BTC (worth $284 million) from Binance in the past 17 hours.

The latest batch of BTC was withdrawn yesterday, with an average purchase price of $87.8K per BTC. This marks a renewed buying spree by the whale, who had previously offloaded 12,287 BTC (worth $1.16 billion) at an average price of $94.3K back in February.

The whale began accumulating again about five days ago when Bitcoin was trading near $84.6K, signaling a strategic re-entry into the market after a period of unloading.

Currently, the whale holds 15,986 BTC in total, valued at approximately $1.39 billion.

The recent upswing in Bitcoin price, coinciding with whale accumulation, suggests that the cryptocurrency might be setting the stage for a prolonged uptrend.

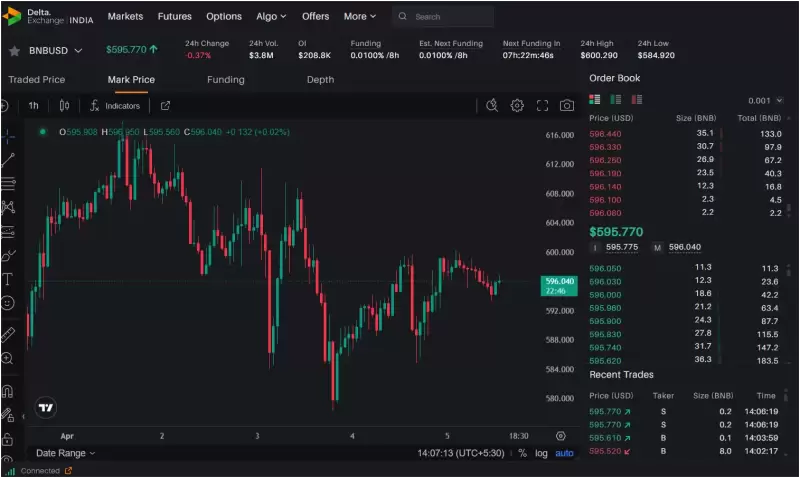

Bitcoin price analysis of daily time frame charts is showing a V-shaped recovery as part of a falling wedge pattern. The chart pattern has two converging trendlines that usually indicate a temporary downtrend ahead of a major breakout.

After trending lower since November 2021, the price of BTC finally bottomed out at $70,400 in late March. Afterwards, the cryptocurrency quickly recovered to challenge the 50-day exponential moving average (EMA) and a downsloping trendline at $86,000.

The coin price has made several attempts to break above this zone of resistance, but each time, sellers stepped in and pushed the cryptocurrency lower. However, the sellers are now encountering difficulties in maintaining control as buyers are applying pressure to push the price higher.

If the price manages to break out and the daily candle manages to close above the 50-day EMA and the downsloping trendline, then it will signal the end of a 60-day correction and set Bitcoin up for a rally above the $109,500 high.

On the other hand, if the price fails to break out and the resistance trendline holds, then it could lead to another reversal and push the price back below the $80,000 level.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- St Thomas of Aquin's High School celebrates after being chosen to receive a £5,000 donation from Tesco.

- Apr 18, 2025 at 08:40 pm

- On Saturday 15th March, Tesco customers at the Edinburgh Nicholson Street Express store were given the chance to take part in a lucky dip to find a golden version of Tesco's famous blue voting token.

-

-

-

- The Graph (GRT) Price Prediction: Can This Cryptocurrency Beat the Odds and Rebound?

- Apr 18, 2025 at 08:35 pm

- The world of cryptocurrency is nothing if not a roller-coaster of hopes and disappointments. Among its many passengers is The Graph (GRT), a token that has excited developers with its unique vision yet confounded investors with its relentless price slump.

-

-

-

-

-