|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Price Predictions: Post-Halving Bullish and Bearish Scenarios

Oct 12, 2024 at 12:03 pm

Since the Bitcoin halving occurred in April 2024, this analysis will focus on how the market is reacting post-halving and what indicators suggest

Bitcoin price movements have been closely followed by traders and investors alike, especially after the recent halving in April 2024. As we enter the second half of the year, let's analyze the technicals and explore the key levels to watch for in the upcoming months.

After the Bitcoin halving event, which occurred in April 2024, let's examine the market's response and analyze the crucial technical indicators that may hint at potential bullish or bearish scenarios for Bitcoin in the short to long term. We'll also explore the key support and resistance levels that could shape BTC's price action in the coming months.

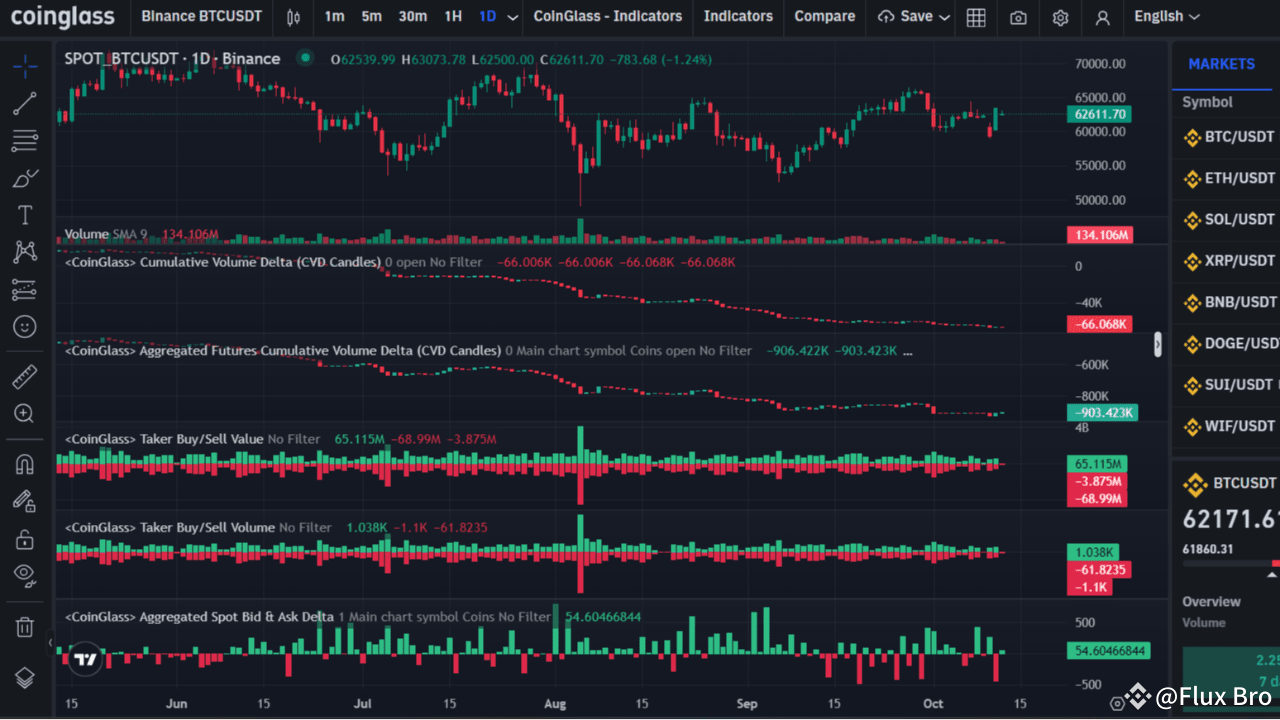

1. Spot Price and Recent Movements:

BTC Price: Currently trading at $61,833.3, showing a slight decrease of 0.1% in the last 24 hours.

Post-Halving Trend: Typically, after a halving, Bitcoin enters an accumulation phase, with price consolidations before any potential explosive moves.

2. Volume (SMA 9):

Volume SMA: At 133.005M, indicating that trading activity is relatively stable post-halving, but a volume breakout could signal a trend shift.

Analysis: A volume breakout is a critical signal of strength or weakness. Increasing volume paired with rising prices often precedes a bullish run.

3. Cumulative Volume Delta (CVD):

Current CVD: -65.398K, suggesting that selling pressure is still dominant.

Analysis: This shows a period of consolidation where sellers dominate, and there could be a potential drop to lower support zones if buying volume doesn't increase soon. However, sharp buying pressure reversals post-halving have been common historically.

4. Aggregated Futures CVD:

Futures Market Insight: With -896.088K in futures CVD, there's a clear indication of sell-side dominance in the futures markets.

Bearish Sign: This metric hints at potential downward price movement, especially if futures traders remain bearish. Historically, futures-driven sell-offs can trigger a short squeeze rally if spot buyers step in strongly.

5. Taker Buy/Sell Volume:

Buy Volume: 64.558M, Sell Volume: 68.406M.

Bearish Short-Term: More sellers than buyers in the spot market indicate bearish pressure, but this could be part of a consolidation phase before a major price movement.

Post-Halving Market Trends:

Historically, Bitcoin halvings lead to supply shocks, as the block rewards get halved. This creates a supply squeeze and typically, prices surge within 6-18 months after the halving event.

Bullish Scenario:

Short-Term Resistance:

$63,200: If BTC breaks this level, it could signal the start of a post-halving rally. A breakout could push BTC toward the next significant resistance at $65,000.

$65,000 - $70,000 Zone: Breaking this region post-halving could trigger a bull market where FOMO (Fear of Missing Out) drives prices higher.

Mid-Term Target:

Historically, Bitcoin sees parabolic gains within 6-12 months after halving events. If BTC sustains momentum and breaks above $70,000, the next major target is $80,000 and possibly towards $100,000 by late 2024 or early 2025.

Bearish Scenario:

Short-Term Support:

$61,000: This is a crucial support level. Breaking below this could lead to a drop to $58,000. If it fails, BTC could retest the $55,000 zone.

$52,000: If macroeconomic conditions turn bearish, and BTC fails to hold $58,000, a deeper correction towards $50,000 - $52,000 is possible, which has historically been a strong accumulation zone.

Mid-Term Bearish Target:

A failure to hold above $55,000 could lead to a longer consolidation phase post-halving, with BTC ranging between $50,000 - $55,000 throughout 2024. This would mirror the 2018 bear market where BTC consolidated post-halving before a major rally.

Key Technical Indicators Post-Halving:

1. RSI (Relative Strength Index):

Current RSI: Neutral at 50-55. This is neither overbought nor oversold territory.

Analysis: RSI above 70 signals an overbought market, so a push towards this level could indicate that BTC may soon correct after a rally. Conversely, RSI dropping to 30

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- Tether Deploys Its Existing and Future Hashrate on OCEAN, a Decentralized Bitcoin Mining Protocol

- Apr 15, 2025 at 04:10 am

- It will focus on delivering high-performance operations to undeveloped areas, particularly in Africa. By deploying hashrate on OCEAN, Tether is working to strengthen Bitcoin's network

-

-

-

-

-

- Retail Access Confirmed for The Smarter Web Company's IPO

- Apr 15, 2025 at 03:50 am

- The Smarter Web Company is offering retail investors in the UK a rare opportunity to participate in its upcoming IPO—providing access to a digital services firm that is also integrating a Bitcoin treasury strategy as part of its long-term financial plan.