|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Mining Network Hashrate Reaches New All-Time High (ATH) of 850 Million Terahashes per Second (TH/s)

Apr 01, 2025 at 09:18 am

Bitcoin mining has been undergoing significant changes as the network's hashrate reached a new all-time high (ATH) of 850 million terahashes per second (TH/s)

March 2025 saw Bitcoin’s hashrate reach a new all-time high (ATH) of 850 million terahashes per second (TH/s). This surge in the network’s computing power, used to validate transactions and secure the blockchain, is significant. A high hashrate makes Bitcoin more secure, harder to attack, and ultimately more valuable.

However, despite the narrative of a booming crypto market in early 2025, Bitcoin miners are now facing difficulties with rising operational costs and tariffs on hardware imports, which could limit the industry’s growth.

Hashrate Surge and Its Implications

Bitcoin’s hashrate determines the speed at which the network can solve complex hashes to validate transactions and add new blocks to the blockchain. As more miners join the network, the hashrate increases, making the network more secure and robust against attempts to disrupt it.

Earlier this year, the hashrate crossed the milestone of 800 million TH/s for the first time, showcasing the significant growth in the network’s computing power. By March 2025, this figure had further risen to 850 million TH/s, highlighting the ongoing influx of miners and their contribution to securing the Bitcoin network.

Thomas Jeegers, CFO & COO of Relai, noted the importance of a high hashrate in deterring attackers. “Each time the network gets stronger, Bitcoin becomes harder to attack, harder to ignore, and more justified in commanding a higher valuation.”

Rising Operational Costs

While a high hashrate is crucial for the health of the Bitcoin network, the increased operational costs are posing challenges for miners, especially in the US. The cost of mining one Bitcoin has doubled since early 2024, now reaching approximately $87,000.

This surge in costs is due to several factors, including higher electricity prices and the rising cost of Application-Specific Integrated Circuits (ASICs), the specialized hardware used in Bitcoin mining. Smaller miners are also at a disadvantage compared to larger firms, which often have access to cheaper electricity and enjoy greater scale advantages in their operations.

As mining becomes less profitable due to rising costs, smaller and less efficient miners may struggle to stay afloat, while larger miners with optimized operations and lower costs are better positioned to withstand the changing economic landscape.

Tariffs on Chinese Hardware

Another challenge for Bitcoin miners is the concentration of hardware production with Chinese mining chip manufacturer Bitmain. As the leading producer of ASIC hardware, Bitmain controls a significant portion of the market share, with estimates ranging from 59% to 76%.

Despite efforts to diversify hardware suppliers, Bitmain’s dominance has raised concerns about potential bottlenecks and supply chain disruptions. In the US, new tariffs on Chinese imports are adding to the operational costs for miners.

Due to stricter customs controls, US-based miners are experiencing delays in receiving Bitmain shipments. Since 2018, the US has imposed duties of up to 27.6% on Chinese mining equipment. These tariffs are part of broader trade tensions between the two superpowers.

Earlier this year, the US Trade Representative's office announced plans to increase tariffs on nearly all Chinese goods in response to China’s alleged economic and trade abuses. This move threatens to escalate trade tensions further and could have a significant impact on various industries.

These tariffs are now a key factor in the total cost of mining one Bitcoin, especially for US-based operations. Smaller miners who rely on cost-effective equipment for optimal profitability may face difficulties if hardware costs continue to rise due to tariffs and other factors.

Moreover, smaller miners typically have less flexibility in switching to different hardware suppliers or adjusting their operations to accommodate changing regulations and tariffs. This lack of adaptability could put them at a disadvantage in the long run.

Strategic Partnerships in the US

Amid these challenges, some US-based companies are forming strategic partnerships to enhance their operations and capitalize on opportunities in the Bitcoin mining sector.

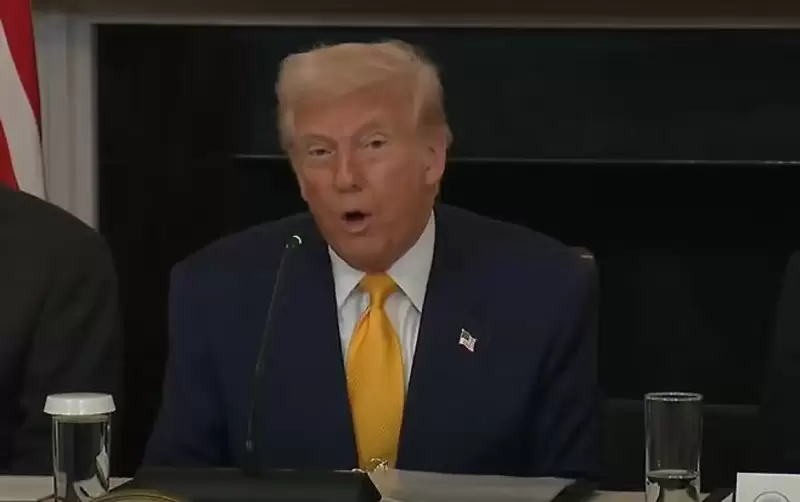

For instance, Hut 8 Corp., a major Bitcoin mining and high-performance computing firm, has partnered with Eric Trump and Donald Trump Jr. to establish American Bitcoin Corp. This venture aims to become the largest and most efficient pure-play Bitcoin mining operation globally.

The partnership brings together Hut 8 Corp.’s advanced technologies and experience in Bitcoin mining with the Trump family's investment acumen and institutional ties. Together, they plan to build a self-reliant Bitcoin mining empire in the US, free from foreign hardware tariffs and regulations.

This initiative is a response to the increasing interest from US institutional investors in the mining sector and the growing need for efficient and self-reliant operations. As more institutions allocate capital to Bitcoin, there is a growing demand for a reliable and productive mining firm.

American Bitcoin Corp. will be fully compliant with US laws and regulations, operating in a transparent manner with a strong focus on corporate governance. This partnership signifies the evolving landscape of the Bitcoin mining

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- OKX Launches Standalone Crypto Wallet App to Expand its Web3 Ecosystem

- Apr 07, 2025 at 01:35 pm

- OKX, the leading crypto exchange that last made headlines for securing the MiCA license and then for the suspension its DEX aggregator, has launched an independent application for its custodial crypto Wallet – OKX Wallet.

-

-

-

- Cryptocurrency OTC Trading Volume Surges Post-US Election, Altcoins Attract New Clients

- Apr 07, 2025 at 01:30 pm

- Several cryptocurrency trading companies have indicated that the results of the U.S. election and the recent rise in cryptocurrency prices have led to a rapid increase in over-the-counter (OTC) trading volume

-

-

-

-

-