|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) Hot Supply Metric Has Dropped Sharply

Mar 22, 2025 at 12:00 am

On-chain data shows the Hot Supply metric has observed a sharp drop for Bitcoin recently. Here's what this could mean for the cryptocurrency.

On-chain data shows that the Hot Supply metric has observed a sharp drop for Bitcoin recently.

Bitcoin (BTC) has seen its "hot supply" decrease significantly in recent months, according to on-chain analytics firm Glassnode.

This portion of the BTC supply is considered its most liquid, with coins part of it last seeing a move within the past week. Hot Supply is an indicator that keeps track of the tokens in circulation.

Hot Supply Drops As Bitcoin Price Drops

According to the firm’s latest report, Hot Supply has seen a triple-digit decline in the past three months. In total, the metric has decreased by more than 50% in the past three months, going from a high of 5.9% to just 2.8%.

"This signals a sharp reduction in liquid BTC available for trade," Glassnode stated. Another indicator that would corroborate this trend is the Exchange Inflow, which measures the total amount of the asset that the investors are transferring to wallets attached with centralized exchanges.

Generally, the holders deposit their tokens to these platforms for selling-related purposes, so the Exchange Inflow can be considered as a gauge for the sell-side activity in the sector.

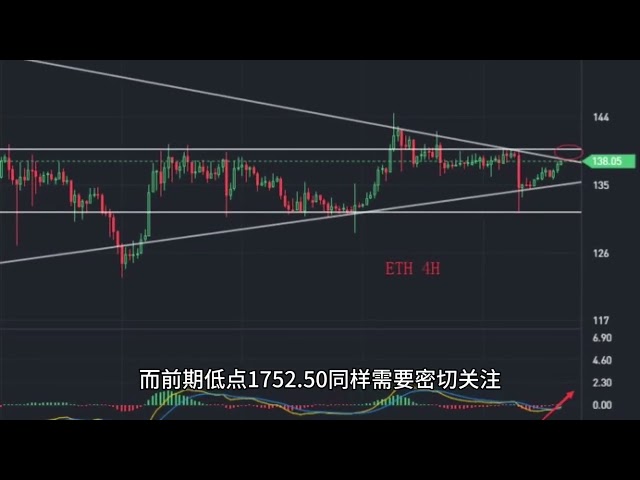

Here is a chart for the Bitcoin Exchange Inflow, which displays how the metric’s value has changed during the last couple of years for the various cohorts:

During the rally, the Bitcoin Exchange Inflow had a value of 58,600 BTC per day, meaning the exchanges were receiving deposits amounting to 58,600 tokens every day. Today, as the market activity has cooled off, the indicator has declined to 26,900 BTC per day. "Lower inflows indicate reduced sell-side activity but also weaker demand," explained the analytics firm.

The spot market isn’t the only one that has seen reduced trading activity, as Glassnode has pointed in another X post that the Futures Open Interest, a measure of the total amount of futures positions related to Bitcoin currently open on exchanges, has also witnessed a notable drawdown since the price all-time high (ATH).

The Bitcoin Futures Open Interest was at $57 billion at the ATH, but now its value has plunged to $37 billion, representing a drop of 35%. "This decline mirrors the contraction seen in on-chain liquidity, pointing to broader risk-off behavior," said the analytics firm.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

![Bitcoin [BTC] Drops by 3% as Hyperliquid Whales Dump Their Holdings Bitcoin [BTC] Drops by 3% as Hyperliquid Whales Dump Their Holdings](/assets/pc/images/moren/280_160.png)

-

-

-

-

- PENGU ETF Promises to Reshape Crypto and Web3 Investing, Bringing Real NFTs to the Public Markets

- Mar 23, 2025 at 12:15 am

- This isn't your typical crypto fund or NFT-themed ETF that plays it safe. No, this is a bold attempt to package real NFTs inside a regulated exchange-traded fund, something that's never been done before.

-

-

![[Bitcoin David] Bitcoin gun is like a dragon and is optimistic about the future trend: wait and see the contract on Saturday and Sunday, and watch the performance! ! ! [Bitcoin David] Bitcoin gun is like a dragon and is optimistic about the future trend: wait and see the contract on Saturday and Sunday, and watch the performance! ! !](/uploads/2025/03/22/cryptocurrencies-news/videos/bitcoin-david-bitcoin-gun-dragon-optimistic-future-trend-wait-contract-saturday-sunday-watch-performance/image-1.jpg)

![Bitcoin [BTC] Drops by 3% as Hyperliquid Whales Dump Their Holdings Bitcoin [BTC] Drops by 3% as Hyperliquid Whales Dump Their Holdings](/uploads/2025/03/22/cryptocurrencies-news/articles/bitcoin-btc-drops-hyperliquid-whales-dump-holdings/img-1_800_480.jpg)