|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Breaks $64K Barrier Despite ETF Outflow Turbulence

Apr 26, 2024 at 03:06 pm

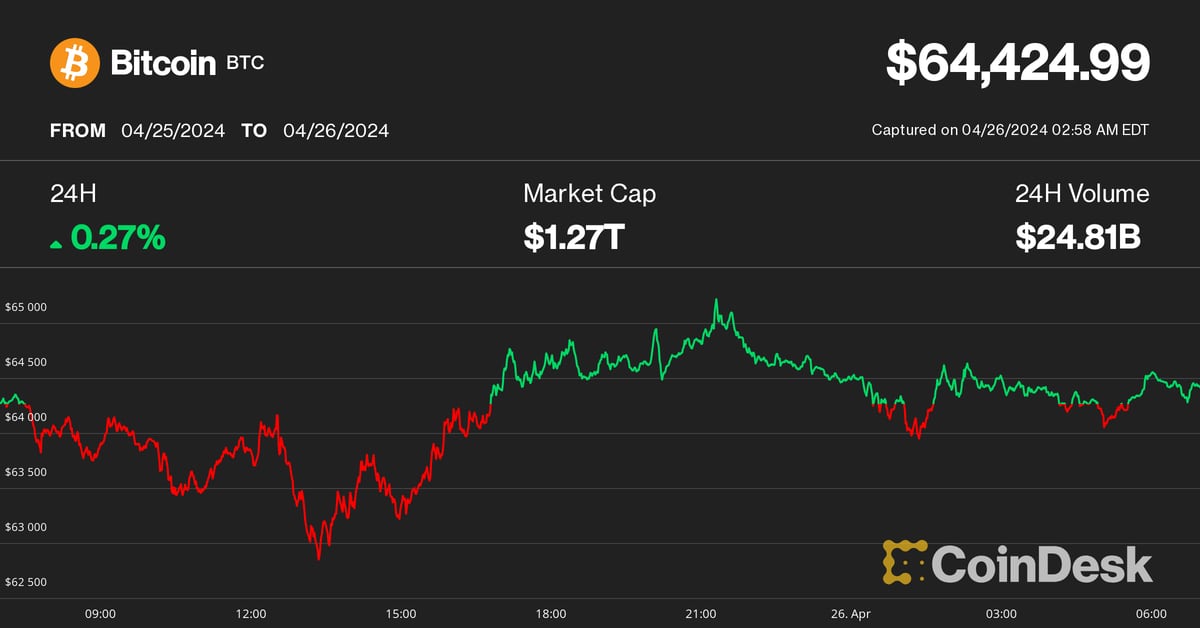

Bitcoin (BTC) remains steady above $64K despite significant outflows from bitcoin exchange-traded funds (ETFs). Outflows from U.S.-listed ETFs reached $217 million in one day, bringing the weekly total to $244.49 million. However, BTC has experienced a 3.7% increase in the past week, indicating a weakening correlation between ETF outflows and BTC's price.

Bitcoin Soars Above $64K, Defying ETF Outflow Headwinds

April 26, 2024, 7:07 AM UTC

In a testament to its resilience, Bitcoin (BTC) has surged beyond the $64,000 mark, defying a significant spike in Exchange-Traded Fund (ETF) outflows.

Data from the U.S. market reveals that Bitcoin ETFs experienced a substantial daily outflow of $217 million, bringing the weekly total to an equally hefty $244.49 million. Despite this exodus, Bitcoin has exhibited remarkable resilience, gaining approximately 3.7% over the past seven days.

The weakening correlation between bitcoin ETF prices and inflows, as observed by JPMorgan, has emerged as a key factor in Bitcoin's ability to thrive amidst ETF outflows. This trend, which has seen the correlation drop from 0.84 in January to 0.60 in recent assessments, indicates a diminished alignment between BTC prices and ETF flows.

Grayscale's flagship Bitcoin ETF (GBTC), given its sheer size, has garnered particular attention. Data from SoSoValue shows that GBTC has witnessed an outflow of $417 million since Monday, yet BTC prices have defied this bearish pressure, continuing their upward trajectory.

Adding to the positive sentiment, liquidation data from GoinGlass reveals a relatively subdued picture, with only $60 million in liquidations over the last 24 hours. Notably, Bitcoin accounted for a mere $13.48 million of this total, with $6.17 million longs being liquidated versus roughly $7 million in shorts.

Meanwhile, the CoinDesk 20 (CD20), a barometer of the top 20 cryptocurrencies, has remained stable, hovering around the 2,246 mark.

This latest surge in Bitcoin's value, coupled with its ability to withstand ETF outflows, underscores its maturing status as a global asset with growing institutional adoption. While ETF flows may provide a momentary snapshot of investor sentiment, Bitcoin's underlying fundamentals, including its limited supply and increasing use as a store of value and medium of exchange, continue to drive its long-term trajectory.

As the cryptocurrency ecosystem evolves, investors are recognizing Bitcoin's unique value proposition, resulting in increased diversification and reduced price volatility. This shift in market dynamics is expected to further bolster Bitcoin's position as a cornerstone of the digital finance landscape.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- DOGE, Fartcoin (FARTCOIN), and Monsta Mash ($MASH) Positioned for Growth in 2025, Recent Onchain Data Reports

- Jan 04, 2025 at 11:05 am

- DOGE recently placed up to 93% of its members in profit. This is because many investors bought Dogecoin during the dip enabling them to harvest more during the surge. It has been rising since recovering from the $0.30 support level. T DOGE is trading at $0.336946, an increase of 1.17% in the last 24 hours.

-

-

- This AI-Powered Real Estate Marketplace Might Be the Solana of Crypto AI Following a 50000% Rally Prediction

- Jan 04, 2025 at 11:05 am

- Artificial intelligence merging with blockchain is believed to be the future of cryptocurrencies. A top Dogecoin trader described AI in cryptocurrency as the perfect synergy

-

-

-

-

- The Virtual Asset Investment Environment is Changing: From the AI Agent Sector to the US IRS DeFi Tax Reporting Mandate

- Jan 04, 2025 at 10:55 am

- In the first week of this year, the virtual asset market slightly rose after the year-end downturn. Bitcoin traded at $97,000, up 1.31% from the previous week