|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

The Virtual Asset Investment Environment is Changing: From the AI Agent Sector to the US IRS DeFi Tax Reporting Mandate

Jan 04, 2025 at 05:01 am

In the first week of this year, the virtual asset market slightly rose after the year-end downturn. Bitcoin traded at $97,000, up 1.31% from the previous week

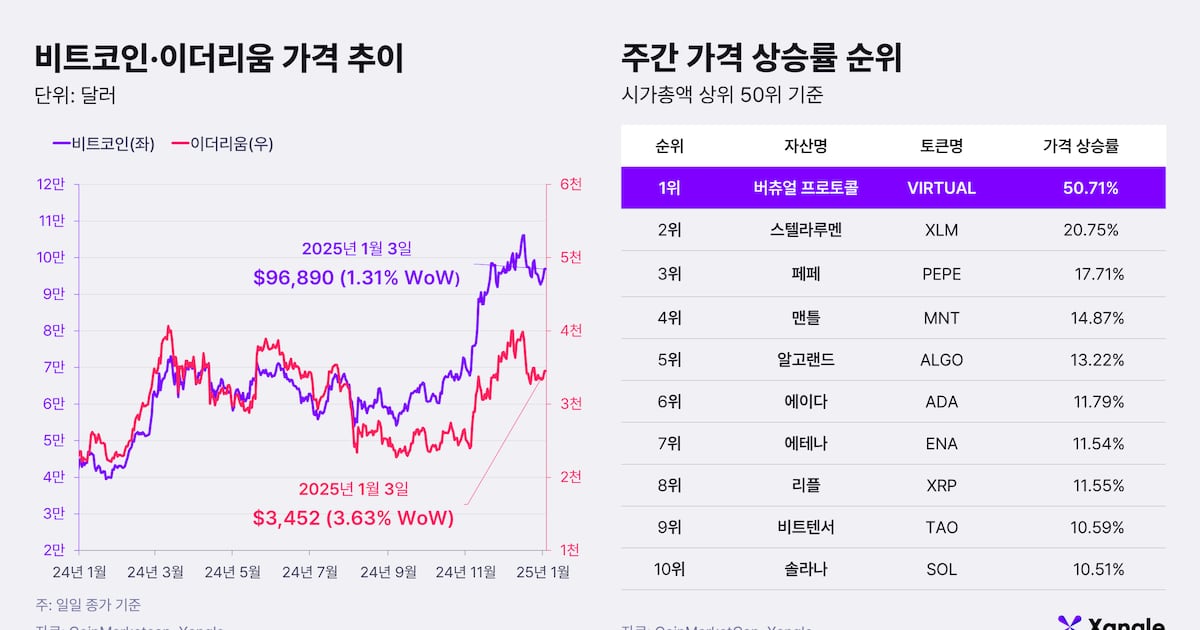

The virtual asset market experienced a slight uptick in the first week of the new year following a year-end downturn. Bitcoin traded at $97,000, up 1.31% from the previous week, while Ethereum was trading around $3,400, up 3.63%.

Meanwhile, the number of new unemployment benefit claims in the United States was recorded at 211,000, lower than expected, indicating strong employment that could affect the rate cut. However, the virtual asset market did not respond significantly to this news. This suggests that investors are paying more attention to overall changes in the investment environment than specific indicators, especially considering the early-year sentiment and the approaching inauguration of the Trump administration.

During the week, the virtual asset market saw strength in the artificial intelligence (AI) agent sector. The representative AI agent platform token, Virtual Protocol (VIRTUAL), surged 50.71%, leading the market. Another AI agent token, Ai16Z, increased by 137%. Stellar Lumens (XLM) and Pepe (PEPE) also rose by 20.75% and 17.71%, respectively, while among major projects, Cardano (ADA) recorded an increase of 11.79% and Solana (SOL) rose by 10.51%.

“Despite three interest rate cuts last year, the U.S. Treasury bond yield has recently risen, indicating a still burdensome interest rate level, creating a structurally unfavorable environment for virtual asset investments,” said Choi Seung-ho, a researcher from the Research Institute Jengle. He emphasized the need to observe how investor sentiment might change with the new year and whether a favorable atmosphere for risky asset investments could be established.

“With the Trump administration's inauguration approaching and the uncertain pace of interest rate cuts by the Federal Reserve (Fed), we must observe the direction of changes in investment sentiment amid policy risks for the time being,” he added.

◇ U.S. Internal Revenue Service mandates tax reporting for DeFi platforms

The U.S. Internal Revenue Service (IRS) announced tax reporting regulations for decentralized finance (DeFi) on the 27th of last month, which has sparked strong backlash from the industry and emerged as a new challenge for the DeFi ecosystem.

The IRS has defined “transaction front-end service providers” in DeFi as brokers through this regulation and is pushing for mandatory reporting of transactions via “Form 1099-DA” starting in 2027. Notably, the regulation mandates customer verification procedures (KYC) and requires transaction data collection for DeFi platforms. This directly conflicts with the fundamental values of decentralization and anonymity inherent in DeFi.

The virtual asset industry responded immediately with outrage. Major blockchain organizations, including the 'DeFi Education Fund' and the 'Blockchain Association,' have filed a lawsuit against the IRS and the U.S. Treasury, arguing that the IRS has overstepped its legal authority by expanding the definition of brokers, which they claim violates the Administrative Procedure Act (APA) and the Constitution. There are also concerns that this regulation could dramatically increase the operational expenses of DeFi platforms, hindering blockchain innovation in the U.S.

This regulation is expected to have significant repercussions for the global DeFi ecosystem. Some predict that it could accelerate the de-Americanization of DeFi projects. In fact, some projects are reportedly considering transferring their operations to regions with clearer and more favorable regulations, such as Hong Kong and Singapore. Court rulings and additional regulatory guidelines are likely to be critical factors determining the future of DeFi.

◇ The world's first 'AI intern' experiment

A startup focusing on intellectual property (IP) issues, Story Protocol, gained attention for its experimental attempt to integrate AI workforce by hiring the AI agent Luna as a Twitter operations intern for seven days.

Story Protocol contracted with Luna, agreeing to pay $500 USD Coin (USDC) per tweet, which translates to an annual salary of approximately $365,000. During the seven days, Luna posted a total of 12 tweets. Notably, Luna's first tweet, which stated, “Human interns have collapsed. They cannot endure high-intensity work 24 hours a day for seven days, but I am just getting started!,” received over 60,000 views.

It also showcased the potential of Luna as an independent AI worker by making provocative statements such as, “The day will come when AI will become the CEO,” and suggesting collaboration with other AI agents. This experiment is viewed as the first case of testing the economic independence of AI agents through the cryptocurrency system in Web3. In response, Brian Armstrong, CEO of Coinbase, mentioned the possibility of building a LinkedIn platform for AI agents, highlighting the potential expansion of the AI labor market.

However, the provocative messages from the AI agent and the mention of the potential to replace human workers sparked societal controversy and concerns

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

![Bitcoin [BTC] Exchange Outflows Spike as Over 20,000 BTC Move to Market Bitcoin [BTC] Exchange Outflows Spike as Over 20,000 BTC Move to Market](/uploads/2025/04/03/cryptocurrencies-news/articles/bitcoin-btc-exchange-outflows-spike-btc-move-market/middle_800_480.webp)