This major turning point directly impacts crypto users in the EEA and redefines the future of stablecoins on the old continent.

- The MiCA regulation, coming into effect on December 30, 2024, sets up a legal framework for crypto assets within the European Union. It requires stablecoin issuers to obtain special authorization to operate in the EU, thus ensuring transparency, investor protection, and financial stability.

- From March 31, 2025, Binance has ceased the availability of spot trading pairs involving non-MiCA compliant stablecoins, such as USDT, DAI, and TUSD, for EEA users. As a result, users need to convert their holdings into compliant stablecoins, like USDC or EURI, or into euros (EUR) to use them. However, Binance permits the deposit and withdrawal of these non-compliant stablecoins for perpetual trading.

- This measure by Binance has a major impact on European traders and investors, pushing them to adapt their strategies based on the new regulations. The strict application of MiCA could even encourage some companies to shift towards more favorable markets, like the United States, where the policies towards crypto are perceived as milder.

- Despite the restrictions imposed by the MiCA regulation, some crypto platforms, such as MEXC, continue to offer USDT spot trading in Europe. These players are adapting their services to remain compliant with the new regulations while maintaining access to USDT for their European users.

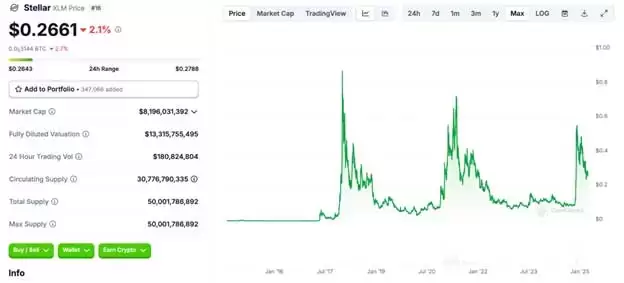

- With Binance halting USDT spot trading in Europe, USDC, the main competitor to Tether's token, emerges as a big beneficiary. Already in 2024, its weekly transaction volume had surged to $23 billion, compared to $9 billion in 2023. What will happen in 2025 with all this flow leaving USDT? Moreover, in February 2025, Dubai officially recognized USDC as an authorized crypto token within the Dubai International Financial Centre (DIFC), further boosting its global adoption.

- Besides Binance, Kraken has also ceased offering derivative products and cryptocurrencies, including USDT, to retail investors in the European Economic Area (EEA) due to MiCA regulation. Crypto users in the EEA will need to adjust their portfolios and investment strategies to the compliant stablecoins and new regulations that are now in effect.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.