|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bank of Korea Intends to Actively Participate in Shaping the Government's Regulations on Crypto Usage

Apr 21, 2025 at 10:11 pm

The Bank of Korea has announced its intention to take a proactive role in shaping the government's regulations on crypto usage in the country.

The Bank of Korea is planning to actively provide input to the government on its regulations for crypto usage in the country, according to a new report by CCNewsWire.

As reported on Thursday, August 24, the central bank’s involvement in advising the government on crypto regulations comes in response to the South Korea Financial Services Commission announcing its intention to begin drafting the second crypto law later this year.

The report, titled “2024 Payment and Settlement Report,” focused on payment trends and analysis in Korea’s payment sector for 2024, as well as the Bank of Korea’s supervisory activities and potential policies.

During this role, the central bank determined that its input would be useful in mitigating potential monetary and financial risks associated with stablecoins. The Bank of Korea highlighted in its report that a strong regulatory framework is important for stablecoins, as they can be used as a means of payment, unlike other digital assets.

“In the case of stablecoins being used as a means of payment, it is necessary to consider the implications for monetary policy and financial stability in more depth than for other types of crypto assets,” the central bank noted.

The institution pointed out that if stablecoins become a means of payment in Korea, it could negatively affect monetary policies due to the stablecoins being linked to foreign currencies.

Moreover, the national bank noted that despite their name, stablecoins are not completely immune to volatility, which could introduce crypto-related risks to South Korea’s financial ecosystem.

The report arrives after South Korea passed a law in July to regulate cryptocurrency usage, introducing tighter rules for crypto exchanges and the government deciding to build a complementary legal framework for stablecoins.

The move will provide clearer guidelines on token listings and address gaps in existing regulations, CCNewsWire noted.

The country’s financial authorities are also planning to impose sanctions on overseas crypto exchanges operating without proper licenses.

Following Trump’s presidency and other significant global shifts, South Korea has become increasingly involved in crypto regulations, making it a key player to watch in the crypto space.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Fetch.ai (FET) Token Rallies 30% as the Company Unveils ASI-1 Extended, Its Most Advanced Web3-native LLM to Date

- Apr 22, 2025 at 12:25 am

- Fetch.ai (FET) is making headlines this week with a sharp 30% rally over the past seven days, supported by strong market momentum and the highly anticipated launch of ASI-1 Extended, its most advanced Web3-native large language model (LLM) to date. The token climbed nearly 8% in the last 24 hours alone, with the price now sitting around $0.6511.

-

-

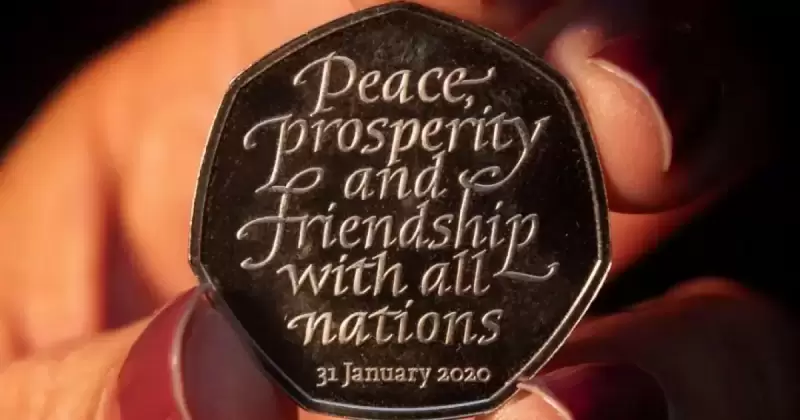

- 2020 Brexit 50p coin sells for £9900 on eBay

- Apr 22, 2025 at 12:20 am

- The silver 50p coin, which was part of a collection first introduced by Sajid Javid in 2020, to mark Britain's departure from the EU, bears the inscription “Peace, prosperity and friendship with all nations” and the date of January 31.

-

- China keeps benchmark loans unchanged in order to block the one-year set to 3.1% and the five-year sentence to 3.6%

- Apr 22, 2025 at 12:15 am

- Input: China kept his benchmark credit rates unchanged on Monday for the sixth month in a row and blocked the one-year loan rate by 3.1% and the five-year sentence at 3.6%.

-

-

-

-