|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Aurora Price Analysis: Temporary Weakness Belies Long-Term Bullish Outlook

Mar 29, 2024 at 11:46 pm

Aurora's price analysis suggests a bullish outlook despite recent weakness, with a decline of 6.10% over the past week. However, the crypto has experienced significant growth of 33.68% in the last month and 27.06% in the past 3 months. Aurora serves as a bridge for Ethereum users and decentralized applications, facilitating their transition to the NEAR blockchain, providing deployment and management of smart contracts and asset transfer across multiple chains.

Aurora Price Analysis: A Comprehensive Evaluation of Near-Term Weakness and Long-Term Outlook

Aurora, a platform bridging the gap between Ethereum and decentralized applications, has witnessed a period of relative weakness in its price trajectory. At press time, the crypto is encountering resistance near the value of $0.672, drifting towards the lower dynamic support level at approximately $0.349.

Overview of Aurora's Functionality and Tokenization

Aurora's core purpose is to facilitate the seamless transition of Ethereum users and applications to the NEAR blockchain. It offers two critical functionalities:

- Deployment and Management of Smart Contracts: Aurora enables developers to deploy and manage Solidity smart contracts within the NEAR ecosystem, leveraging a familiar toolset.

- Asset Transfer Across Multiple Chains: The platform facilitates the seamless transfer of assets, including ERC-20 tokens, across Ethereum, NEAR, and Aurora through the utilization of the Rainbow Bridge.

Aurora's foundational token is ETH, which serves to optimize user experience and provide developers with a comfortable working environment. The AURORA token, on the other hand, plays a crucial role in governance, ensuring the protocol's appropriate evolution. The AuroraDAO, comprising members from diverse segments of the blockchain industry, is responsible for the platform's governance structure.

Technical Analysis: Evaluating Recent Weakness and Long-Term Momentum

Aurora's price has recently exhibited weakness, halting near the $0.672 mark and gravitating towards the 50 EMA support level. Despite this temporary setback, the crypto's overall performance throughout the year has been positive.

- Over a week, Aurora's price has decreased by approximately 6.10%.

- The coin has grown by nearly 33.68% in a month.

- In the last 3 months, it has increased by 27.06%.

- Over the last 6 months, Aurora has provided an impressive return of 670.00%.

- Year-to-date, it has grown by 43.66%.

Despite the current weakness, analysts remain generally bullish on Aurora's long-term prospects, suggesting that the crypto price could attain higher levels in upcoming trading sessions.

Volume and Social Sentiment Analysis: Assessing Market Dynamics

Examination of the price and volume graph reveals a gradual decline in trading volume from mid-month, corresponding with the price drop. A sustained decline in trading volume could lead to further price depreciation.

The graph of social dominance, which gauges the level of interaction surrounding a crypto on social media platforms like Twitter, Instagram, and Telegram, has also been decreasing in recent months. This decline may have contributed to the negative price impact. An increase in social engagement could potentially reverse this trend and positively influence the price.

Conclusion: Long-Term Bullish Outlook Despite Near-Term Volatility

Aurora's price analysis indicates a bullish long-term outlook, with the expectation that the current weakness is temporary and the bullish momentum will continue. The crypto remains within the control of buyers, increasing the likelihood of reaching higher levels despite the mild correction.

Disclaimer:

It is crucial to emphasize that the views and opinions expressed in this report are solely for informational purposes and should not be construed as financial, investment, or other advice. Investing in or trading stocks involves inherent risks, and it is imperative to conduct thorough research before making any financial decisions.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

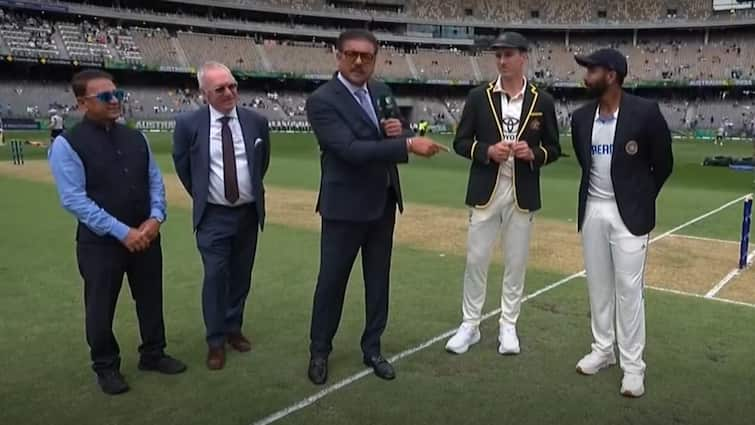

- Border-Gavaskar Trophy 2024-25: India are batting first in the first Test match of the Border-Gavaskar Trophy 2024-25 series at Optus Stadium in Perth after Jasprit Bumrah won the coin toss, and there are some fesh faces to be seen in action today.

- Nov 22, 2024 at 02:30 pm

- The reigning BGT champions have handed debuts to all-rounder Nitish Kumar Reddy and pacer Harshit Rana, and Devdutt Paddikal comes in place of injured Shubman Gill.

-

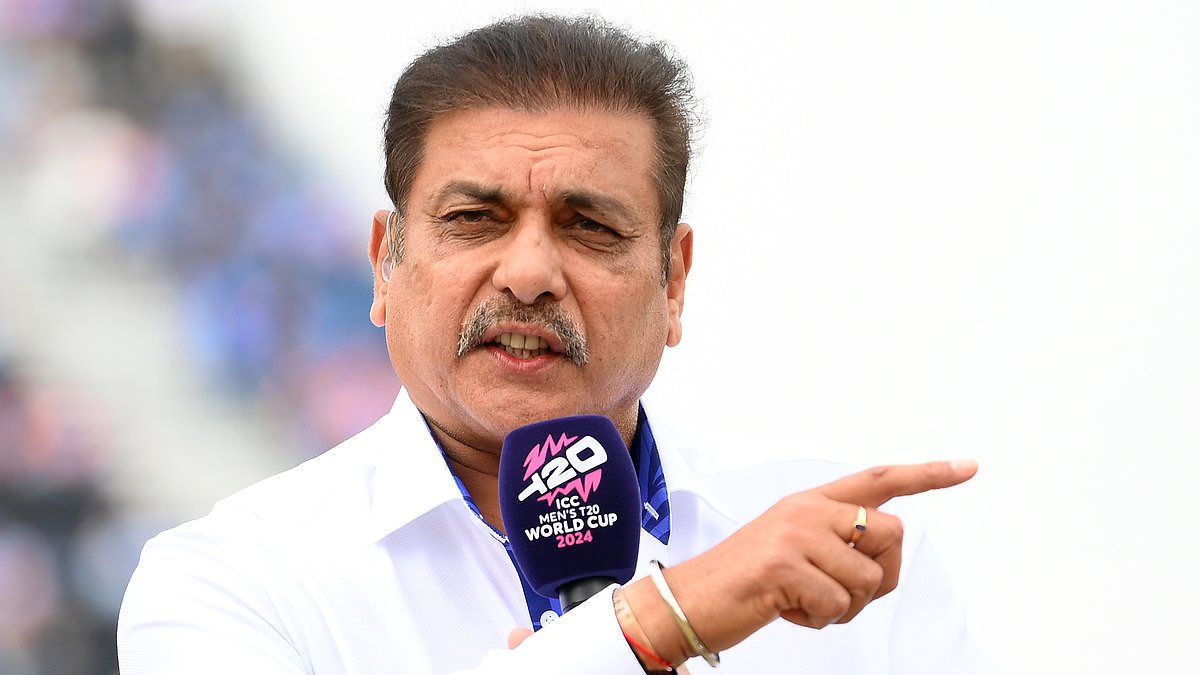

- Ravi Shastri steals the show with over-the-top theatrics at the toss that has cricket fans in splits

- Nov 22, 2024 at 02:30 pm

- The highly anticipated Test series between India and Australia got off to an incredible start before a ball had even been bowled on Friday courtesy of a head-turning performance by the legendary Ravi Shastri.

-

-