|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Aave and Maker Put Feud Behind Them With New DeFi Integrations and a StarCraft Tournament

Sep 27, 2024 at 03:58 pm

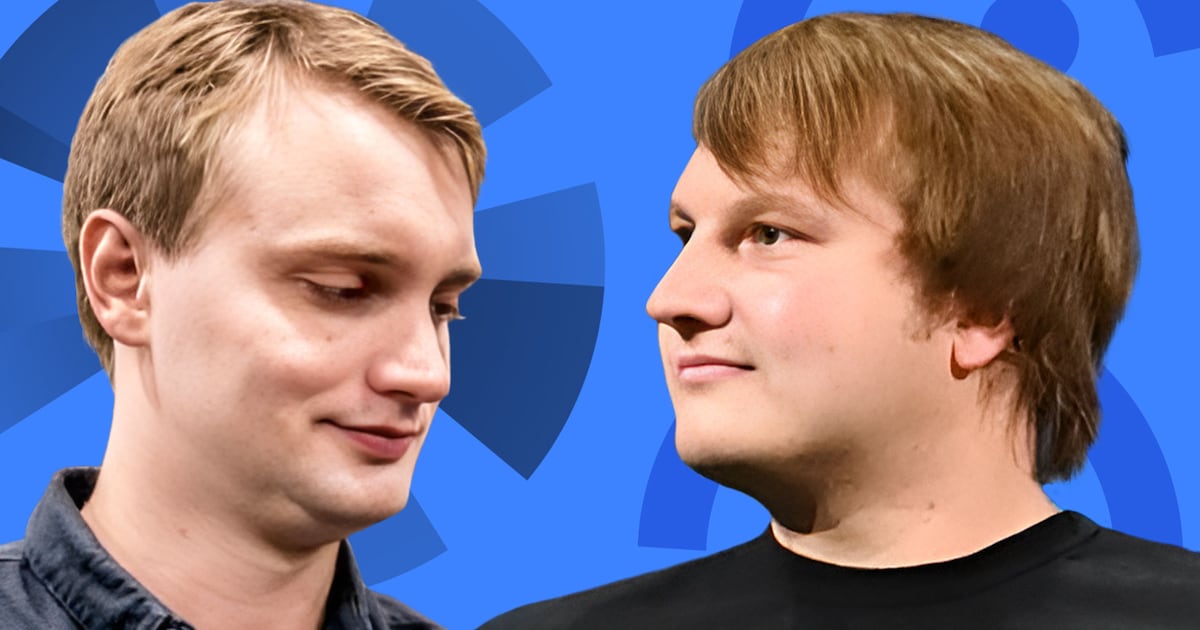

Stani Kulechov, the founder of Aave, and Rune Christensen, the co-founder of Maker and its decentralised stablecoin DAI, haven't always seen eye to eye.

Amid the buzz of a crypto conference in South Korea, the founders behind two influential DeFi protocols, Aave and Maker, took a break for something a bit different: a live Starcraft II tournament.

Rune Christensen, co-founder of Maker and its decentralized stablecoin DAI, and Stani Kulechov, founder of Aave, haven't always seen eye to eye. But as the Starcraft tournament unfolded, the two crypto OGs bonded over their shared love of gaming.

“Stani is my bro,” Christensen told DL News on the sidelines of this year’s Token2049 event in Singapore.

“We’re DeFi bros,” said Stani in a separate interview.

Some context:

The Aave and Maker communities have clashed over several heated issues.

In April, Maker faced criticism for its risky proposal to acquire $1 billion of Ethena's untested stablecoin. Later, in July, the Aave community alleged that Maker was not fulfilling its obligations in a revenue-sharing agreement between the two protocols.

At one point, Kulechov even supported a proposal to remove DAI from all Aave markets, a drastic move considering the stablecoin's importance in the lender's operations.

However, tensions eased after Aave reduced the amount of DAI that users could borrow, and the two protocols eventually found common ground on the revenue-sharing agreement.

Now, both projects are evolving at a crucial juncture in decentralized finance.

Under the newly launched Avara umbrella, Aave has transformed into a DeFi supermarket, offering loans, a stablecoin, a crypto wallet and a social media network.

And Maker, now known as Sky, is introducing a brand new stablecoin. These moves highlight how both projects have emerged from the crypto crackup of 2022 with resilience and a plan.

While many DeFi projects have floundered amid rug pulls, hacks, and obsolescence, Aave and Maker, er, Sky, have quietly built up businesses that generate something rare in the space — revenue.

In the last year, Aave recorded $283 million on its top line, and Sky has notched a cool $233 million itself, according to DefiLlama.

So what better time for Kulechov and Christensen to clear the air?

“We have this DeFi renaissance moment where people are looking back at what’s been built in DeFi and what actually has legs and fundamentals,” said Kulechov.

“That’s Aave, and that’s Sky.”

A deeper dive into Aave and Maker:

Born out of the heady days of heavy coin creation in 2017, Aave and Maker both made lasting breakthroughs while many crypto players indulged in the explosion of ICOs.

Sky, then called Maker, launched the industry’s first decentralized stablecoin, DAI.

Aave, then called EthLend, enabled investors to lend and borrow their cryptocurrencies.

One brought dollars on the blockchain, the other simple banking.

And from the outset, the two operated in complementary but distinct ways. One of Aave’s very first lending markets was for the DAI stablecoin.

The duo played critical roles during the DeFi summer in 2020, a period which saw the niche soak up almost $180 billion in investors’ money.

They stayed afloat as summer turned to an icy crypto winter in 2022, and more than 77% of that money fled the DeFi space.

But the partnership between Sky and Aave began cooling the following year.

In May 2023, Sky launched its own lending and borrowing product called Spark Protocol. It even used code from Aave as part of a revenue-sharing agreement both protocols agreed to.

Spark aimed to boost DAI adoption by creating incentives that couldn’t be found elsewhere in the market.

Two months later, Aave struck back.

It launched its very own decentralised stablecoin called GHO in July 2023. Like DAI, GHO was an overcollateralised cryptocurrency pegged to the US dollar.

Suddenly, Sky and Aave were no longer operating in parallel to one another but colliding.

When the Maker community proposed backing $1 billion in DAI with the untested, high-yield stablecoin by Ethena, the Aave community proposed eradicating all DAI markets.

“The offboarding process should start immediately in case of a favorable outcome,” Kulechov wrote at the time.

After an analysis from Chaos Labs outlined the risk and proposed less drastic measures, Aave ultimately kept DAI, and there are still hundreds of millions of DAI sloshing around Aave today.

“It’s about sending a message to the broader space,” said Christensen. “Sky and Aave can figure out how to work together.”

The budding bromance extends beyond the two founders. Aave and Sky announced

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Valour Launches the Market's First Dogecoin (DOGE) Exchange-Traded Product (ETP)

- Nov 28, 2024 at 06:20 am

- Valour, a subsidiary of fintech company DeFi Technologies (DEFTF), has launched the market's first Dogecoin (DOGE-USD) exchange-traded product (ETP), which will trade on Sweden's Spotlight Stock Market.

-

-

- QUANTUM: A Quantum-Safe and AI-Compliant Decentralized Blockchain Solution for the Financial Industry

- Nov 28, 2024 at 06:20 am

- QUANTUM is designed to overhaul the financial transaction systems by replacing outdated, centralized methods with a quantum-safe and AI-compliant decentralized blockchain solution that offers enhanced security and efficiency.

-

-

-

- Ethereum (ETH) Rallies 9%, SUI Surges 12.9% as Cryptocurrency Market Heats Up

- Nov 28, 2024 at 06:20 am

- In the fast-paced world of cryptocurrency, Ethereum (ETH) is making waves with a remarkable 9% rally on Wednesday. This surge is largely attributed to significant capital inflows into ETH Exchange-Traded Funds (ETFs), alongside noticeable increases in open interest and futures premiums.

-

-