|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密市场近期出现大幅资金流出,上周全球数字资产投资产品净流出5亿美元。这些资金流出主要来自灰度转换的现货比特币交易所交易基金(GBTC),尽管其影响随着本周每日资金流出量的逐渐减少而逐渐减弱。

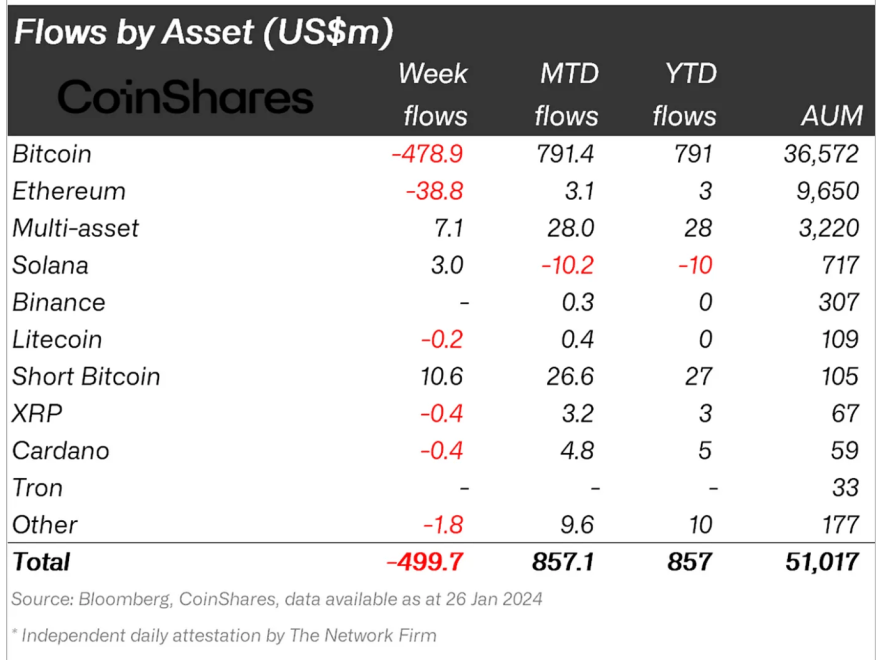

The crypto market, particularly Bitcoin, has recently experienced significant outflows. According to a recent report from CoinShares, digital asset investment products worldwide saw net outflows of $500 million last week.

加密货币市场,尤其是比特币,最近经历了大幅资金外流。根据 CoinShares 最近的一份报告,上周全球数字资产投资产品净流出 5 亿美元。

These outflows predominantly stemmed from Grayscale’s converted spot Bitcoin exchange-traded fund (GBTC), though its impact seems to be diminishing with daily outflows reducing progressively throughout the week. James Butterfill, Head of Research at CoinShares, highlights this trend, noting a decrease in the intensity of outflows.

这些资金流出主要来自灰度转换的现货比特币交易所交易基金(GBTC),尽管随着本周每日资金流出量逐渐减少,其影响似乎正在减弱。 CoinShares 研究主管 James Butterfill 强调了这一趋势,并指出资金外流强度有所下降。

While Grayscale’s GBTC experienced a decrease in outflows, there has been a surge in capital moving into the newly established spot Bitcoin ETFs. Last week, these spot ETFs collectively attracted $1.8 billion in fresh capital, with BlackRock’s IBIT and Fidelity’s FBTC at the forefront, securing $744.7 million and $643.2 million, respectively.

尽管 Grayscale 的 GBTC 流出量有所减少,但流入新成立的现货比特币 ETF 的资金却激增。上周,这些现货 ETF 总共吸引了 18 亿美元的新资本,其中贝莱德的 IBIT 和富达的 FBTC 名列前茅,分别吸引了 7.447 亿美元和 6.432 亿美元。

相关阅读:谷歌关注比特币 ETF——从今天开始,广告会引发加密货币的热度吗?

Since their debut on January 11, these fresh market entrants have amassed $5.8 billion in total inflows. This influx has effectively balanced out the $5 billion that flowed out of GBTC, culminating in a net positive inflow of $759.4 million into the crypto market funds.

自 1 月 11 日首次亮相以来,这些新的市场进入者已累计流入 58 亿美元。这一资金流入有效地平衡了 GBTC 流出的 50 亿美元,最终导致加密货币市场基金净流入 7.594 亿美元。

Global Outflows And Bitcoin’s Market Resilience

全球资金外流和比特币的市场弹性

The impact of these outflows extends beyond Grayscale, with other altcoin-based funds also registering net outflows. Ethereum investment products, for instance, saw $39 million left, with smaller amounts also exiting Polkadot and Chainlink funds.

这些资金流出的影响不仅限于灰度,其他基于山寨币的基金也出现了净流出。例如,以太坊投资产品剩余 3900 万美元,还有少量资金退出 Polkadot 和 Chainlink 基金。

Solana was an exception in this trend, which witnessed inflows worth $3 million. Interestingly, blockchain equities continued to attract investments, with an additional $17 million inflow last week.

Solana 是这一趋势中的一个例外,流入金额达 300 万美元。有趣的是,区块链股票继续吸引投资,上周新增资金流入 1700 万美元。

加密资产流动。 |来源:Coinshares

The regional analysis further sheds light on these market movements. US-based funds experienced the most significant net outflows, totaling $409 million, while Switzerland and Germany saw outflows of $60 million and $32 million, respectively.

区域分析进一步揭示了这些市场走势。美国基金的净流出最为显着,总计 4.09 亿美元,而瑞士和德国的基金分别流出 6,000 万美元和 3,200 万美元。

Brazil emerged as a notable exception, registering $10.3 million. Butterfill suggests that these outflows, particularly in the US, were likely prompted by the substantial outflows from Grayscale, totaling $5 billion, contributing to broader market uncertainties.

巴西是一个显着的例外,录得 1,030 万美元。 Butterfill 表示,这些资金外流,尤其是在美国,很可能是由 Grayscale 的巨额资金外流(总计 50 亿美元)造成的,从而导致了更广泛的市场不确定性。

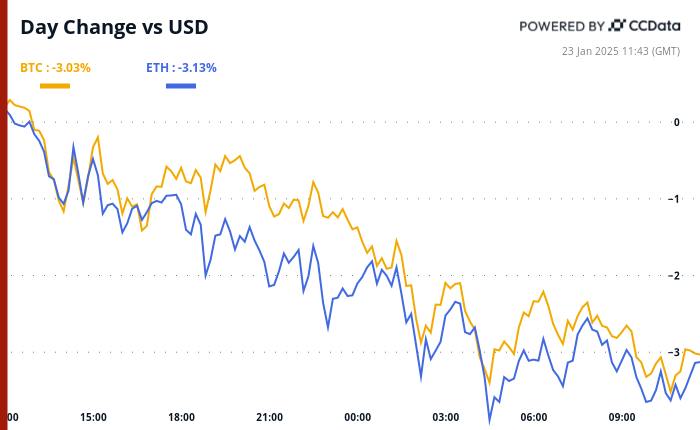

Despite these market dynamics, Bitcoin has shown slight signs of recovery, regaining 3.4% of its value in the past 7 days after a recent dip below $39,000. Bitcoin trades above this mark at $42,074, though it has seen a modest 0.7% decrease over the past day.

尽管存在这些市场动态,比特币仍显示出轻微复苏的迹象,在最近跌破 39,000 美元后,过去 7 天恢复了 3.4% 的价值。比特币交易价格高于这一水平,价格为 42,074 美元,尽管过去一天小幅下跌了 0.7%。

BTC 价格在 1 小时图上横盘整理。资料来源:TradingView.com 上的 BTC/USDT

Historical Patterns And Future Outlook For Bitcoin

比特币的历史模式和未来展望

Analysts and investors closely monitor patterns and indicators for future trends as the market navigates through these shifts. Crypto analyst Jelle has highlighted an interesting historical pattern in Bitcoin’s performance.

随着市场经历这些转变,分析师和投资者密切关注未来趋势的模式和指标。加密货币分析师 Jelle 强调了比特币表现中一个有趣的历史模式。

The analyst notes that February has historically been a bullish month for Bitcoin, particularly following a bearish January and a positive performance in the last four months of the previous year.

该分析师指出,从历史上看,二月一直是比特币看涨的月份,特别是在一月份的看跌和上一年最后四个月的积极表现之后。

相关阅读:中国基金巨头在香港提交首只现货比特币ETF

Jelle backs this up with Coinglass data, which supports this observation, showing that in 2015 and 2016, when Bitcoin closed the last four months of the year in the green, it followed up with a bearish January and a bullish February.

Jelle 用 Coinglass 数据支持了这一观点,该数据显示,在 2015 年和 2016 年,当比特币在一年中的最后四个月以绿色收盘时,随后出现了看跌的 1 月和看涨的 2 月。

Looks like #Bitcoin continues the pattern we’ve been monitoring since September.

看起来 #Bitcoin 延续了我们自 9 月份以来一直在监控的模式。

4 months in the green, one in the red.

4 个月为绿色,1 个月为红色。

If history keeps repeating, February should be strong. pic.twitter.com/fWbXw4rlvK

如果历史不断重演,二月应该会很强劲。 pic.twitter.com/fWbXw4rlvK

— Jelle (@CryptoJelleNL) January 23, 2024

— Jelle (@CryptoJelleNL) 2024 年 1 月 23 日

Given this pattern, Jelle anticipates that February could again be a positive month for Bitcoin, potentially bringing significant gains.

鉴于这种模式,Jelle 预计二月可能再次成为比特币积极的月份,可能带来显着的收益。

.Featured image from Unsplash, Chart from TradingView

.精选图片来自 Unsplash,图表来自 TradingView

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- 比特币价格即将创下历史新高,狗狗币(DOGE)暴跌

- 2025-01-23 21:15:43

- 随着 BTC 代币飙升至 104,050 美元水平,比特币价格获得看涨支撑。专家称现货比特币ETF获批是重大举措

-

- RCO Finance:提供最先进交易工具的全自动无代码平台

- 2025-01-23 21:15:43

- RCO Finance 平台是一个完全自动化的无代码平台,为每个人(从初学者到金融专家)提供最先进的交易机会

-

-

-

-

- 2025 年 2 月 6 个最值得关注的新 ICO

- 2025-01-23 21:05:43

- 由于美国比特币储备可能会在特朗普就职后出现,加密货币似乎将在 2025 年第一季度出现新的反弹。

-

- CME 否认有关 XRP 和 SOL 期货上市的报道后,比特币和主要加密货币走弱

- 2025-01-23 21:05:43

- 尽管比特币持续在 10 万美元以上波动,但零售需求仍然强劲。

-