|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

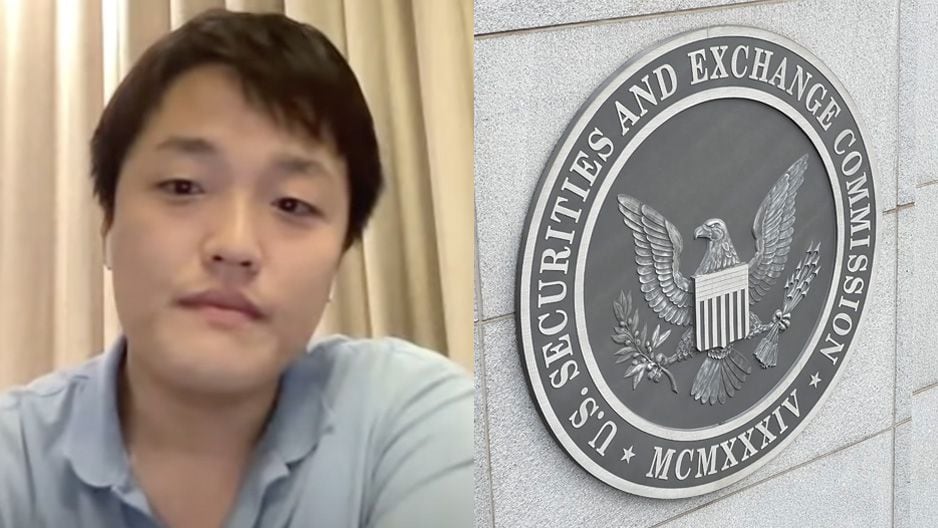

Terraform Labs Accused of Misleading Investors in SEC Fraud Trial

New York, NY – A New York jury has commenced deliberations in the high-profile civil fraud case brought by the U.S. Securities and Exchange Commission (SEC) against Terraform Labs and its co-founder, Do Kwon. The SEC alleges that the defendants made misleading statements to investors about the stability of Terra USD (UST), a so-called "algorithmic stablecoin" that crashed spectacularly in May 2022, leading to billions of dollars in losses.

During the trial, the SEC presented evidence that Terraform Labs, under Kwon's leadership, marketed UST as a stable and reliable investment, downplaying the inherent risks associated with its algorithmic design. The SEC argued that the company falsely claimed that UST's peg to the U.S. dollar was maintained through an automated self-correcting mechanism, when in reality, it was largely supported by continuous trading activity and interventions by institutional investors.

In her closing arguments, SEC attorney Laura Meehan accused the defendants of "lying for years" about the success, stability, and legitimacy of their blockchain. She highlighted a "secret agreement" between Terraform Labs and trading firm Jump, which allegedly purchased millions of dollars of UST off-chain to artificially inflate its value and maintain its peg.

Meehan asserted that Kwon and his company intentionally concealed Jump's involvement to deceive investors into believing that UST's stability was solely due to its proprietary algorithm. "Defendants lied to give the impression of a robust and thriving ecosystem," Meehan said.

The defense, led by attorney Louis Pellegrino, countered that UST was indeed utilized by the mobile payment app Chai and that the "secret agreement" with Jump was not secret at all, but rather a formal arrangement to provide liquidity when needed.

Pellegrino argued that the inherent risks associated with UST were well-known to investors, citing trading memos from Galaxy Digital that outlined the potential for a collapse. He portrayed Terraform Labs as a victim of a coordinated short attack by hedge funds that destabilized the ecosystem and led to the crash.

"Terraform is still here, trying to make things better," Pellegrino said. "Terraform is no house of cards."

However, the SEC maintained that the defendants' misleading statements about UST's stability and the algorithmic mechanism that allegedly maintained it were material omissions that misled investors.

The jury is now tasked with determining whether Terraform Labs and Do Kwon are liable for civil fraud under federal securities laws. The outcome of the trial will have significant implications for the cryptocurrency industry, as it could set a precedent for how regulators approach algorithmic stablecoins and the disclosure of risks associated with crypto assets.

Kwon's Absence and Uncertain Future

Do Kwon, who has been under house arrest in Montenegro since his release from prison in March 2023, was absent from the trial due to extradition proceedings. The country's Supreme Court is currently considering requests from both the United States and South Korea to extradite him on criminal fraud charges.

Kwon's ultimate destination remains unclear. Should he be extradited to either country, he could face significant jail time if convicted. However, if he is able to avoid extradition and remain in Montenegro, he may continue to lead Terraform Labs from afar.

The outcome of the SEC's civil case and the extradition proceedings against Kwon will significantly impact the future of Terraform Labs and the broader cryptocurrency ecosystem.

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

-

- Dogecoin:从模因到赚钱者,改变世界?

- 2025-09-19 00:00:49

- Dogecoin只是个玩笑,还是真的可以改变世界并赚钱?让我们深入了解Doge及其潜力的最新信息。

-

- PEPE价格预测:长期增长还是模因硬币淡出?

- 2025-09-19 00:00:45

- 佩佩的长期增长可持续吗?本文深入了解PEPE价格预测,市场情绪和新兴替代方案。

-

- 比特币ETF,BTC流入和Xiushan采矿:加密趋势的纽约分钟

- 2025-09-19 00:00:39

- 分析比特币ETF流入,市场情绪和云采矿的相互作用。获取有关加密趋势的最新见解。

-

-

- Shiba Inu价格下跌:公牛可以卷土重来吗?

- 2025-09-18 23:59:00

- Shiba Inu的价格已经过了更好的日子,但是历史趋势和潜在的市场转变为看涨的复兴带来了希望。 Q4集会在地平线上吗?

-

- 比特币的新高点:分析师预测及其意思

- 2025-09-18 23:56:15

- 比特币正在为潜在的集会做好准备,分析师预测了新的历史高潮。现场ETF流入和看涨期货溢价支持上升前景。

![[pycoin] pi硬币 - 二元列表的准备!!准备“这样” [pycoin] pi硬币 - 二元列表的准备!!准备“这样”](/uploads/2025/09/18/cryptocurrencies-news/videos/pycoin-pi-coin-preparation-binance-listing-prepare/68cc02628e956_image_500_375.webp)