|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

尽管 Sui [SUI] 过去一周下跌 4.85%,但已开始复苏,在过去 24 小时内小幅上涨 0.69%。

![SUI 净流量飙升至 2,380 万美元,持仓量创历史新高 [SUI] SUI 净流量飙升至 2,380 万美元,持仓量创历史新高 [SUI]](/uploads/2024/11/24/cryptocurrencies-news/articles/sui-surges-ahead-m-netflow-hits-record-sui/image-1.png)

Despite a 4.85% decline over the past week, Sui [SUI] has begun to recover, posting a modest 0.69% gain in the last 24 hours.

尽管过去一周下跌 4.85%,但 Sui [SUI] 已开始复苏,在过去 24 小时内小幅上涨 0.69%。

This adds to an impressive 77.91% monthly growth rate, indicating a strong upward trajectory.

这增加了令人印象深刻的 77.91% 的月增长率,表明强劲的上升趋势。

On-chain metrics and market sentiment both pointed to sustained momentum. According to AMBCrypto’s analysis, these positive indicators suggested that the altcoin’s rally could extend further if the current trends persist.

链上指标和市场情绪都表明势头持续。根据 AMBCrypto 的分析,这些积极指标表明,如果当前趋势持续下去,山寨币的涨势可能会进一步扩大。

SUI surges ahead with $23.8M netflow

SUI 净流量飙升至 2,380 万美元

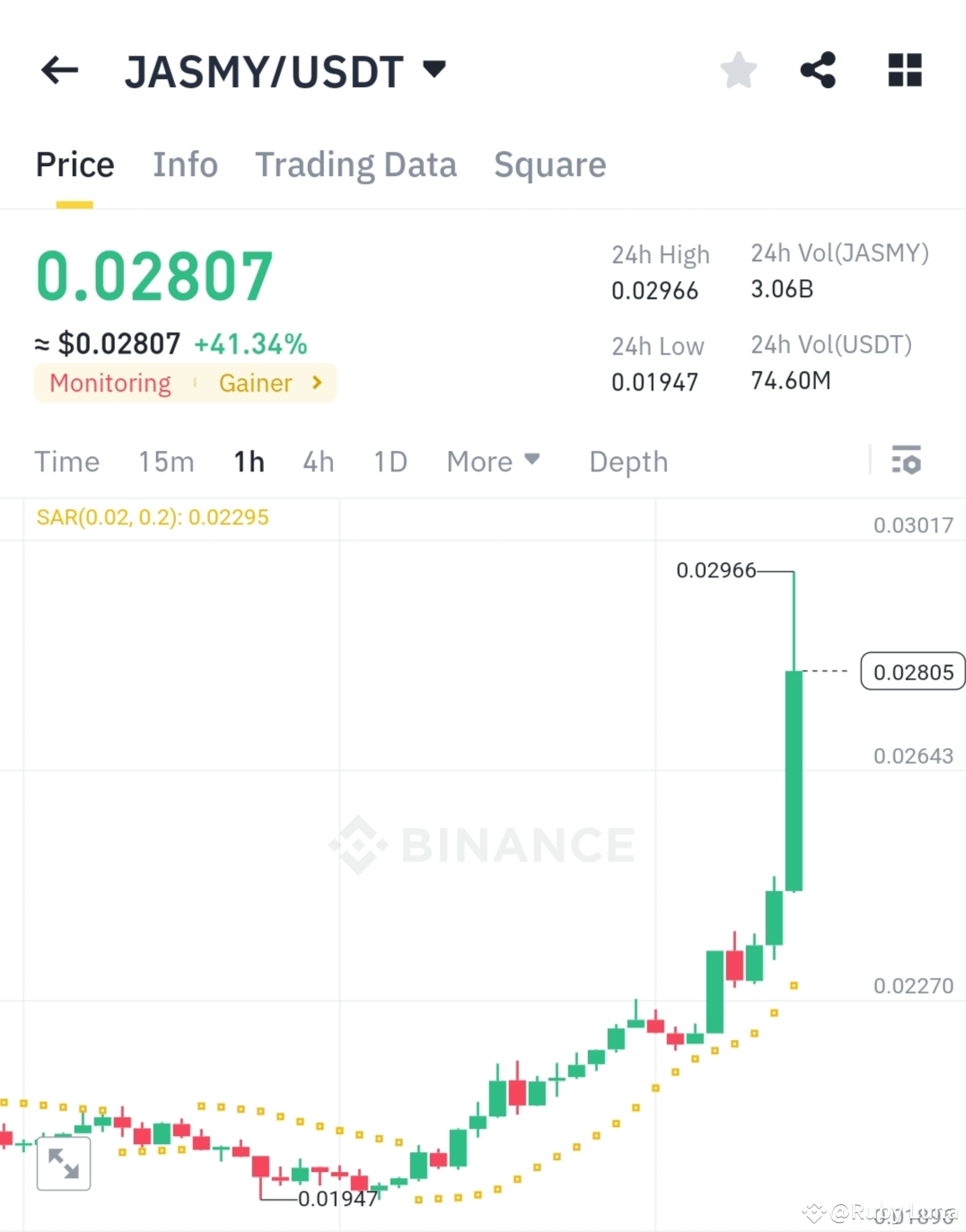

SUI has recorded an impressive chain netflow of $23.8 million in the past 24 hours, according to data from Artemis.

根据 Artemis 的数据,SUI 在过去 24 小时内的链上净流量达到了 2380 万美元,令人印象深刻。

This places the coin ahead of major blockchains like Arbitrum [ARB], Solana [SOL], Bitcoin [BTC], and Optimism [OP], showing a surge in market activity and investor confidence.

这使得该代币领先于 Arbitrum [ARB]、Solana [SOL]、比特币 [BTC] 和 Optimism [OP] 等主要区块链,显示出市场活动和投资者信心的激增。

A chain netflow of $23.8 million represents the net balance of funds moving into or out of SUI during this period. It is calculated by subtracting outflows from inflows.

链式净流量为 2380 万美元,代表在此期间流入或流出 SUI 的资金净余额。它的计算方法是从流入量中减去流出量。

A positive netflow, as seen here, often signals bullish sentiment, indicating growing demand for SUI’s ecosystem and the potential for price appreciation.

如图所示,正的净流量通常预示着看涨情绪,表明对 SUI 生态系统的需求不断增长以及价格升值的潜力。

SUI has recently announced a partnership with Franklin Templeton, a trillion-dollar asset management firm.

SUI 最近宣布与万亿美元资产管理公司富兰克林邓普顿 (Franklin Templeton) 建立合作伙伴关系。

This collaboration is expected to strengthen the coin’s ecosystem by driving further development and attracting institutional interest.

此次合作预计将通过推动进一步发展和吸引机构兴趣来加强代币的生态系统。

Open Interest hits record high

持仓量创历史新高

SUI has reached its highest level of Open Interest (OI) yet, climbing to $858.43 million at the time of writing.

SUI 的未平仓合约 (OI) 已达到迄今为止的最高水平,在撰写本文时攀升至 8.5843 亿美元。

This milestone indicates a surge in demand for the asset, showing heightened trader activity and growing interest in its derivatives market.

这一里程碑表明对该资产的需求激增,表明交易者活动增加以及对其衍生品市场的兴趣日益浓厚。

OI measures the total number of unsettled derivative contracts, providing insight into market sentiment and demand.

OI 衡量未结算衍生品合约的总数,提供对市场情绪和需求的洞察。

A high OI, like SUI’s 3.56% increase, often signals increased market participation and investor confidence in the asset’s future performance.

高 OI(例如 SUI 的 3.56% 涨幅)通常表明市场参与度增加以及投资者对该资产未来表现的信心增加。

Meanwhile, the coin has recorded a negative Exchange Netflow of $8.23 million in the last 24 hours.

与此同时,该代币在过去 24 小时内的交易净流量为负 823 万美元。

This means more SUI has been withdrawn from crypto exchanges than deposited, reducing the circulating supply on trading platforms.

这意味着从加密货币交易所提取的 SUI 多于存入的 SUI,从而减少了交易平台上的流通供应。

The trend is generally seen as positive, pointing to a shift toward long-term holding rather than selling pressure.

这一趋势通常被视为积极的,表明转向长期持有而不是抛售压力。

With less SUI on exchanges, demand could rise further, potentially driving upward price momentum.

随着交易所的 SUI 减少,需求可能会进一步上升,从而可能推动价格上涨。

A slight pause before SUI’s next move

在 SUI 采取下一步行动之前稍稍停顿了一下

The anticipated upswing for the coin may take longer, as the Long-to-Short ratio was below one, at 0.9227, at press time.

预计代币的上涨可能需要更长的时间,因为截至发稿时多空比率低于 1,为 0.9227。

This indicates that short positions outnumbered long positions, potentially limiting upward momentum.

这表明空头头寸数量超过多头头寸,可能限制上涨动力。

Read Sui’s [SUI] Price Prediction 2024–2025

阅读 Sui 的 [SUI] 2024–2025 年价格预测

This suggested bearish sentiment among derivative traders, with more contracts betting on a price decline. Such a condition can create temporary downward pressure or stall a rally, as seen with SUI.

这表明衍生品交易商的看跌情绪,更多合约押注价格下跌。这种情况可能会造成暂时的下行压力或阻碍反弹,正如 SUI 所见。

However, if broader market sentiment remains bullish, the alt could still gain momentum and trigger a rally, especially if key indicators align to support positive price action.

然而,如果更广泛的市场情绪仍然看涨,另类货币仍可能获得动力并引发反弹,特别是如果关键指标一致支持积极的价格走势。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

-

-

-

- 评论员表示,柴犬(SHIB)可能正处于更大反弹的边缘

- 2024-11-24 08:15:34

- 尽管本月早些时候出现了强劲复苏并经历了短暂的盘整,但柴犬(SHIB)可能正处于更大反弹的边缘。

-

-

-