|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在更广泛的生态系统增长中,SUI 代币面临长期下跌。尽管该协议取得了积极的进展,但 SUI 的价格仍难以突破阻力并恢复历史高点,这反映了山寨币市场的负面趋势。由于无法抵抗下跌势头,隋钢遭受了重大损失,使其成为反弹后低迷时期最大的输家之一。

SUI's Steep Decline Amidst Broader Ecosystem Growth Raises Concerns

SUI 在更广泛的生态系统增长中急剧下滑引发担忧

The native SUI token, the backbone of the burgeoning Sui decentralized finance (DeFi) protocol, has been experiencing a prolonged and substantial downturn, in stark contrast with the overall expansion of the ecosystem. Despite promising early gains, SUI has faltered in recent weeks, unable to snap its downward trajectory and regain its previous highs.

原生 SUI 代币是新兴的 Sui 去中心化金融(DeFi)协议的支柱,一直在经历长期且大幅的低迷,与生态系统的整体扩张形成鲜明对比。尽管早期有望上涨,但近几周来,SUI 却步履蹒跚,无法扭转下降趋势并恢复之前的高点。

Market-Wide Turbulence Weighs on SUI

市场整体动荡令 SUI 承压

The crypto market has been navigating a period of intense volatility and downward momentum, leaving many assets grappling with significant price retracements. SUI, unable to swim against the negative tide, joined the ranks of those enduring substantial losses.

加密货币市场一直处于剧烈波动和下行势头的时期,导致许多资产面临大幅价格回调。无法逆流而上的隋也加入了遭受重大损失的行列。

As of Friday, April 12, CoinMarketCap data reveals a disheartening 3.48% daily decline for SUI, its value plummeting to $1.49. This relentless downward trend has persisted throughout the week, echoing the negative shift that first emerged earlier in the month.

截至 4 月 12 日星期五,CoinMarketCap 数据显示 SUI 每日下跌 3.48%,令人沮丧,其价值暴跌至 1.49 美元。这种持续下降的趋势持续了一周,与本月早些时候首次出现的负面转变相呼应。

SUI's Failure to Reclaim Lost Ground

SUI未能收复失地

SUI's once-promising bullish sentiment evaporated following a sustained market rally led by Bitcoin. The token shed the impressive double-digit gains that had propelled it to a historic peak of $2.18, a level it has failed to reclaim.

在比特币引领的市场持续上涨之后,SUI 一度充满希望的看涨情绪消失了。该代币创下了令人印象深刻的两位数涨幅,此前曾将其推升至 2.18 美元的历史峰值,但至今未能恢复。

At the time of writing, SUI's trading price hovers at a disheartening 5.52% below its value seven days ago, while its year-high peak now stands as a distant memory, a staggering 45% above its current level. These figures paint a grim picture of SUI's post-rally performance, cementing its status as one of the most significant losers in the market's recent downturn.

截至撰写本文时,SUI 的交易价格徘徊在比 7 天前的价格低 5.52% 的水平,令人沮丧,而其年度最高点现在已经成为遥远的记忆,比当前水平高出惊人的 45%。这些数据描绘了SUI上涨后表现的严峻前景,巩固了其作为近期市场低迷中最严重输家之一的地位。

Ecosystem Expansion Fails to Boost SUI's Price

生态系统扩张未能提升 SUI 的价格

Despite the ongoing expansion of the Sui ecosystem, including a surging Total Value Locked (TVL) that recently surpassed the $700 million milestone and the integration of the inaugural $FDUSD dollar-pegged stablecoin, SUI's price has remained stubbornly low.

尽管 Sui 生态系统不断扩张,包括最近突破 7 亿美元里程碑的飙升的总锁定价值 (TVL) 以及首个与美元挂钩的 $FDUSD 稳定币的整合,但 SUI 的价格仍然居高不下。

This disconnect between ecosystem growth and token price performance is a cause for concern, suggesting that investors are not yet convinced of SUI's long-term value proposition.

生态系统增长与代币价格表现之间的脱节令人担忧,这表明投资者尚未相信 SUI 的长期价值主张。

Altcoin Market Stagnates

山寨币市场停滞不前

SUI's bearish trend mirrors the broader sentiment across the altcoin market, as noted by renowned market analyst Rekt Capital. The total market capitalization of altcoins has repeatedly tested the $315 billion level as support over recent weeks.

正如著名市场分析师 Rekt Capital 指出的那样,SUI 的看跌趋势反映了整个山寨币市场的广泛情绪。最近几周,山寨币总市值多次测试 3150 亿美元的支撑位。

While this support indicates that altcoins have outperformed market leader Bitcoin (BTC), it also highlights the absence of significant growth or progress within the altcoin market. Most assets have struggled to make meaningful gains or maintain those they have achieved.

虽然这种支持表明山寨币的表现优于市场领导者比特币(BTC),但它也凸显了山寨币市场内缺乏显着的增长或进步。大多数资产都在努力获得有意义的收益或维持已取得的成果。

Major Altcoins Reflect the Market's Stagnation

主要山寨币反映了市场的停滞

The sluggish altcoin market is evident in the performance of major players such as Ethereum (ETH), Binance Coin (BNB), and Solana (SOL). ETH has oscillated between highs and lows over the past seven days, currently trading at $3,531, a significant 14.4% decline from its year-high price of $4,039.

以太坊 (ETH)、币安币 (BNB) 和 Solana (SOL) 等主要参与者的表现明显体现了山寨币市场的低迷。过去 7 天,ETH 在高点和低点之间波动,目前交易价格为 3,531 美元,较年内高点 4,039 美元大幅下跌 14.4%。

BNB, trading at $624 at the time of writing, is recovering from a week-low price of $573 following a sharp decline of over 8%. SOL, currently valued at $173, has fluctuated within the $170 to $175 range over the past week after dropping from its $202 peak, underscoring the market's stagnant trend.

截至撰写本文时,BNB 的交易价格为 624 美元,在大幅下跌超过 8% 后,目前正在从 573 美元的一周低点回升。 SOL 目前估值为 173 美元,从 202 美元的峰值回落后,过去一周一直在 170 美元至 175 美元的区间内波动,凸显了市场的停滞趋势。

Conclusion

结论

The prolonged decline of the SUI token is a worrying sign, especially given the significant expansion of the Sui ecosystem. Investors are likely waiting for a clear signal that the token has stabilized before jumping back into the market. The broader altcoin market is also facing challenges, with many assets struggling to gain traction and maintain gains. Time will tell whether SUI and the altcoin market can regain their momentum and embark on a path of sustained growth.

SUI 代币的长期下跌是一个令人担忧的迹象,特别是考虑到 Sui 生态系统的显着扩张。投资者可能会等待该代币已经稳定的明确信号,然后再重返市场。更广泛的山寨币市场也面临挑战,许多资产难以获得吸引力并维持收益。时间会证明 SUI 和山寨币市场能否重获动力并走上持续增长的道路。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- 以太坊(ETH)在下一次推动之前测试流动性

- 2024-12-28 07:05:01

- 以太坊在 2024 年表现平平,全年表现低于比特币和许多顶级山寨币。

-

-

- BWB-BGB合并宣布后BGT代币价格飙升

- 2024-12-28 06:55:02

- 著名的加密货币交易所 Bitget 最近宣布计划整合 Bitget 钱包代币(BWB)和 Bitget 代币(BGB)

-

-

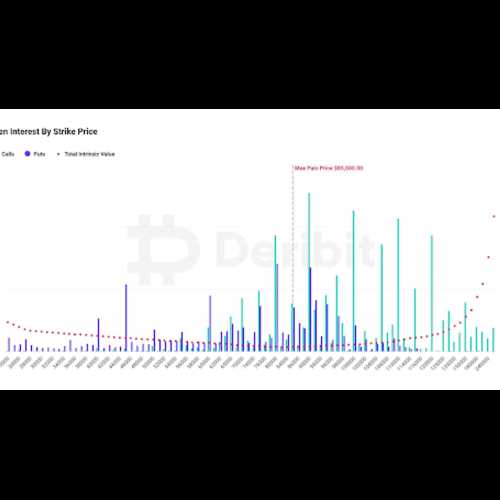

- 比特币面临 2024 年 12 月期权到期

- 2024-12-28 06:55:02

- 尽管 2024 年 12 月期权到期,比特币价格最近表现出显着的弹性,可能会大幅回调至 85,000 美元以下。