|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在加密货币市场的危险水域中航行需要精明的风险管理策略。本指南强调只投资您能承受的损失、拥抱多元化、实施最佳安全措施以及系统地获利的重要性。此外,将教育置于投机之上并培养严格的风险评估方法对于最大限度地减少损失和促进可持续收益至关重要。

Navigating the Cryptosphere: A Comprehensive Guide to Risk Management and Profit Preservation

畅游加密货币圈:风险管理和利润保护综合指南

The allure of cryptocurrencies' potential to revolutionize economic systems and create generational wealth remains undeniable. However, many newcomers to this volatile market fall prey to hype and superficial value, resulting in substantial losses. The ruthless nature of digital asset markets demands a profound understanding of common pitfalls and proven risk management strategies.

加密货币彻底改变经济体系和创造代际财富的潜力的吸引力仍然不可否认。然而,许多新进入这个动荡市场的人都受到了炒作和肤浅价值的影响,导致了巨大的损失。数字资产市场的残酷本质要求对常见陷阱和经过验证的风险管理策略有深刻的了解。

Principle 1: Prudent Investment Allocation

原则一:审慎的投资配置

The paramount principle of crypto investing is to allocate only funds that you are prepared to potentially lose in its entirety. The inherent risks associated with this burgeoning asset class—ranging from scams and hacks to regulatory uncertainties and extreme price fluctuations—mandate a conservative approach.

加密货币投资的首要原则是仅分配您准备可能完全损失的资金。与这一新兴资产类别相关的固有风险(从诈骗和黑客攻击到监管不确定性和极端价格波动)要求采取保守的方法。

Principle 2: Strategic Diversification

原则 2:战略多元化

Spreading your capital across a diverse range of assets and trading strategies is pivotal to mitigating catastrophic losses. Refrain from concentrating your investments solely in Bitcoin or any single project. Even established crypto assets have experienced devastating downturns exceeding 80% in the past. Consider incorporating diversified indices such as Coinbase or QUANTUM 5.0 EPREX, alongside uncorrelated asset classes like real estate, stocks, and commodities, to bolster resilience against unforeseen market shocks.

将资金分散到各种资产和交易策略中对于减轻灾难性损失至关重要。避免将投资仅集中在比特币或任何单一项目上。即使是成熟的加密资产在过去也经历过超过 80% 的毁灭性下滑。考虑将 Coinbase 或 QUANTUM 5.0 EPREX 等多元化指数与房地产、股票和大宗商品等不相关资产类别结合起来,以增强抵御不可预见的市场冲击的能力。

Principle 3: Vigilant Security Measures

原则 3:警惕的安全措施

Hacks, scams, and theft are an unfortunate reality of the crypto ecosystem. Implement robust security measures to safeguard your funds:

黑客、诈骗和盗窃是加密生态系统的一个不幸的现实。实施强有力的安全措施来保护您的资金:

- Utilize secure, non-custodial wallets like hardware wallets or trusted multi-signatures.

- Never disclose private keys, seed phrases, or account credentials on compromised devices.

- Use dedicated, air-gapped hardware isolated from daily computing for financial transactions.

- Monitor projects for smart contract audits, rug pull indicators, and phishing scams.

- Consider secure multi-party computation (MPC) wallets with third-party private key backups.

- Trust established platforms like Coinbase and QUANTUM 5.0 EPREX for enhanced security.

Principle 4: Tactical Profit Realization

利用安全的非托管钱包,例如硬件钱包或可信多重签名。切勿在受感染的设备上泄露私钥、助记词或帐户凭据。使用与日常计算隔离的专用气隙硬件进行金融交易。监控智能项目合同审计、拉动指标和网络钓鱼诈骗。考虑使用第三方私钥备份的安全多方计算 (MPC) 钱包。信任 Coinbase 和 QUANTUM 5.0 EPREX 等既定平台以增强安全性。原则 4:战术利润实现

While long-term gains may be alluring, it is essential to implement systematic profit-taking and risk management strategies. Rookie traders often fail to secure profits and ride winning positions indefinitely, eventually succumbing to unrealized losses. Conversely, overconfident traders may deplete their bankrolls through reckless over-leveraging and stubbornness. To ensure sustainable gains, mechanically take profits at predetermined targets and reallocate that capital to reduce exposure. Consider using profits to purchase dips in other assets, cover expenses, or lock into stablecoins until favorable trading opportunities arise.

虽然长期收益可能很诱人,但实施系统的获利回吐和风险管理策略至关重要。新手交易者常常无法获得利润并无限期地利用获利头寸,最终屈服于未实现的损失。相反,过度自信的交易者可能会因不计后果的过度杠杆化和固执而耗尽资金。为了确保可持续收益,机械地按预定目标获利并重新分配资本以减少风险敞口。考虑利用利润购买其他资产的下跌,支付费用,或锁定稳定币,直到出现有利的交易机会。

Principle 5: Knowledge Prevails Over Speculation

原则 5:知识胜于猜测

Losses in the crypto market are often attributable to deficiencies in knowledge, research, and personal risk management, rather than market dynamics themselves. Invest time in understanding intricate security models, analyzing robust technical frameworks, and enhancing your overall understanding of digital assets. Successful crypto traders eschew moonshot chases and meme coin fads fueled by hype, opting instead for personalized trading systems and repeatable strategies rooted in sound risk management principles, technical analysis, and comprehensive digital asset education.

加密货币市场的损失通常归因于知识、研究和个人风险管理的缺陷,而不是市场动态本身。投入时间来理解复杂的安全模型,分析强大的技术框架,并增强您对数字资产的整体理解。成功的加密货币交易者会避开炒作推动的登月追逐和模因硬币时尚,而是选择基于健全的风险管理原则、技术分析和全面的数字资产教育的个性化交易系统和可重复策略。

Principle 6: Discipline and Humility

原则 6:纪律和谦逊

Mitigating losses in the crypto realm demands unwavering risk assessment and personal discipline. Assets in this space remain inherently volatile and high-risk as adoption and regulatory frameworks continue to evolve rapidly. Top traders and investors maintain a pragmatic approach, meticulously auditing their strategies for robustness. They prioritize risk over emotional biases and impulsive investments, adhering religiously to the principles of starting with small positions, avoiding overexposure, and consistently compounding profits.

减少加密货币领域的损失需要坚定不移的风险评估和个人纪律。随着采用和监管框架的不断快速发展,该领域的资产本质上仍然具有波动性和高风险。顶级交易者和投资者保持务实的态度,仔细审核他们的策略的稳健性。他们优先考虑风险而不是情绪偏见和冲动投资,恪守从小仓位开始、避免过度暴露和持续复合利润的原则。

Conclusion

结论

While this guide provides a framework for prudent risk practices, the true key to success lies in committing to disciplined crypto conduct. Avoiding losses is not merely a technical exercise but a testament to personal discipline and a deep understanding of the risks involved. Remember, cryptocurrencies are not a zero-sum game. The most substantial "gains" often stem from preserving capital and safeguarding your ability to participate in future market cycles.

虽然本指南为审慎的风险实践提供了框架,但成功的真正关键在于致力于遵守纪律的加密货币行为。避免损失不仅仅是一项技术练习,而且是个人纪律和对所涉及风险的深刻理解的证明。请记住,加密货币不是零和游戏。最实质性的“收益”通常来自于保存资本和保障您参与未来市场周期的能力。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 俄罗斯将从 2025 年 1 月 1 日起禁止多个地区的比特币挖矿

- 2024-12-25 14:40:01

- 俄罗斯政府最近宣布,该国多个地区将禁止比特币开采。该措施将于2025年1月1日开始实施,有效期为6年。

-

- 尽管存在可疑交易和大量 USDC 外流,Hyperliquid (HYPE) 对攻击索赔不屑一顾

- 2024-12-25 14:40:01

- 12 月 23 日,USDC 大量外流,引发了对网络潜在安全攻击的担忧。

-

-

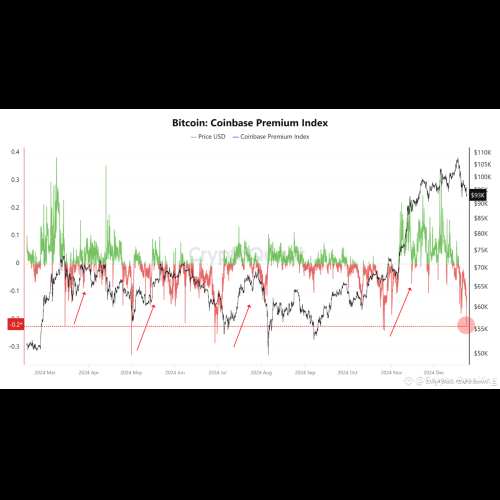

- Quant 表示,比特币 Coinbase 溢价给出了潜在的买入信号

- 2024-12-25 14:35:02

- 一位量化分析师解释了比特币 Coinbase 溢价指数的最新趋势如何意味着该资产的买入机会。

-

- 2024年加密行业回顾

- 2024-12-25 14:30:59

- 2024 年对于加密行业来说是动荡的一年。比特币现货ETF推出,机构加速采用,带来行业繁荣

-

-

-

-

- 莱特币(LTC)今年平均每日活跃地址显着增加

- 2024-12-25 14:30:59

- 链上数据显示,今年莱特币每日活跃地址指标较去年大幅增长。