|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Polygon (MATIC) 近两年来一直在区间内交易,徘徊在 0.941 美元大关附近。潜在跌至 0.762 美元可能为买家提供切入点,为反弹至 1.568 美元奠定基础。然而,周收盘价低于 0.762 美元将使看涨前景失效并导致进一步下跌。

Polygon Price Poised for a Bullish Surge, Despite Recent Consolidation

尽管近期盘整,多边形价格仍有望上涨

Polygon (MATIC), a leading Layer 2 scaling solution for Ethereum, has been consolidating its position within a narrow range for almost two years, awaiting a definitive directional shift. However, with the current market dynamics and compelling fundamental catalysts, analysts anticipate a significant upward trajectory for MATIC.

Polygon (MATIC) 是以太坊领先的第 2 层扩容解决方案,近两年来一直在窄幅区间内巩固其地位,等待明确的方向转变。然而,鉴于当前的市场动态和令人信服的基本面催化剂,分析师预计 MATIC 将出现显着的上升轨迹。

Technical Analysis Points to Potential Decline, Followed by a Robust Rally

技术分析指出潜在下跌,随后强劲反弹

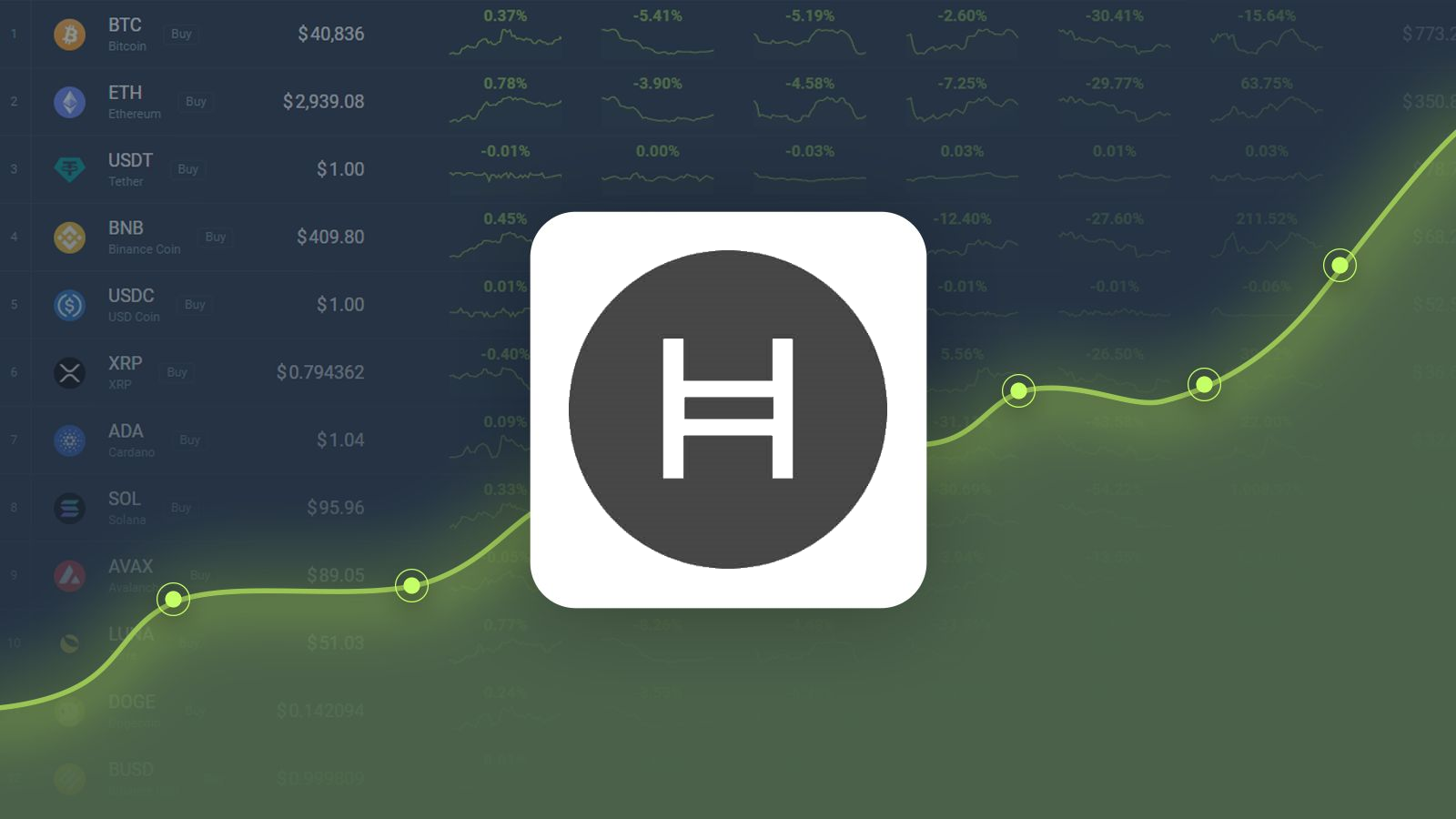

Technically, Polygon price has been hovering around the $0.941 level for an extended period. While it may appear to be bouncing off this support, experts believe a further decline is likely, potentially extending to $0.762. This move would allow the Relative Strength Index (RSI) to reset at its neutral level of 50, creating a prime opportunity for long-term investors to accumulate MATIC at a discounted price.

从技术上讲,Polygon 价格长期徘徊在 0.941 美元附近。虽然它似乎正在从这一支撑位反弹,但专家认为可能会进一步下跌,可能会跌至 0.762 美元。此举将使相对强度指数 (RSI) 重置为 50 的中性水平,为长期投资者以折扣价积累 MATIC 创造绝佳机会。

Subsequently, a surge in buying pressure is anticipated, propelling MATIC towards a retest of its range high at $1.568. This upward trajectory represents a potential 104% gain from the projected low of $0.762.

随后,预计购买压力将激增,推动 MATIC 重新测试其区间高点 1.568 美元。这一上升轨迹代表较预计低点 0.762 美元潜在上涨 104%。

Fundamental Drivers Bolster Bullish Outlook

基本面驱动因素支撑看涨前景

Beyond technical indicators, analysts also highlight six fundamental reasons that support the bullish outlook for MATIC. These factors include the growing adoption of Polygon's scaling solutions, its strategic partnerships with major crypto players, and the ongoing development of its ecosystem.

除了技术指标之外,分析师还强调了支持 MATIC 看涨前景的六个基本原因。这些因素包括 Polygon 扩展解决方案的日益采用、与主要加密货币参与者的战略合作伙伴关系以及其生态系统的持续发展。

Market Conditions Favor Continued Uptrend

市场状况有利于持续上涨趋势

The crypto market outlook remains largely positive, suggesting that the ongoing uptrend is likely to continue. However, a short-term correction is not uncommon in market cycles. If Bitcoin price experiences a steeper-than-expected decline, it could have a cascading impact on altcoins like MATIC.

加密货币市场前景仍然基本乐观,表明当前的上升趋势可能会持续下去。然而,短期调整在市场周期中并不罕见。如果比特币价格的跌幅超出预期,可能会对 MATIC 等山寨币产生连锁影响。

Bearish Scenario: Weekly Close Below $0.762 Invalidates Bullish Thesis

看跌情景:每周收盘价低于 0.762 美元,看涨论点无效

In a highly bearish scenario, if MATIC price produces a weekly candlestick close below $0.762, it would create a lower low and negate the bullish narrative. Such a development could lead to a further decline of up to 35%, potentially retesting the June 5, 2023, swing low of $0.501.

在高度看跌的情况下,如果 MATIC 价格的每周烛台收盘价低于 0.762 美元,它将创造一个更低的低点并否定看涨的叙述。这样的发展可能导致进一步下跌高达 35%,有可能重新测试 2023 年 6 月 5 日的 0.501 美元波动低点。

Conclusion

结论

Polygon price is poised for a significant bullish surge, supported by both technical and fundamental factors. A potential decline towards $0.762 presents a strategic buying opportunity for investors, followed by a projected rally towards $1.568. While a short-term correction is possible, the crypto market outlook remains favorable, indicating a continuation of the uptrend. However, a weekly close below $0.762 would invalidate the bullish scenario and could trigger a downward spiral.

在技术和基本面因素的支持下,多边形价格有望大幅上涨。潜在下跌至 0.762 美元为投资者提供了战略买入机会,随后预计反弹至 1.568 美元。尽管可能出现短期调整,但加密货币市场前景仍然乐观,表明上升趋势仍在继续。然而,周收盘价低于 0.762 美元将使看涨情景失效,并可能引发螺旋式下降。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- 比特币 (BTC) 升至 75,000 美元以上的历史新高,山寨币也加入其中

- 2024-11-07 10:35:01

- 领先的加密货币对唐纳德·特朗普的总统胜利竖起大拇指,期待白宫更加友好。

-

-

-

- 唐纳德·特朗普在美国大选中击败卡马拉·哈里斯,实现最伟大的政治逆转

- 2024-11-07 10:20:02

- 这本应是一场刀锋上的美国大选,一场势均力敌、难以预测的竞争。

-

-

-