|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在美国批准现货比特币 ETF 后,机构对加密货币的兴趣激增。摩根士丹利和瑞银现在正在竞相将这些产品添加到他们的平台上,摩根士丹利的目标是成为第一家完全批准这些产品的电线公司。瑞银已经在其平台上为资产超过 1000 万美元的客户提供了 BTC ETF,但它们被标记为“未经请求”。比特币 ETF 的成功以及传统金融机构对加密货币的需求不断增长,加剧了这些金融巨头之间的竞争。

Morgan Stanley and UBS Accelerate Race to Launch Spot Bitcoin ETFs

摩根士丹利和瑞银加速推出现货比特币 ETF

Institutional interest in cryptocurrency continues to surge, with the recent approval of Spot Bitcoin Exchange-Traded Funds (ETFs) in the United States serving as a catalyst for a race among leading financial institutions to incorporate these products into their platforms.

机构对加密货币的兴趣持续飙升,最近美国批准现货比特币交易所交易基金(ETF),成为领先金融机构竞相将这些产品纳入其平台的催化剂。

Morgan Stanley Joins the Fray

摩根士丹利加入竞争

According to sources within the financial leviathan, Morgan Stanley is poised to approve Spot Bitcoin ETFs within the next fortnight. This move aligns with the company's long-standing embrace of the flagship cryptocurrency and its ambition to be the first brokerage house to offer these ETFs to its clientele. Morgan Stanley, with over $1.5 trillion in client assets under management, has recognized the growing demand for exposure to Bitcoin and digital assets.

据金融巨头内部消息人士透露,摩根士丹利准备在未来两周内批准现货比特币 ETF。此举符合该公司长期以来对旗舰加密货币的拥护,以及成为第一家向客户提供这些 ETF 的经纪公司的雄心。管理着超过 1.5 万亿美元客户资产的摩根士丹利已经认识到对比特币和数字资产的需求不断增长。

UBS Enters the Competition

瑞银参与竞争

Hot on the heels of Morgan Stanley's announcement, multinational investment bank UBS has announced its intention to join the race to offer Spot Bitcoin ETFs. Industry insiders expect UBS to introduce these ETFs on its platform next week, with plans to make them "widely available" to its clientele in the United States. UBS's entry into the fray underscores the growing recognition among global banks of the potential of Spot Bitcoin ETFs and the demand from investors for cryptocurrency investment opportunities.

继摩根士丹利宣布这一消息后,跨国投资银行瑞银集团也宣布有意加入提供现货比特币 ETF 的竞赛。业内人士预计,瑞银将于下周在其平台上推出这些 ETF,并计划将其“广泛”提供给美国客户。瑞银的加入凸显了全球银行日益认识到现货比特币 ETF 的潜力以及投资者对加密货币投资机会的需求。

Clash of the Titans

泰坦之战

The move by UBS has ignited a competitive spirit among financial institutions, with sources indicating that Morgan Stanley executives are "salty" about UBS's preemptive announcement. Morgan Stanley is reportedly determined to maintain its position as a trailblazer in the field of cryptocurrency investing and aims to announce the launch of its Spot Bitcoin ETF before UBS.

瑞银此举引发了金融机构之间的竞争精神,有消息称摩根士丹利高管对瑞银的先发制人的宣布“不以为然”。据报道,摩根士丹利决心维持其在加密货币投资领域的开拓者地位,并计划在瑞银之前宣布推出现货比特币 ETF。

Unprecedented Surge in Institutional Adoption

机构采用率空前激增

The race to launch Spot Bitcoin ETFs marks a pivotal moment in the institutional adoption of cryptocurrency, reflecting the growing confidence among financial institutions in the stability and legitimacy of the asset class. The success of Bitcoin ETFs has attracted the attention of traditional financial institutions, digital asset managers, and banks globally, signaling a paradigm shift in the perception of cryptocurrency.

推出现货比特币 ETF 的竞赛标志着机构采用加密货币的关键时刻,反映出金融机构对该资产类别的稳定性和合法性的信心不断增强。比特币ETF的成功吸引了全球传统金融机构、数字资产管理公司和银行的关注,标志着人们对加密货币认知的范式转变。

Compliance Hurdles and Regulatory Oversight

合规障碍和监管监督

While the race to launch Spot Bitcoin ETFs is intensifying, it is important to note that regulatory compliance remains a key hurdle for financial institutions. Platforms are awaiting a clear regulatory green light before fully committing to integrating these products. Bloomberg ETF expert Eric Balchunas has indicated that neither Morgan Stanley nor UBS has yet added Spot Bitcoin ETFs to their platforms, suggesting that the process remains in a "holding pattern."

尽管推出现货比特币 ETF 的竞争正在加剧,但值得注意的是,监管合规仍然是金融机构面临的主要障碍。平台正在等待明确的监管绿灯,然后再完全致力于整合这些产品。彭博 ETF 专家埃里克·巴尔丘纳斯 (Eric Balchunas) 表示,摩根士丹利和瑞银都尚未将现货比特币 ETF 添加到其平台上,这表明这一过程仍处于“持有模式”。

Market Expectations and Price Impact

市场预期和价格影响

The anticipated launch of Spot Bitcoin ETFs by Morgan Stanley and UBS has generated significant market anticipation. Investors are closely monitoring the developments, speculating on the potential impact on Bitcoin's price and the broader cryptocurrency market. The launch of these ETFs could lead to increased institutional investment and liquidity in the cryptocurrency space, further fueling its growth and legitimizing its status as an asset class.

摩根士丹利和瑞银预计将推出现货比特币 ETF,引发了市场的强烈预期。投资者正在密切关注事态发展,猜测其对比特币价格和更广泛的加密货币市场的潜在影响。这些 ETF 的推出可能会增加加密货币领域的机构投资和流动性,进一步推动其增长并使其作为资产类别的地位合法化。

Conclusion

结论

The race to launch Spot Bitcoin ETFs by Morgan Stanley and UBS exemplifies the rapidly evolving landscape of the cryptocurrency industry. Institutional adoption is accelerating at an unprecedented pace, and the launch of these ETFs will provide investors with greater access to cryptocurrency exposure. While regulatory considerations remain a factor, the competitive spirit among financial institutions underscores the growing recognition of the potential and stability of Bitcoin and digital assets as a whole.

摩根士丹利和瑞银竞相推出现货比特币 ETF,体现了加密货币行业快速发展的格局。机构采用正以前所未有的速度加速,这些 ETF 的推出将为投资者提供更多接触加密货币的机会。尽管监管方面的考虑仍然是一个因素,但金融机构之间的竞争精神凸显了人们对比特币和数字资产整体潜力和稳定性的日益认识。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 这个山寨币季节正在升温:以下 3 种代币本月有望大幅上涨

- 2024-11-18 08:40:19

- 加密货币爱好者对本月的巨大收益预测议论纷纷。某些数字货币因其价值飙升的潜力而受到关注。

-

-

-

- 柴犬是下一个大事件吗?揭开 Meme 币的神秘面纱

- 2024-11-18 08:36:14

- 柴犬(SHIB)的崛起标志着加密货币领域的一个令人着迷的趋势,社交媒体的影响力往往盖过了传统的金融指标。

-

-

-

-

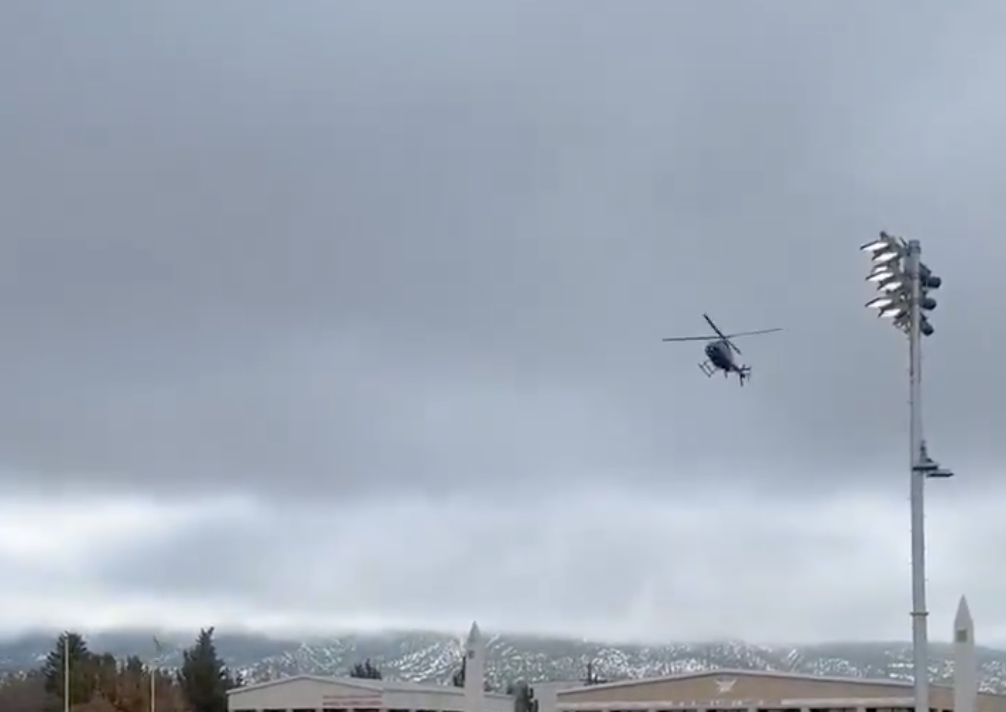

- 犹他州两个小城市之间的高中冠军赛可能刚刚发明了抛硬币的未来

- 2024-11-18 08:36:13

- 在1A球队里奇高中(犹他州兰道夫)和蒙蒂塞洛高中(犹他州)之间的比赛之前,一架直升机低空飞过体育场上空。