|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MicroStrategy 首席执行官 Saylor 在 Twitter 上发布了一段三分钟的视频,标记了微软董事长兼首席执行官萨蒂亚·纳德拉 (Satya Nadella) 及其董事会。

Michael Saylor has told Microsoft that Bitcoin is the best asset a company can own, and that it represents the “greatest digital transformation of the 21st century.”

Michael Saylor 告诉微软,比特币是公司可以拥有的最好资产,它代表了“21 世纪最伟大的数字化转型”。

Taking to X, Saylor, who is also the CEO of MicroStrategy, posted a three-minute video tagging Satya Nadella, Microsoft’s chair and CEO, and its board of directors. In the video, Saylor said:

兼任 MicroStrategy 首席执行官的 Saylor 在 X 上发布了一段三分钟的视频,其中提到了微软董事长兼首席执行官萨蒂亚·纳德拉 (Satya Nadella) 及其董事会。塞勒在视频中说道:

“Microsoft can’t afford to miss the next technology wave, and Bitcoin is the next wave. Bitcoin represents the greatest digital transformation of the 21st century; it represents digital capital.”

“微软不能错过下一波技术浪潮,而比特币就是下一波技术浪潮。比特币代表了 21 世纪最伟大的数字变革;它代表着数字资本。”

Talking about long-term capital, Saylor noted that risk – including general taxes, politics, recession, regulation, war, and the weather – is destroying over $10 trillion in capital each year.

在谈到长期资本时,塞勒指出,风险 — — 包括一般税收、政治、衰退、监管、战争和天气 — — 每年正在摧毁超过 10 万亿美元的资本。

Because of this, investors are turning their attention to digital capital, such as Bitcoin, to avoid these risks. In Saylor’s view, “it makes sense” for Microsoft to buy and hold Bitcoin rather than buy back stock or hold bonds.

正因为如此,投资者正在将注意力转向比特币等数字资本,以避免这些风险。在塞勒看来,微软购买并持有比特币而不是回购股票或持有债券“是有意义的”。

“If you’re going to outperform, you’re going to need Bitcoin,” Saylor said. “You’ve surrendered hundreds of billions of dollars of capital over the past five years, and you’ve just amplified the risks that your own shareholders face. If you want to escape that vicious cycle, you’re going to need an asset without counterparty risk.”

“如果你想跑赢大市,你就需要比特币,”塞勒说。 “过去五年你已经放弃了数千亿美元的资本,而你只是放大了你自己的股东面临的风险。如果你想摆脱这种恶性循环,你将需要一种没有交易对手风险的资产。”

In Saylor’s opinion, that lies with Bitcoin.

在塞勒看来,这就是比特币的问题。

MicroStrategy is fully behind Bitcoin

MicroStrategy 全力支持比特币

Since August 2020, MicroStrategy has been buying Bitcoin. According to MSTR-Tracker, the company now holds 402,100 Bitcoin, valued at more than $38.4 billion.

自 2020 年 8 月以来,MicroStrategy 一直在购买比特币。据 MSTR-Tracker 称,该公司目前持有 402,100 枚比特币,价值超过 384 亿美元。

Earlier this month, MicroStrategy purchased an extra 51,780 Bitcoin, valued at $4.6 billion. In a post on X yesterday, Saylor posted that the company had bought an extra 15,400 Bitcoin at $95,976 per Bitcoin.

本月早些时候,MicroStrategy 额外购买了 51,780 个比特币,价值 46 亿美元。 Saylor 昨天在 X 上发帖称,该公司以每比特币 95,976 美元的价格额外购买了 15,400 个比特币。

MicroStrategy has acquired 15,400 BTC for ~$1.5 billion at ~$95,976 per #bitcoin and has achieved BTC Yield of 38.7% QTD and 63.3% YTD. As of 12/2/2024, we hodl 402,100 $BTC acquired for ~$23.4 billion at ~$58,263 per bitcoin. $MSTR

MicroStrategy 已以每比特币约 95,976 美元的价格以约 15 亿美元的价格收购了 15,400 个 BTC,并实现了季度至今 38.7% 和年初至今 63.3% 的 BTC 收益率。截至 2024 年 12 月 2 日,我们以约 234 亿美元的价格收购了 402,100 美元比特币,每比特币约 58,263 美元。 $MSTR

— Michael Saylor⚡️ (@saylor) December 2, 2024

— Michael Saylor⚡️ (@saylor) 2024 年 12 月 2 日

Share this article

分享这篇文章

Categories:

类别:

Tags: Bitcoin, Michael Saylor, Microsoft, X

标签:比特币、Michael Saylor、微软、X

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

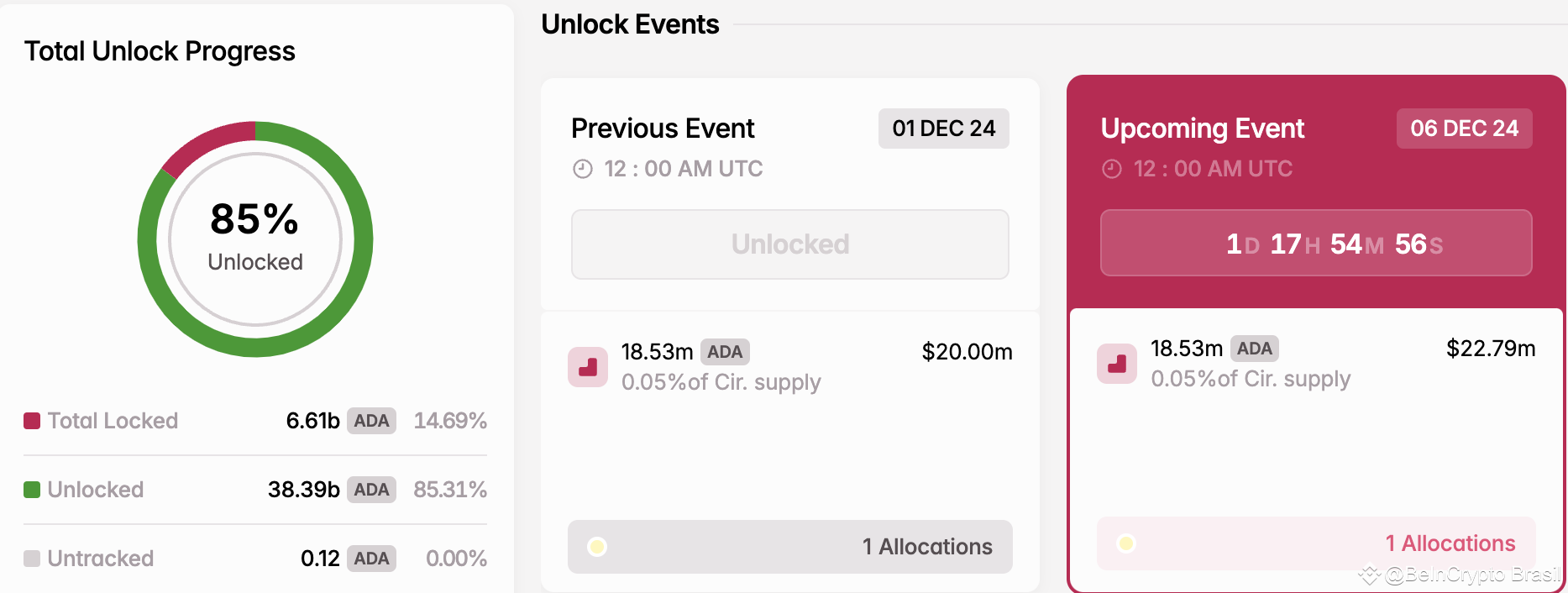

- 鲸鱼在代币解锁前出售卡尔达诺(ADA)——分析

- 2024-12-05 02:30:02

- 卡尔达诺 (ADA) 鲸鱼在过去 30 天内推动加密货币价格上涨 270%,现在在 ADA 解锁之前抛售

-

-

-

- BRP 在魁北克省的三个工厂解雇了 120 名工人和管理人员

- 2024-12-05 02:25:02

- BRP Inc. 表示,其魁北克三处工厂已解雇 120 多名工人和管理人员。

-

- 俄罗斯总统弗拉基米尔·普京表示“没有人可以禁止比特币”

- 2024-12-05 02:25:02

- 在“俄罗斯的召唤!”在莫斯科投资论坛上,弗拉基米尔·普京总统谈到了比特币作为支付手段的作用。

-

-

-

-