|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在过去六个月中,商业智能公司 Microstrategy(纳斯达克股票代码:MSTR)的股价以美元计算,涨幅高达 152%。

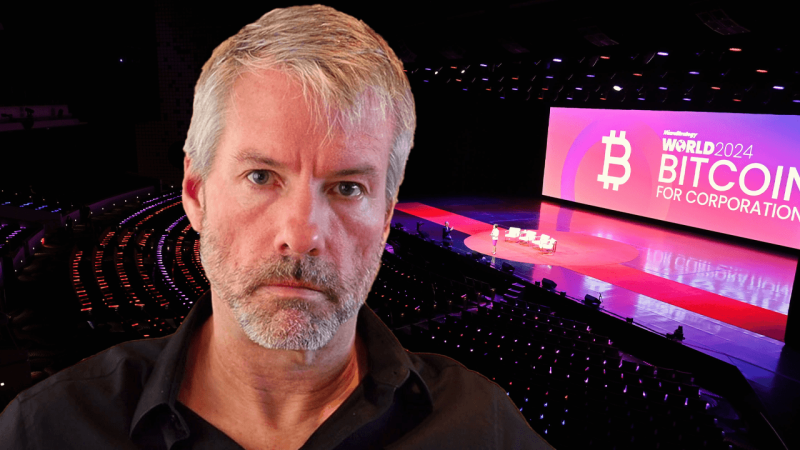

Business intelligence company Microstrategy (Nasdaq: MSTR) has seen its stock rise an impressive 152% when measured against the U.S. dollar over the past six months. Over the preceding five days alone, the company’s stock has advanced by 27.92%.

商业智能公司 Microstrategy(纳斯达克股票代码:MSTR)的股价在过去六个月中相对美元上涨了 152%,令人印象深刻。仅过去五天,该公司股价就上涨了 27.92%。

Complementing this impressive performance, Microstrategy's strategic investment in bitcoin (BTC) has also yielded exceptional returns during the same period. Data indicates that since initiating its bitcoin (BTC) acquisition strategy in 2020, Microstrategy has accumulated an extraordinary total of 450,000 bitcoins.

与这一令人印象深刻的业绩相辅相成的是,Microstrategy 对比特币 (BTC) 的战略投资在同一时期也产生了非凡的回报。数据显示,自2020年启动比特币(BTC)收购策略以来,Microstrategy已累计收购了45万枚比特币。

The firm has allocated $28.179 billion toward these acquisitions, employing leveraged debt as part of its financing approach. Notably, as reported by Bitcoin.com News just yesterday, the company was exploring another share expansion model to generate additional capital for further bitcoin purchases.

该公司已为这些收购拨款 281.79 亿美元,并采用杠杆债务作为其融资方式的一部分。值得注意的是,正如 Bitcoin.com News 昨天报道的那样,该公司正在探索另一种股票扩张模式,以为进一步购买比特币产生额外资金。

By Monday, Microstrategy’s holdings could potentially increase, as Michael Saylor hinted on Sunday with a cryptic statement: “Things will be different tomorrow,” accompanied by an image of the firm’s portfolio tracker. Historically, such statements from Saylor have preceded announcements of new bitcoin acquisitions.

到周一,Microstrategy 的持股量可能会增加,正如 Michael Saylor 周日发表的一份神秘声明所暗示的那样:“明天情况会有所不同”,并附有该公司投资组合跟踪器的图片。从历史上看,塞勒的此类声明是在宣布新的比特币收购之前发表的。

To date, after methodically dollar-cost averaging into BTC and expending $28.179 billion, the company’s bitcoin position has appreciated by a staggering $19.055 billion. As of Jan. 19, 2025, Microstrategy's BTC holdings are valued at $47.234 billion.

迄今为止,在有条不紊地以美元成本平均投资 BTC 并花费 281.79 亿美元之后,该公司的比特币头寸已增值了惊人的 190.55 亿美元。截至 2025 年 1 月 19 日,Microstrategy 持有的 BTC 价值为 472.34 亿美元。

According to the “There Is No Second Best” tracker hosted by blockchaincenter.net, had Saylor and his firm opted to acquire ether (ETH) instead, their investment would have yielded only a 33% gain, as opposed to the current 68%.

根据 Blockchaincenter.net 主办的“没有第二好”追踪器,如果 Saylor 和他的公司选择收购以太坊 (ETH),他们的投资只会产生 33% 的收益,而不是目前的 68%。

In that hypothetical scenario, Microstrategy’s holdings would amount to $37.504 billion, falling significantly short of its current $47.234 billion valuation for its bitcoin reserves. Microstrategy’s unwavering commitment to bitcoin reflects a bold conviction in its long-term potential, with the firm’s strategy serving as a high-stakes bet on the digital asset's supremacy over alternatives like ether.

在这种假设情况下,Microstrategy 的比特币持有量将达到 375.04 亿美元,远远低于其目前的比特币储备估值 472.34 亿美元。 Microstrategy 对比特币坚定不移的承诺反映了对其长期潜力的坚定信念,该公司的战略是对数字资产相对于以太坊等替代品的霸主地位的高风险赌注。

By coupling financial innovation with a calculated investment approach, Microstrategy has, at least so far, positioned itself not only as a corporate trailblazer, but also as a case study in the intersection of finance and digital transformation.

通过将金融创新与精心设计的投资方法相结合,至少到目前为止,Microstrategy 不仅将自己定位为企业开拓者,而且还成为金融与数字化转型交叉领域的案例研究。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 在市场下降期间,最好的新加密预售要投资

- 2025-02-22 03:35:24

- 根据我们的分析和见解,模因硬币可能会受益于加密经济中流动性的增加,这是最好的新加密代币。

-

-

- SEC删除针对Coinbase的诉讼,表示加密监管的变化

- 2025-02-22 03:30:24

- 在加密货币行业的重大发展中,美国证券交易委员会(SEC)已同意放弃对Coinbase的诉讼

-

-

- 发现大量XRP积累:9家银行可能正在为这次山寨币飞行做准备

- 2025-02-22 03:30:24

- 随着特朗普对加密货币的立场减轻了对数字货币的限制,全球金融机构正在探索更简单的国际付款方式

-

- 为什么XRP可能是加密货币的下一个大事

- 2025-02-22 03:30:24

- 在停滞期中,XRP持续了2.67美元,徘徊在一个有利的有利位置,比最近的低点高出50%。

-

-

-