|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marathon Digital (MARA) 是比特币挖矿领域最大的参与者之一,它刚刚推出了一种管理运营成本的新方法。

Bitcoin (BTC) mining company Marathon Digital (NASDAQ:MARA) has revealed a new strategy to manage its cost of operations by lending out a portion of its BTC holdings.

比特币 (BTC) 矿业公司 Marathon Digital(纳斯达克股票代码:MARA)公布了一项新战略,通过借出部分 BTC 资产来管理其运营成本。

According to a statement from the company, Marathon has lent out 7,377 BTC, which constitutes roughly 16% of its total crypto deposit. This move comes amid increasing energy costs and competition in the mining space, pushing companies to adapt and innovate.

根据该公司的一份声明,Marathon 已借出 7,377 BTC,约占其加密货币存款总额的 16%。此举是在能源成本不断增加和采矿领域竞争加剧的背景下做出的,迫使公司进行适应和创新。

With nearly 45,000 BTC in its reserves, valued at about $4.4 billion at the time of the announcement, Marathon’s decision to lend some of its assets marks a significant development in the crypto industry. The company has entered into short-term loan agreements with third parties to generate modest, single-digit returns.

Marathon 拥有近 45,000 BTC 储备,在宣布时价值约为 44 亿美元,Marathon 决定出借部分资产,标志着加密行业的重大发展。该公司已与第三方签订短期贷款协议,以产生适度的个位数回报。

“There has been significant interest in $MARA BTC lending program, so here’s a bit more detail:

“人们对 $MARA BTC 借贷计划很感兴趣,所以这里有更多细节:

– It focuses on short-term arrangements with well-established third parties.

– 它侧重于与成熟的第三方的短期安排。

– It generates a modest single-digit yield.

– 它产生适度的个位数收益率。

– It has been active throughout 2024.

– 整个 2024 年一直很活跃。

The long-term…,” Marathon Digital’s Robert Samuels stated in a tweet.

从长远来看……”马拉松数字公司的罗伯特·塞缪尔斯在推文中表示。

This approach highlights a growing trend among Bitcoin miners to explore new avenues for profitability. As mining becomes more competitive, companies are seeking alternative methods to sustain their operations.

这种方法凸显了比特币矿工探索新盈利途径的日益增长的趋势。随着采矿业的竞争变得更加激烈,公司正在寻求替代方法来维持其运营。

However, the decision to lend out Bitcoin comes with inherent risks, especially given the crypto lending industry’s past failures. To mitigate these dangers, Marathon has emphasized the importance of conducting thorough due diligence and selecting partners that meet specific criteria.

然而,借出比特币的决定会带来固有的风险,特别是考虑到加密货币借贷行业过去的失败。为了减轻这些危险,马拉松强调了进行彻底的尽职调查和选择符合特定标准的合作伙伴的重要性。

Despite the challenges, leasing out Bitcoin enables miners like Marathon to create additional revenue streams, helping them cope with rising operational costs without having to sell off their primary asset.

尽管面临挑战,租赁比特币使像 Marathon 这样的矿工能够创造额外的收入来源,帮助他们应对不断上升的运营成本,而不必出售其主要资产。

This development comes as the Bitcoin network’s hashrate reaches new record levels, indicating intense competition among miners. A higher hashrate drives up energy consumption, putting pressure on miners to innovate and find new ways to stay afloat.

这一发展正值比特币网络的哈希率达到新的纪录水平,表明矿工之间的激烈竞争。更高的算力会增加能源消耗,给矿工带来创新和寻找新方法维持生计的压力。

Marathon Digital has demonstrated its ability to adapt to such challenges through its continuous expansion. The company’s strategy involves adding to its Bitcoin reserves through mining and acquisition, ensuring its position as a leading player in the crypto mining industry.

Marathon Digital 通过不断扩张证明了其适应此类挑战的能力。该公司的战略包括通过挖矿和收购增加比特币储备,确保其在加密货币挖矿行业的领先地位。

By leveraging its Bitcoin assets to generate yield, Marathon showcases resilience in the evolving landscape. While the long-term success of this strategy remains to be seen, Marathon’s approach may set a precedent for other miners facing similar operational pressures.

通过利用其比特币资产产生收益,马拉松在不断变化的环境中展现了弹性。虽然这一战略的长期成功还有待观察,但马拉松的做法可能为其他面临类似运营压力的矿商树立先例。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

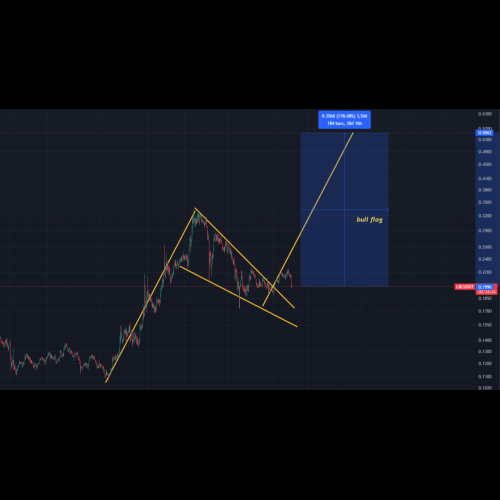

- #LRC/USDT 多头信号

- 2025-01-08 07:10:21

- 正如您所看到的,lrc 硬币创建了一个巨大的看涨模式,称为上升三角形。现在lrc持有巨大的成交量剖面支撑区和上升三角形支撑线。这是现货的巨大买入机会。突破这个看涨模式后,技术上它将触及 0.29,正如您在更长的时间范围内看到的那样,lrc 硬币创建了一个巨大的牛市旗形,现在牛市旗形被打破。这样我们就可以在现货钱包中购买一些硬币。在较长的时间范围内,比特币的主导地位是看跌的,因为比特币的主导地位也打破了其牛旗支撑线。这就是为什么lrc币在较长时间范围看跌中看涨usdt主导地位,因为在usdt.d大幅抛售之后创建了头肩形态,所以我看跌usdt.d。当 usdt.d 抛售加密货币时,市场将产生严重的负相关性。

-

-

-