|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

据加密数据和分析提供商 Kaiko 报道,据称与 FTX 姐妹公司 Alameda Research 有联系的加密钱包一直在积极

A crypto wallet, allegedly linked to FTX’s sister company Alameda Research, has been consolidating holdings ahead of potential creditor repayments from the bankrupt crypto exchange, according to crypto data & analytics provider Kaiko.

据加密数据和分析提供商 Kaiko 称,据称与 FTX 姊妹公司 Alameda Research 有关的一个加密钱包一直在破产加密交易所的债权人偿还潜在债务之前整合其持股。

Earlier this year, FTX announced that it had recovered enough tokens to pay most of its creditors back in full, based on the value of their holdings at the time it filed for bankruptcy. The exchange is expected to start repayments after the final approval of its wind-down plan, expected in early October.

今年早些时候,FTX 宣布已收回足够的代币,根据其申请破产时所持代币的价值全额偿还大部分债权人。该交易所预计将在 10 月初最终批准其停业计划后开始还款。

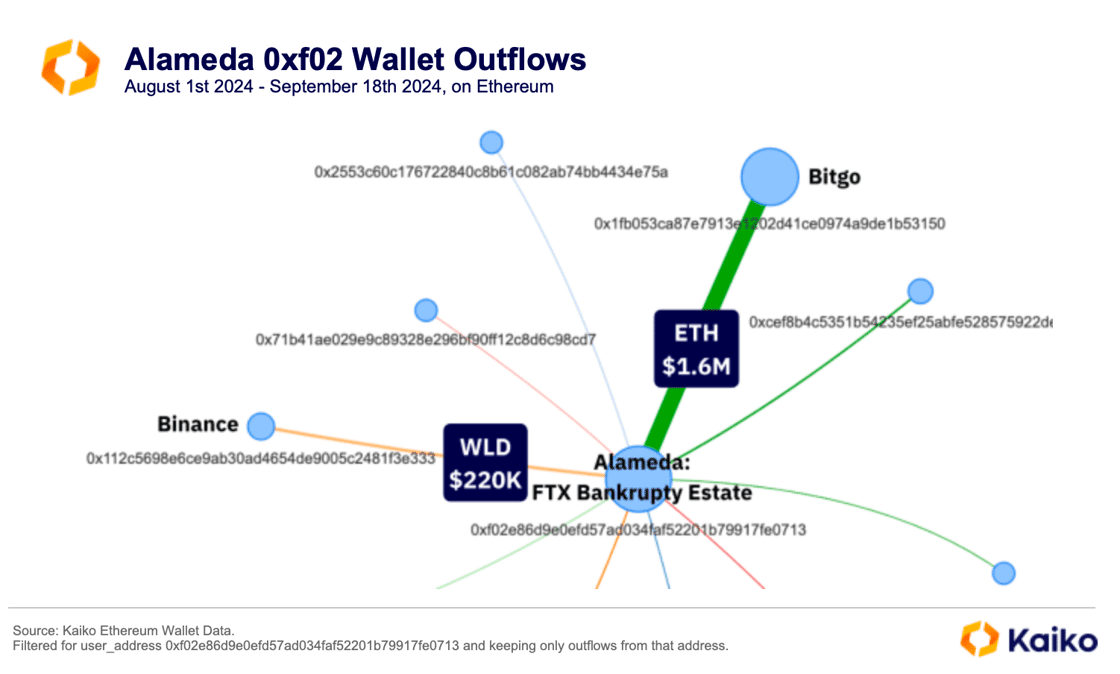

Using Kaiko’s wallet data solution, the company investigated the transfers in and out of the wallet (0xf02e86d9e0efd57ad034faf52201b79917fe0713). Over the past month, it has transferred $1.6 million in ETH to crypto custodian BitGo and $220K in World Coin (WLD) to Binance.

使用 Kaiko 的钱包数据解决方案,该公司调查了钱包的转入和转出 (0xf02e86d9e0efd57ad034faf52201b79917fe0713)。在过去的一个月里,它已将 160 万美元的 ETH 转移至加密货币托管机构 BitGo,并将 22 万美元的 World Coin (WLD) 转移至币安。

Transfers to exchanges are generally viewed as bearish because traders usually move assets there to sell them. Alameda Research was an early investor in Worldcoin, holding 75 million ($118M) WLD tokens. Since July, these tokens have been gradually unlocked by Worldcoin’s developer, Tools for Humanity (TFH).

转移到交易所通常被视为看跌,因为交易者通常将资产转移到交易所出售。 Alameda Research 是 Worldcoin 的早期投资者,持有 7500 万枚(1.18 亿美元)WLD 代币。自 7 月以来,这些代币已由 Worldcoin 的开发商 Tools for Humanity (TFH) 逐步解锁。

A closer look at the wallet’s inflows reveals asset consolidation through multiple transfers from various smaller wallets, most likely owned by Alameda Research, with the largest inflow totaling $1.27 million USDT coming from OKX.

仔细观察钱包的资金流入会发现,资产是通过来自各种较小钱包的多次转账进行整合的,这些钱包很可能属于 Alameda Research,其中最大的流入总额为 127 万美元 USDT 来自 OKX。

As of September 18, Alameda’s wallet still holds $64M in WLD. Selling these could heavily impact prices, which are already down 30% since the July 24 token unlock. Other major holdings include several small, illiquid tokens like FTX’s FTT ($13M) and Bona Network’s BOBA ($9M) tokens, which together have a 1% market depth of only $0.7M daily.

截至 9 月 18 日,Alameda 的钱包中仍持有 6400 万美元的 WLD。出售这些资产可能会严重影响价格,自 7 月 24 日代币解锁以来,价格已下跌 30%。其他主要持股包括几种小型、非流动性代币,例如 FTX 的 FTT(1300 万美元)和 Bona Network 的 BOBA(900 万美元)代币,这些代币的市场深度合计为 1%,每日仅为 70 万美元。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 莱特币(LTC)突破趋势线阻力,预示着潜在的突破

- 2024-11-23 23:45:01

- 莱特币(LTC)最近突破了趋势线阻力,预示着图表上可能会突破。截至撰写本文时,LTC 的交易价格为 89.11 美元

-

- CYBRO 预售飙升至 400 万美元,专家预测潜在投资回报率达 1200%

- 2024-11-23 23:45:01

- 假日季引发了领先数字货币之间的激烈竞争。经典巨人迎战开拓创新者

-

-

- 揭开金融的未来:加密货币如何重塑生活和经济

- 2024-11-23 23:00:02

- 与传统货币不同,数字货币利用区块链技术,存在于网络空间中,并且基本上不受监管。尽管最近出现波动

-

-

-

-

-

![尽管实用性不断增长,但 MakerDAO [MKR] 代币的表现仍逊于竞争对手 尽管实用性不断增长,但 MakerDAO [MKR] 代币的表现仍逊于竞争对手](/uploads/2024/11/23/cryptocurrencies-news/articles/makerdao-mkr-token-underperforms-rivals-growing-utility/image-1.jpg)