|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在美国,相比股票等传统投资,Z 一代和千禧一代对加密货币表现出强烈的偏好。根据 Policygenius 的一项调查,20% 的 Z 世代拥有加密货币,而只有 18% 的人持有股票,而千禧一代也优先考虑加密货币,拥有 22% 的所有权。这种向数字资产的转变归因于对住房负担能力的担忧,由于加密货币的可访问性和潜在回报,Z 世代和千禧一代更有可能投资加密货币。

Generation Z and Millennials Embrace Cryptocurrencies over Stocks

Z 世代和千禧一代更喜欢加密货币而不是股票

New York, January 10, 2023 - A recent survey by Policygenius and YouGov reveals a growing preference among Generation Z and millennials for cryptocurrencies over traditional investments like stocks.

纽约,2023 年 1 月 10 日 - Policygenius 和 YouGov 最近的一项调查显示,Z 世代和千禧一代对加密货币的偏好超过了股票等传统投资。

The survey, which polled 1,213 Americans, found that 20% of individuals aged 18 to 26 own cryptocurrencies, while only 18% own stocks. This contrasts with millennials, aged 27 to 42, where 22% own cryptocurrencies and 27% own stocks.

这项调查对 1,213 名美国人进行了调查,发现 18 至 26 岁的人中有 20% 拥有加密货币,而只有 18% 拥有股票。这与 27 至 42 岁的千禧一代形成鲜明对比,其中 22% 的人拥有加密货币,27% 的人拥有股票。

This preference for cryptocurrencies reflects a larger shift in investment priorities among younger generations. While baby boomers continue to favor traditional investments like real estate (45%) and stocks (33%), Generation Z and millennials are more likely to turn to digital assets.

这种对加密货币的偏好反映了年轻一代投资重点的更大转变。虽然婴儿潮一代继续青睐房地产(45%)和股票(33%)等传统投资,但 Z 一代和千禧一代更有可能转向数字资产。

Factors Driving the Shift

推动转变的因素

Several factors contribute to this shift in investment preferences. One significant factor is the affordability crisis facing Generation Z and millennials. Soaring interest rates, limited housing inventory, and stagnant incomes have made homeownership increasingly out of reach for many. This has led them to explore alternative investment options like cryptocurrencies.

有几个因素导致了投资偏好的这种转变。一个重要因素是 Z 一代和千禧一代面临的负担能力危机。飙升的利率、有限的住房库存和停滞的收入使许多人越来越难以拥有住房。这促使他们探索加密货币等替代投资选择。

Another factor driving the preference for cryptocurrencies is the growing use of social media for financial advice. Generation Z and millennials are more likely to consult social media platforms for investment recommendations, while older generations tend to rely on traditional financial professionals.

推动加密货币偏好的另一个因素是越来越多地使用社交媒体提供财务建议。 Z 一代和千禧一代更有可能咨询社交媒体平台寻求投资建议,而老一辈则倾向于依赖传统的金融专业人士。

Cryptocurrency Market Performance

加密货币市场表现

The cryptocurrency market has experienced significant growth in recent years. According to Statista, the industry was valued at $40.7 billion in 2023, a 50% increase from the previous year. The number of users has also grown exponentially, from 73.52 million in 2020 to 670.50 million in 2023.

近年来,加密货币市场经历了显着增长。据 Statista 统计,2023 年该行业估值为 407 亿美元,比上一年增长 50%。用户数量也呈指数级增长,从2020年的7352万增长到2023年的67050万。

Emotional Aspects of Investing

投资的情感方面

The survey also explored the emotional aspects of investing. While 31% of baby boomers reported feeling satisfied with their financial management, only 31% of Generation Z expressed the same level of pride. This suggests a growing sense of financial anxiety and uncertainty among younger generations.

该调查还探讨了投资的情感方面。虽然 31% 的婴儿潮一代表示对自己的财务管理感到满意,但只有 31% 的 Z 一代表达了同样程度的自豪感。这表明年轻一代的财务焦虑和不确定性日益增强。

Financial Hacks and Habits

财务黑客和习惯

Generation Z and millennials are also more likely to engage in financial "hacks" such as no-spend challenges and infinite banking. These strategies prioritize saving and reducing expenses.

Z 一代和千禧一代也更有可能参与金融“黑客”活动,例如无支出挑战和无限银行业务。这些策略优先考虑节省和减少开支。

Conclusion

结论

The growing preference for cryptocurrencies among Generation Z and millennials represents a significant shift in the investment landscape. The affordability crisis, the influence of social media, and the strong performance of the cryptocurrency market have all contributed to this trend. As the cryptocurrency industry continues to mature, it remains to be seen whether this preference will persist or evolve over time.

Z 世代和千禧一代对加密货币的日益偏好代表着投资格局的重大转变。负担能力危机、社交媒体的影响以及加密货币市场的强劲表现都促成了这一趋势。随着加密货币行业的不断成熟,这种偏好是否会持续存在或随着时间的推移而演变还有待观察。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- 以太坊(ETH)在下一次推动之前测试流动性

- 2024-12-28 07:05:01

- 以太坊在 2024 年表现平平,全年表现低于比特币和许多顶级山寨币。

-

-

- BWB-BGB合并宣布后BGT代币价格飙升

- 2024-12-28 06:55:02

- 著名的加密货币交易所 Bitget 最近宣布计划整合 Bitget 钱包代币(BWB)和 Bitget 代币(BGB)

-

-

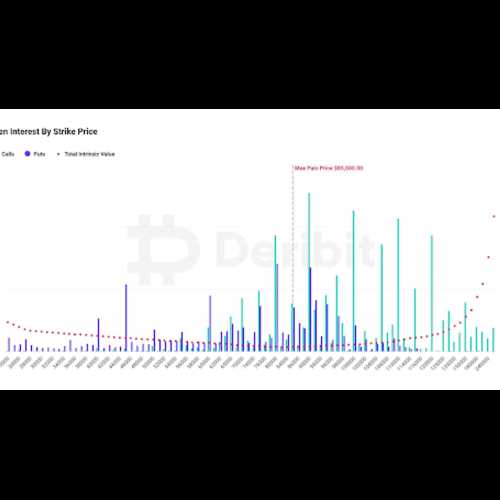

- 比特币面临 2024 年 12 月期权到期

- 2024-12-28 06:55:02

- 尽管 2024 年 12 月期权到期,比特币价格最近表现出显着的弹性,可能会大幅回调至 85,000 美元以下。